Key Notes

- Trading volume dropped over 20% to $4.14 billion while open interest rose 1.66%, indicating weak speculator participation overall.

- Short contracts exceeded long positions across 1h, 12h, and 24h windows, suggesting traders expect the uptick to be temporary.

- DOGE faces resistance at $0.23-$0.28 range with potential breakout to $0.25 or pullback to $0.18 depending on momentum shifts.

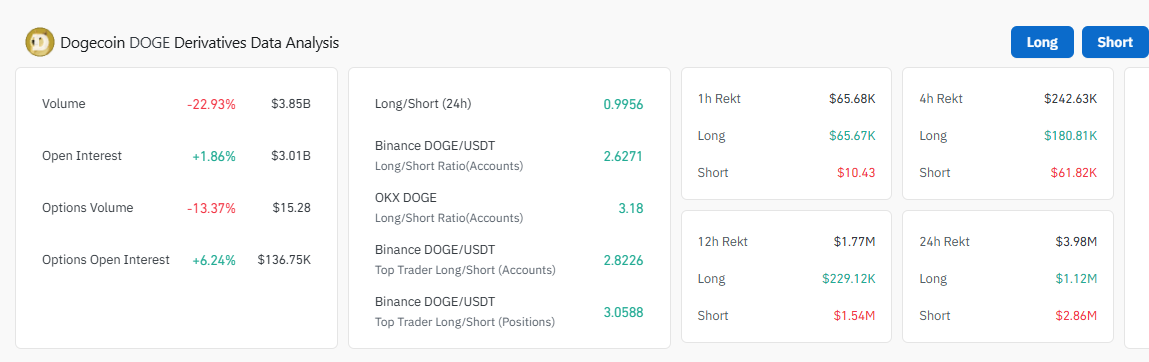

Despite Dogecoin’s 3.5% recovery to $0.205 on August 6, derivatives data suggest the rebound lacks conviction. Daily trading volume in DOGE fell over 20%, dropping to $4.14 billion, highlighting weak participation from short-term price speculators.

More notably, open interest rose 1.66% to $3.05 billion, while short contracts exceeded long positions across all major intraday windows: 1h, 12h, and 24h. This divergence indicates that a majority of new positions were initiated with a bearish bias, as traders expect the uptick to be temporary.

Dogecoin Derivatives Market Analysis | Source: Coinglass

Coinglass liquidation data further confirms this trend. Over the past 24 hours, $4.73 million in DOGE positions were liquidated—$2.72 million from shorts, but a substantial $2.01 million from longs—suggesting bulls are still being squeezed.

On shorter timeframes, short liquidations continue to overshadow longs, with $1.34 million against $65,000 on the 4-hour chart, and $1.66 million against $460,000 over the past 12 hours.

Moreover, top trader accounts also lack bullish conviction despite broader long/short ratios appearing neutral (0.99).

In summary, the Dogecoin market data points toward cautious optimism, with the 3.5% rebound in DOGE spot price being overshadowed by dominant bearish sentiment in derivatives.

However, if broader market catalysts boost buying momentum, the concentration of leveraged short positions could spark a powerful short squeeze, potentially sending Dogecoin surging toward the $0.25 mark.

DOGE at Crossroads: $0.25 Breakout or $0.18 Crash Ahead?

Dogecoin DOGE $0.21 24h volatility: 3.0% Market cap: $31.03 B Vol. 24h: $1.05 B has staged a notable recovery, reclaiming the lower Bollinger Band and establishing support above the critical $0.20 threshold. However, technical indicators reveal a narrow trading corridor ahead. The daily chart shows the upper Bollinger Band forming a formidable resistance ceiling at $0.28, while the median band at $0.23 presents the first major hurdle for any sustained upward momentum.

To confirm a bullish reversal, DOGE must close above the $0.23 level. Affirming this stance, the MACD remains bearish but is gradually flattening out, suggesting momentum could shift if price continues to consolidate above $0.205.

Dogecoin price forecast

If DOGE fails to break $0.228, it risks pulling back toward the lower band near $0.18, which has acted as support during the past week’s consolidation phase. A daily close above $0.228 could trigger a move toward $0.25, fueled by a potential short squeeze if bearish positions are liquidated en masse.

On the flip side, a price rejection at $0.22 followed by high-volume selling could drag Dogecoin back to $0.18.