PUMP Might Not Be Done Pumping: Another 15% Rally in Sight as Buyers Refuse to Quit

After rallying 37% in a week, PUMP is now eyeing a breakout above $0.00354. With whales and public figures still accumulating, another 15% gain could follow.

After gaining over 37% in the last 7 days, the PUMP price is refusing to cool off. Despite a mild +6% move in the past 24 hours, the token is showing signs of continued strength, even as broader market momentum fades. The big question: Is another breakout brewing, or are we looking at the tail end of this rally?

Let’s break down the on-chain data, liquidation setups, and chart patterns signaling what comes next.

Influencer Buying and Whale Activity Signal Confidence

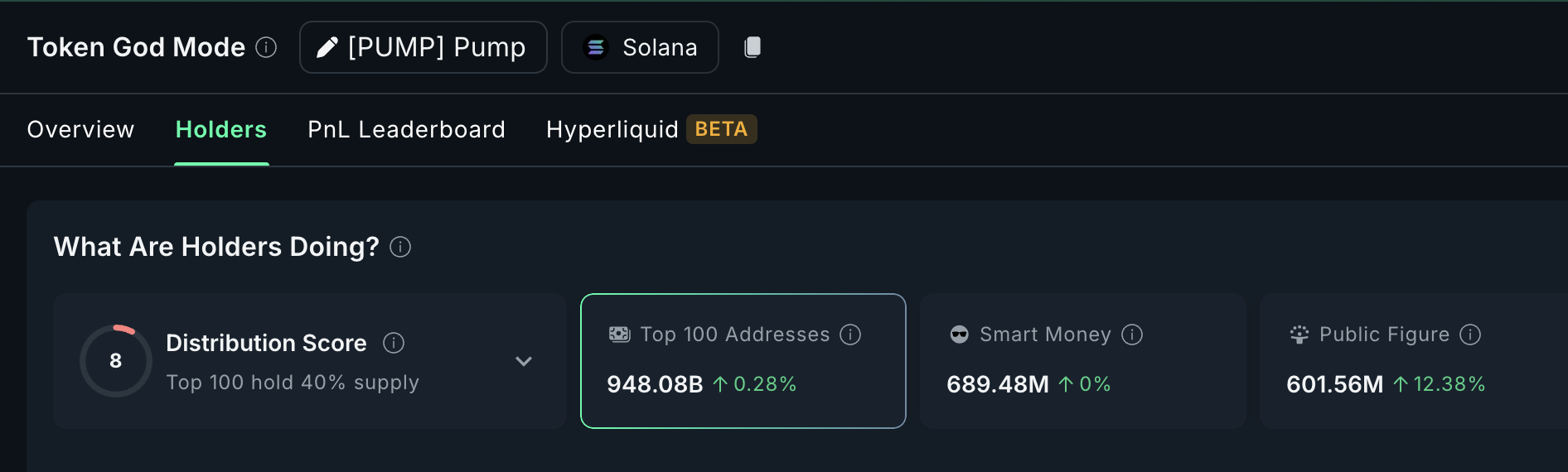

While price has been consolidating just below the $0.0035 level, top addresses and public figures aren’t letting up. According to Nansen data, the top 100 addresses now hold 948.08 billion tokens, reflecting a 0.28% increase in the past 24 hours. Public figure wallets, often linked to influencers and known crypto traders, have also jumped 12.38%, holding 601.56 million PUMP.

PUMP accumulation by Public Figure and traders:

PUMP accumulation by Public Figure and traders:

What’s more important is that whales have been quietly accumulating throughout the week. Over the past 7 days, whale holdings have grown by 25.24%. This isn’t a signal of exhaustion; it’s a sign of conviction.

These large players are buying into strength, suggesting that they see room for further upside.

PUMP accumulation by whales:

PUMP accumulation by whales:

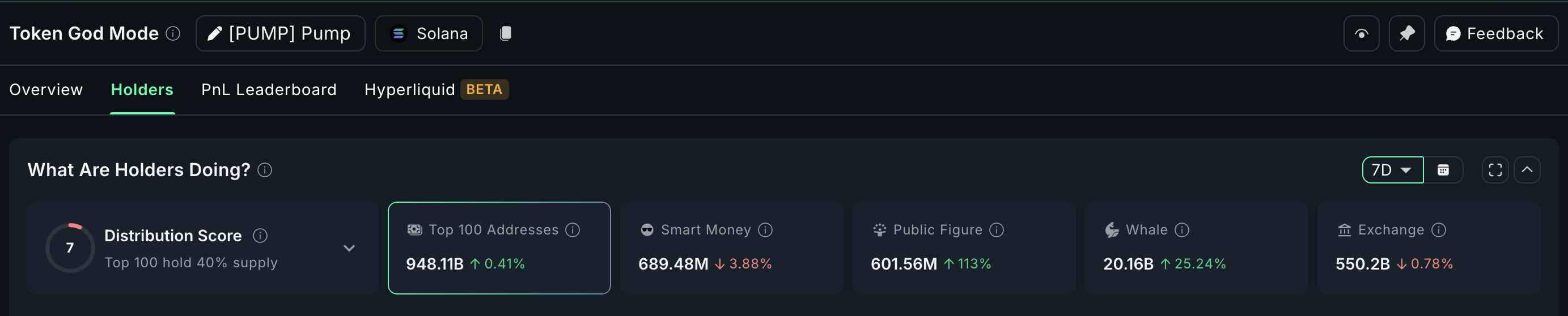

Backing this view is the derivatives market. The long/short ratio has flipped decisively bullish over the last few days, holding above 1.05.

PUMP long/short ratio:

PUMP long/short ratio:

That means more traders are entering long positions than shorts, and this rising leverage bias is aligning with the smart money activity on-chain.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

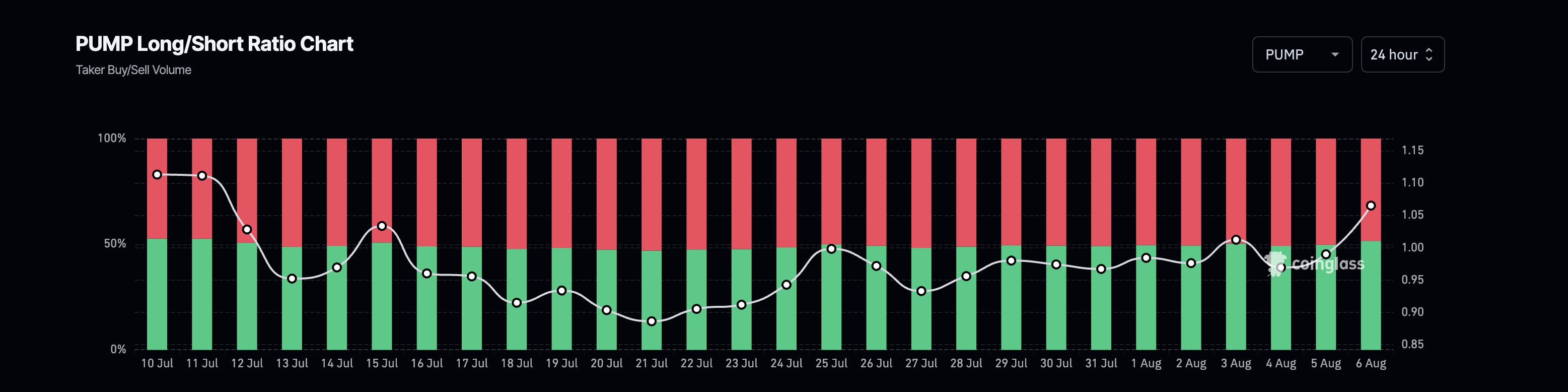

Liquidation Map Reveals Where Shorts Could Get Crushed

The liquidation map from Hyperliquid supports the same bullish outlook. At the current price of $0.0034, PUMP is inching closer to a dense cluster of short positions.

The largest pileup of short liquidations begins at $0.0035 and intensifies around the $0.0035 to $0.0039 range. These price levels coincide with where short sellers start to get wiped out.

PUMP liquidation map:

PUMP liquidation map:

Although total short open interest sits at $1.92 billion, long positions are currently at $5.48 billion, almost three times the size. While fewer shorts exist, the sheer size of their exposure makes them vulnerable. If PUMP pushes above $0.0035, it could trigger a liquidation chain reaction, forcing shorts to exit and driving the price higher in the process.

These liquidation thresholds are more than just numbers; they’re pressure points. And they align almost perfectly with the price action pattern forming on the chart.

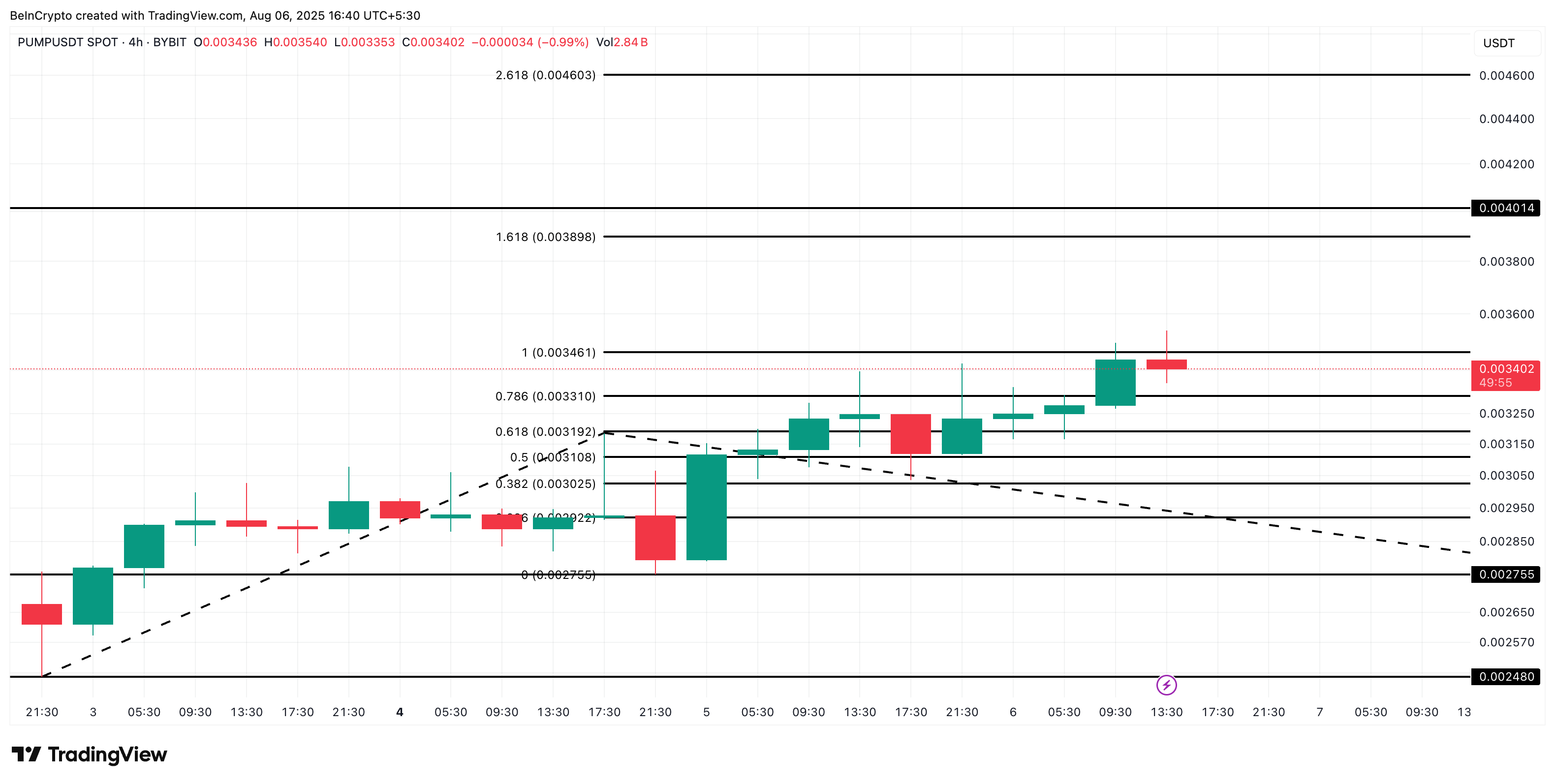

PUMP Price Eyes Breakout From Ascending Triangle Pattern

The PUMP price is trading inside an ascending triangle pattern on the 2-hour chart. This setup typically resolves with a breakout to the upside, especially when backed by higher lows and accumulation, which is what we’re seeing now.

PUMP triangle pattern:

PUMP triangle pattern:

Note: Two downside moves pierced the lower trendline, but both were wick-only breakdowns and not full-body candle closes. According to standard technical analysis principles, a valid triangle breakdown typically requires a decisive full-body candle close below the trendline with confirmation volume. Since that hasn’t occurred, the ascending triangle pattern remains valid.

The key resistance to break lies around $0.0035, where the previous breakout was attempted. This price also overlaps with the liquidation cluster we just discussed, creating a dual trigger point for momentum.

PUMP price analysis:

PUMP price analysis:

If this level breaks, the next immediate resistance is $0.0038, followed by $0.0040. The former would mark a 15% gain from the current price of $0.0034. That level also coincides with a key Fibonacci extension zone and psychological round number that often acts as Magnet Resistance. If momentum continues beyond $0.0040, the next target lies near $0.0046, representing a 35% rally from today’s levels.

But traders must also keep an eye on invalidation. If PUMP fails to hold the ascending trendline support around $0.0033 and breaks, it would invalidate the current bullish structure. That could open the door to a deeper pullback toward $0.0030 or even lower.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve is likely to implement a hawkish rate cut this week, with internal "infighting" about to begin.

This week's Federal Reserve meeting may feature a controversial "hawkish rate cut." According to the former Vice Chair of the Federal Reserve, the upcoming 2026 economic outlook may be more worth watching than the rate cut itself.

Discover How ZKsync Fast-Tracks Blockchain Security

In Brief ZKsync Lite will be retired by 2026, having achieved its goals. ZKsync team plans a structured transition, ensuring asset security. Future focus shifts to ZK Stack and Prividium for broader application.

Bittensor Follows Bitcoin Path With TAO Halving

Mining Sector Falls 1.8 % Despite Bitcoin Rally