ETH holds $3.6K as Ethereum daily transactions near all-time high

Ethereum was trading at $3,658 at press time, posting a 2.2% gain over the last 24 hours as on-chain metrics show a surge in transaction activity.

- Ethereum is trading at $3,658, up 2.2% on the day but down 4.7% over the week.

- Daily Ethereum transactions hit 1.87M on Aug. 6, nearing record highs.

- Technical indicators show neutral momentum, with price consolidating between $3,450 and $3,920.

The price remains 30% higher than it was a month ago, even though it has slipped 4.7% over the past week. As buyers and sellers balance out, the current weekly range of $3,380 to $3,874 represents a period of sideways movement.

Meanwhile, there are indications that market activity is slowing down. Daily trading volume has dropped 15.6% to $22.2 billion, while derivatives volume is down more than 20% to $77.2 billion, according to Coinglass data . A slight decline in open interest indicates that there are fewer active positions in the market.

Network activity climbs as stablecoin demand returns

Ethereum’s ( ETH ) network usage is increasing sharply. Daily transactions rose to 1.87 million on Aug. 6, based on Etherscan data , nearing the all-time high of 1.96 million recorded in Jan. 2024. The uptick marks a reversal from the trend seen last year, when Ethereum lost ground to faster, cheaper chains like Solana ( SOL ).

Stablecoin activity, mainly Tether ( USDT ) and USD Coin ( USDC ), is driving a large portion of the transaction growth amid rising optimism regarding the U.S. legislative environment. On-chain usage has increased and market confidence is being restored thanks to the recently passed GENIUS Act, which clarifies regulations for dollar-backed stablecoins.

In parallel, demand from institutional investors continues to grow. As reported by Nate Geraci, president of NovaDius Wealth, both ETH-treasury-holding companies and U.S. spot ETH ETFs have accumulated 1.6% of the total ETH supply each since early June, for a combined 3.2% share.

Strategic ETH Reserve data shows that 64 companies now hold 3.03 million ETH, valued at around $11.8B. U.S. spot ETH ETFs net assets, on the other hand, have reached $20.61 billion.

Ethereum technical analysis

Ethereum is showing neutral momentum. The price is hovering just under the 20-day simple moving average at $3,685. The relative strength index is at 58, neither overbought nor oversold. Most oscillators, including the Stochastic, commodity channel index, and MACD, point to a balanced setup.

Moving averages remain supportive. ETH is trading above its 10-day through 200-day exponential and simple moving averages. The awesome oscillator and momentum both exhibit some strength, but not enough to support a clear trend in either direction.

The price may move toward $3,920 if it breaks above $3,685. Support at $3,450 is still crucial on the downside. For now, ETH appears to be consolidating while underlying demand continues to grow.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether financial analysis: Needs an additional $4.5 billion in reserves to maintain stability

If a stricter and fully punitive approach is applied to $BTC, the capital shortfall could range from 1.25 billion to 2.5 billion USD.

The fundraising flywheel has stalled, and crypto treasury companies are losing their ability to buy the dip.

Although the treasury companies appear to have ample resources, the disappearance of stock price premiums has cut off their financing channels, causing them to lose their ability to buy the dip.

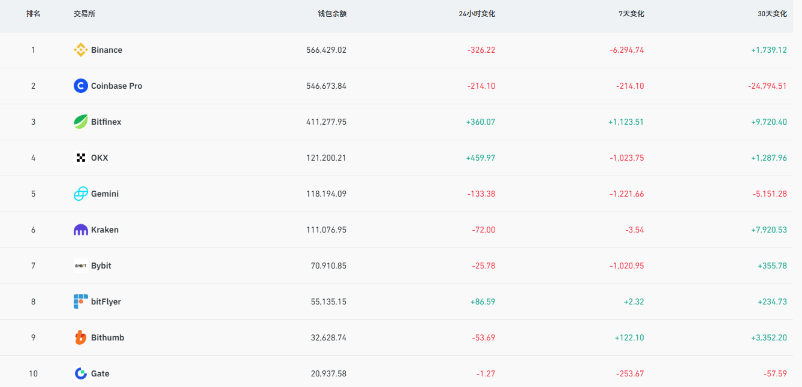

Nearly 10,000 bitcoins withdrawn from exchanges, is the market about to change direction?