SBI Holdings has filed proposals for Bitcoin and XRP ETFs in Japan, aiming to mainstream crypto investments through regulated, diversified offerings.

-

SBI’s ETF proposals could revolutionize crypto investments in Japan.

-

SBI Holdings is diversifying with a gold-backed ETF to balance volatility.

-

Japan’s regulatory environment is becoming increasingly favorable for crypto ETFs.

SBI Holdings aims to mainstream crypto investments in Japan with proposed Bitcoin and XRP ETFs, backed by a strong regulatory framework.

Japan to Launch XRP ETF

Financial giant SBI Holdings has filed for Bitcoin [BTC] and Ripple [XRP] ETFs, signaling a bold step toward mainstreaming crypto investments in Asia.

Backed by its strong alliance with Ripple and a robust regulatory framework, SBI isn’t just eyeing digital assets; it’s also diversifying with a gold-backed ETF aimed at balancing volatility.

Through these funds, SBI hopes to offer Japanese investors more secure, regulated avenues into the crypto market, aligning with its broader push to drive adoption across the country.

That being said, SBI Holdings’ growing interest in digital assets is anything but sudden.

The banking giant has long maintained close ties with Ripple, standing as one of the largest users of XRP through Ripple’s Global Payments Network.

This relationship has extended into consumer-facing services as well.

It includes features that let customers convert credit card points into XRP, a move that speaks volumes about the company’s commitment to mainstream crypto integration.

Is this a rumor or genuine news?

Yet, despite the buzz on social media, reports suggesting that SBI has already received approval for an XRP ETF are misleading.

While excitement around crypto ETFs continues to surge globally, particularly in the U.S., SBI’s efforts are still at the proposal stage.

However, the company has yet to make any formal announcements confirming ETF approvals.

That said, Japan’s regulatory environment appears increasingly favorable.

Is Japan’s Ecosystem Compatible with an ETF?

With a newly launched Working Group on Web3 policy under one of Japan’s top financial watchdogs, the country is laying the groundwork for a more structured and innovation-friendly crypto landscape.

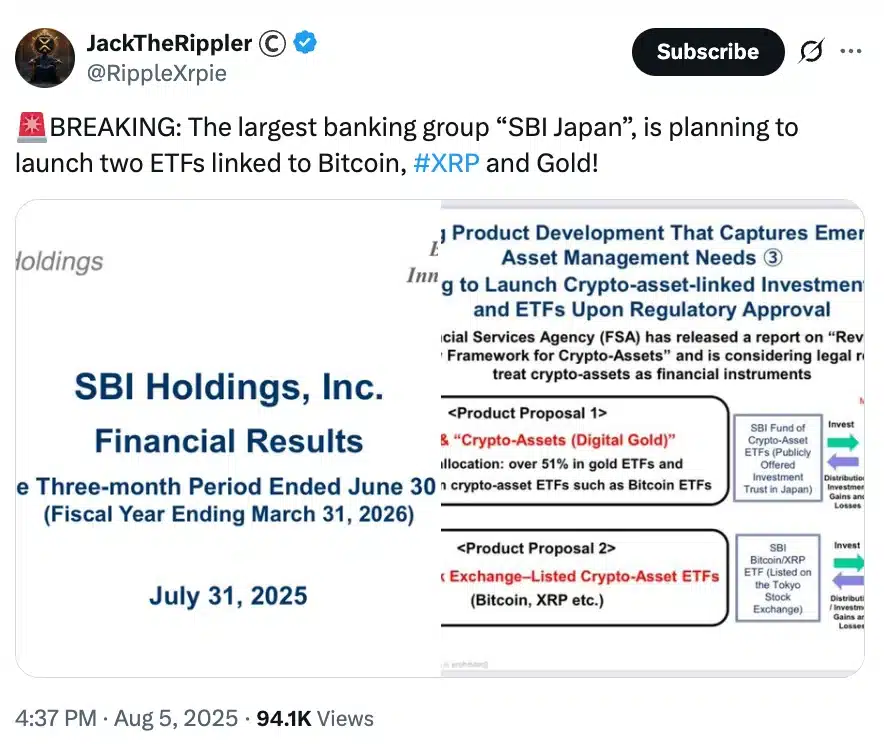

This proactive stance seems to have given SBI the confidence to prepare for crypto-based investment products. According to its latest earnings report, SBI is clearly planning two distinct ETF offerings.

One will focus exclusively on crypto, with direct investments in assets like Bitcoin and XRP.

The second takes a diversified approach, bundling cryptocurrencies with gold-backed securities under a trust structure, potentially offering investors a more balanced risk profile.

If approved, SBI’s innovative ETF offerings could mark a significant leap forward for Japan’s crypto investment landscape, potentially placing the nation ahead of its global counterparts in regulatory agility.

While the U.S. continues to navigate a complex approval process for altcoin ETFs and South Korea begins warming up to the idea through political discourse, Japan appears poised to lead.

Key Takeaways

- SBI Holdings has filed proposals for Bitcoin and XRP ETFs in Japan, aiming to mainstream crypto investments through regulated, diversified offerings.

- As the U.S. continues to grapple with the prospects of altcoin ETFs, Japan may be quietly taking the lead.

Conclusion

In summary, SBI Holdings’ push for Bitcoin and XRP ETFs represents a significant step forward for crypto investments in Japan. With a favorable regulatory environment and innovative offerings, Japan could set a precedent for other nations in the crypto space.