Strategy leads July frenzy as institutional BTC holdings hit $428 billion; survey sees S&P 500 crypto treasury adoption continuing

Quick Take Tracked entities added 166,000 BTC in July, lifting total holdings to 3.64 million BTC, valued at $428 billion at the end of last month, as public companies expanded their bitcoin treasuries. Public-company BTC stacks are up 170% in the past year, a trend that institutional investors expect will increasingly proliferate balance sheets in the tech-heavy S&P 500.

A wave of corporate buyers and Wall Street investors added more than 166,000 bitcoin in July, capping a month in which tracked entities, including publicly traded companies and exchange-traded products, increased total holdings to 3.64 million BTC worth $428 billion at month-end, according to Bitcoin Treasuries’ July Adoption Report reviewed by The Block.

The report attributes roughly two-thirds of July's net additions, about 107,082 BTC, to public and private companies, with the remainder largely from ETFs and other funds.

The Block previously reported several building blocks behind last month’s totals—including Strategy’s late-month 21,021 BTC add tied to its $2.5 billion Stretch preferred stock raise , Trump Media’s bitcoin treasury disclosures, and Coinbase's Q2 treasury purchase .

July accumulation

Michael Saylor's Strategy led corporate activity as July’s biggest mover, disclosing 31,466 BTC across three purchases to end the month with 628,791 BTC. Newcomer Bitcoin Standard Treasury Company listed 30,021 BTC, and Trump Media & Technology Group disclosed 18,430 BTC following a May capital raise, the report said.

Government wallets were quieter. The United States added 10 BTC, El Salvador 33 BTC, and Bhutan was a net seller (-776 BTC) after sales and repurchases during the month, the report noted.

Other additions included XXI (+6,284 BTC to 43,514 BTC), Metaplanet (+3,782 BTC to 17,132 BTC), Sequans Communications (+3,072 BTC), and Empery Digital, formerly Volcon (+3,803 BTC). Coinbase’s 2,509 BTC purchase brought its treasury to 11,776 BTC, returning it to the public top 10.

Metrics and other crypto treasuries

Beyond headline balances, the report tracks equity-market gauges — mNAV, forward mNAV, BTC Yield, and Sats per Share — as investors look for ways to compare treasury strategies. Strategy's 31,466 BTC July haul helped it add the most satoshis per share among the companies profiled, analysts wrote. In July, TD Cowen said Strategy's NAV premium was logical since it can access low-interest financing facilities and has increased BTC per share issuance in the last 18 months.

The report also flags growing institutional interest beyond bitcoin, noting more than $10 billion in Ethereum treasuries and an expanding cohort of Solana treasuries. Solana-focused firms own about $554 million in SOL tokens, according to The Block’s data dashboard. Those figures strengthen the narrative for a broader corporate-treasury experimentation alongside BTC’s rise.

Growing adoption

With fund flows still a dominant driver of price and multiple issuers continuing to finance buys, Bitcoin Treasuries expects treasury adoption to stay active, particularly in the U.S., where policy clarity is improving. Public companies have increased the amount of bitcoin they hold by 170% in the past year, accounting for around 3.2% of BTC’s total supply.

Other experts also expect the surge in BTC accumulation by public companies to continue as adoption accelerates and supportive policy backdrops mature.

Findings from a Nickel Digital Asset Management survey, conducted through a third-party firm called Pureprofile, which claims it polled 200 institutional investors, found that almost half of the respondents believe 10% or more of S&P 500 companies will soon have Bitcoin on their balance sheets.

Additionally, the survey said 86% of wealth managers support publicly traded corporations having BTC treasuries.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple CEO Declares ‘Nobody Can Manipulate XRP Prices’ amid December Volatility. Here’s Why.

Expert to XRP Holders: This Will Be One of the Biggest Fakeouts in History If This Happens

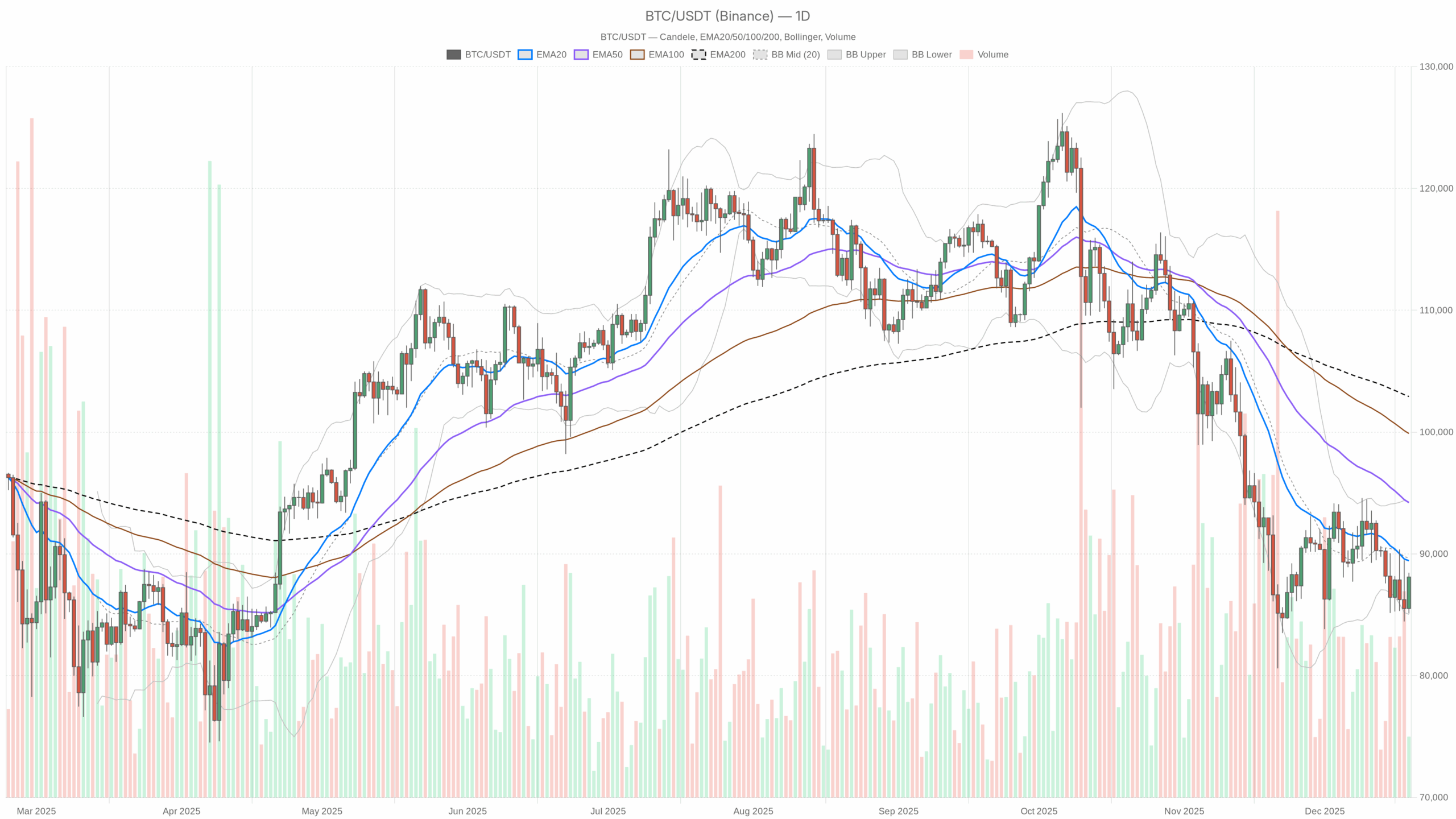

BTC price outlook: short-term bounce inside a larger downtrend

Best Solana Wallets as Visa Chooses Solana and USDC for US Bank Settlements