Galaxy Earns $30,7 Million, Expands Bitcoin and AI Exposure

- Galaxy Digital reports $30,7 million in profit in the second quarter

- Company accumulates 4.272 BTC valued at US$48 million

- Expansion in artificial intelligence strengthens Galaxy's strategy

After posting a loss of US$295 million in the first quarter, Galaxy Digital reversed the negative performance and ended the second quarter of 2025 with net profit of US$ 30,7 million . The result represents a significant recovery, accompanied by earnings per share of US$0,08 and adjusted EBITDA of US$211 million, driven by the appreciation of the company's digital assets.

July marked the best month of financial performance since the company's listing on Nasdaq on May 16. The highlight was the Global Markets segment, which delivered record results, in addition to significant growth in the asset management and infrastructure areas.

One of the key milestones of the period was the acquisition of 4.272 bitcoins, increasing the company's reserves to US$48 million in BTC. In total, Galaxy Digital's assets under management total US$2,6 billion, distributed among Bitcoin, Ethereum, and venture capital investments. The company also has US$1,2 million in stablecoins and cash.

Another milestone of the quarter was the completion of one of the largest Bitcoin transactions ever recorded, with the sale of more than 80.000 BTC to a single institutional client, reinforcing the company's presence in the large-scale trading market.

In addition to its focus on cryptocurrencies, Galaxy is directing investments toward artificial intelligence infrastructure. The company acquired 160 acres of land to expand its Helios data center, as part of a strategic agreement with CoreWeave to provide additional computing power for AI.

Diversification beyond crypto assets, with AI integration and infrastructure expansion, reflects Galaxy's strategy to build a more robust digital financial ecosystem. The combination of growing Bitcoin reserves and expanding computing capacity strengthens its position among the leading players in the digital asset sector.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

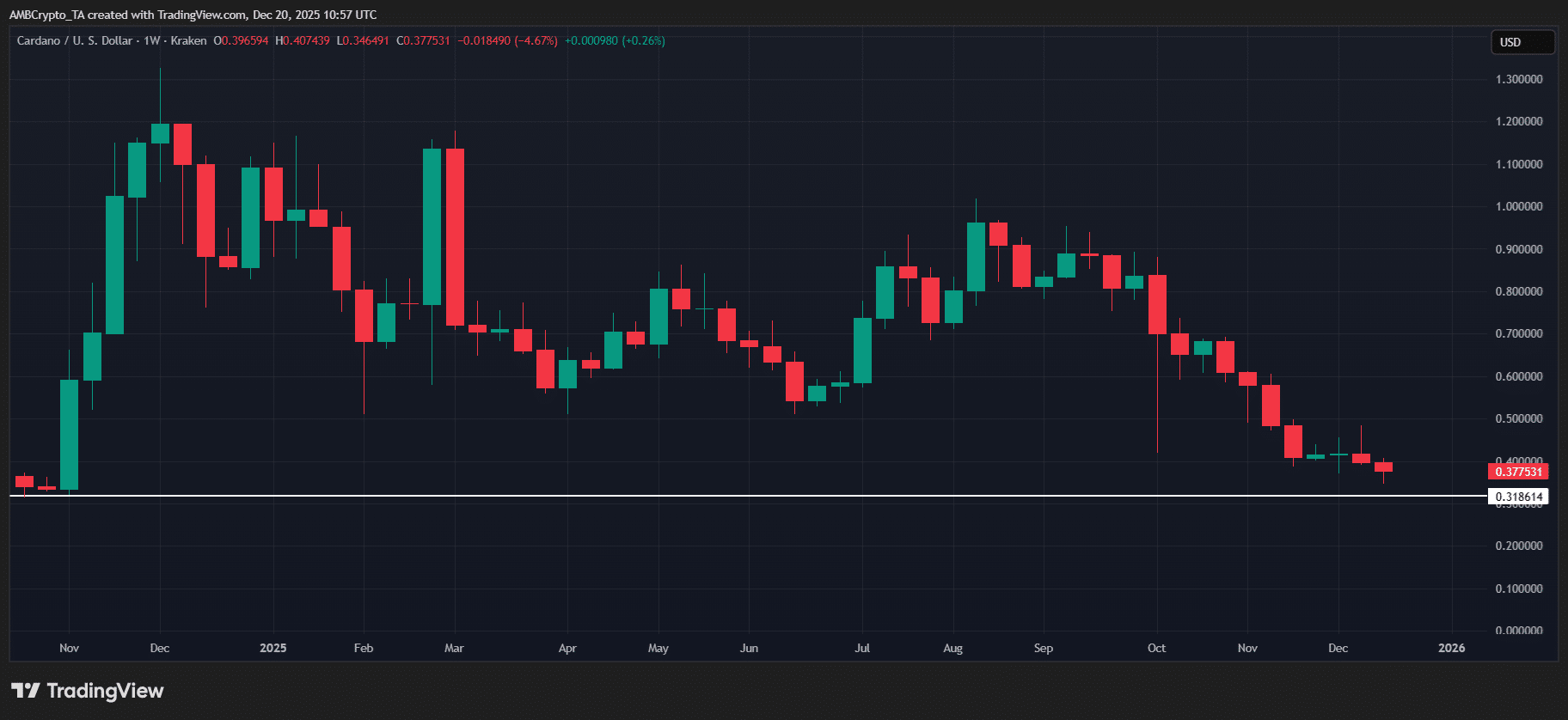

Cardano erases 100% of election rally gains – Can ADA hold top 10?

Why SEI must reclaim KEY support to avoid drop below $0.07

Ethereum Faces Uncertainty with Tight Trading Range