J.P. Morgan, HQLAx and Ownera Launch Intraday Repo Solution, With $5bn Traded in the First Month

J.P. Morgan, HQLAx and Ownera announce the launch of their cross-ledger Repo solution. Repo traders are now able to exchange cash at J.P. Morgan and collateral at HQLAx intraday, with settlement and maturity times specified to the minute. While digital solutions have recently gained market prominence, there is a need for interoperability and precise cash and securities settlement. Ownera’s market … <a href="https://beincrypto.com/jp-morgan-hqlax-ownera-intraday-repo-5bn/">Continued</a>

J.P. Morgan, HQLAx and Ownera announce the launch of their cross-ledger Repo solution. Repo traders are now able to exchange cash at J.P. Morgan and collateral at HQLAx intraday, with settlement and maturity times specified to the minute.

While digital solutions have recently gained market prominence, there is a need for interoperability and precise cash and securities settlement. Ownera’s market leading routing technology has allowed J.P. Morgan and HQLAx to orchestrate the full lifecycle of Repo transactions, from execution through the delivery-versus-payment (DvP) exchange of collateral and cash across ledger platforms with precise settlement, which can help repo participants optimize their intraday liquidity. Ownera’s routers connect market participants peer-to-peer using the open FinP2P protocol, delivering application-layer orchestration across digital platforms.

The first phase of the solution is now live with executed transactions reaching up to $1bn in trading volume per given day, with expected future volume growth. The solution facilitates the exchange of ownership of securities on the HQLAx platform for cash settled on J.P. Morgan Digital Financing application via blockchain deposit accounts on J.P. Morgan’s Kinexys.

The full potential of the solution lies in its scalability as digital solutions gain traction across institutional financial markets. Designed from the outset to operate at an industry-wide level, the platform reduces market fragmentation by supporting potential future extension to multiple trading venues, collateral sources, and digital cash instruments— potentially including deposit tokens, stablecoins, and emerging central bank digital money solutions.

Ami Ben-David, CEO and Founder of Ownera commented: “It has been a privilege to work with J.P. Morgan and HQLAx – two exceptional organizations- in bringing this solution to production. Intraday Repo represents one of the clearest and most compelling use cases for tokenized assets, and reaching daily trading volumes of up to $1 billion is an exciting validation of the model’s scalability. We’re looking forward to building on this momentum and expanding the solution across the broader market in an open and collaborative way.”

Dan Phillips, Executive Director, Markets Digital Assets, J.P. Morgan, “Ownera is offering a key utility to enable meaningful growth in the institutional DLT ecosystem. We look forward to further supporting our clients’ intraday Repo needs, utilizing new pools of collateral in collaboration with both HQLAx and Ownera.”

Richard Glen, Solutions Architect Lead, HQLAx commented: “This solution transforms how clients manage intraday liquidity, offering precision and speed as well as certainty and control. This is a crucial, foundational step towards a truly interconnected and highly efficient global repo market.”

About Ownera

Ownera is a technology company bringing interconnectivity solutions to the world of digital assets. Ownera’s routers enable global distribution and liquidity by connecting tokenized assets distributed by sell-side institutions to buy-side demand. The routers facilitate the negotiation, orchestration and settlement of transactions between the counterparties and their various regulated service providers including custodians, broker dealers, transfer agents, cash providers, lenders and others. Ownera’s routers implement the open FinP2P protocol originally pioneered by the company.

About HQLA-X

HQLA-X is a financial technology innovation firm that specialises in delivering liquidity management and collateral management solutions for institutional clients in the global securities lending and repo markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

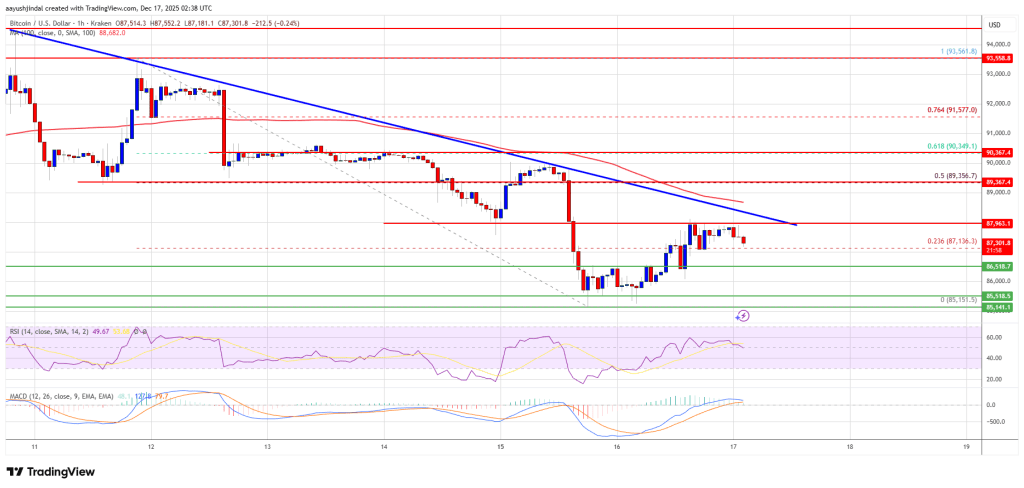

Bitcoin price regroups after decline—Is a directional breakout imminent?

Two main reasons why the current decline of ONDO is only temporary.