Vitalik backs Ethereum treasury firms, but warns of overleverage

Ethereum co-founder Vitalik Buterin threw his support behind Ether

ETH$3,890treasury companies, but warned that the trend could spiral into an “overleveraged game” if not handled responsibly.

In an interview with the Bankless podcast released on Thursday, Buterin said the growing number of public companies buying and holding Ether was valuable because it exposes the token to a broader range of investors.

“There’s definitely valuable services that are being provided there,” Buterin said. He added that companies buying into ETH treasury firms instead of holding the token directly gives people “more options,” especially those with “different financial circumstances.”

So-called crypto treasury companies have become a hot trend on Wall Street, garnering billions of dollars to buy up and hold swaths of cryptocurrencies, with the most popular plays being Bitcoin and Ether.

Leverage must not lead to ETH’s “downfall”

Buterin tempered his support with caution, stressing that ETH’s future must not come at the cost of excessive leverage.

“If you woke me up three years from now and told me that treasuries led to the downfall of ETH, then, of course, my guess for why would basically be that somehow they turned it into an overleveraged game.”

He outlined a worst-case chain reaction where a drop in ETH’s price turned into forced liquidations that cascaded and drove the token’s price down, also causing a loss of credibility.

However, Buterin is confident that ETH investors have enough discipline to steer clear of such a collapse.

“These are not Do Kwon followers that we’re talking about,” he said, mentioning the co-founder of the Terra blockchain that collapsed in 2022.

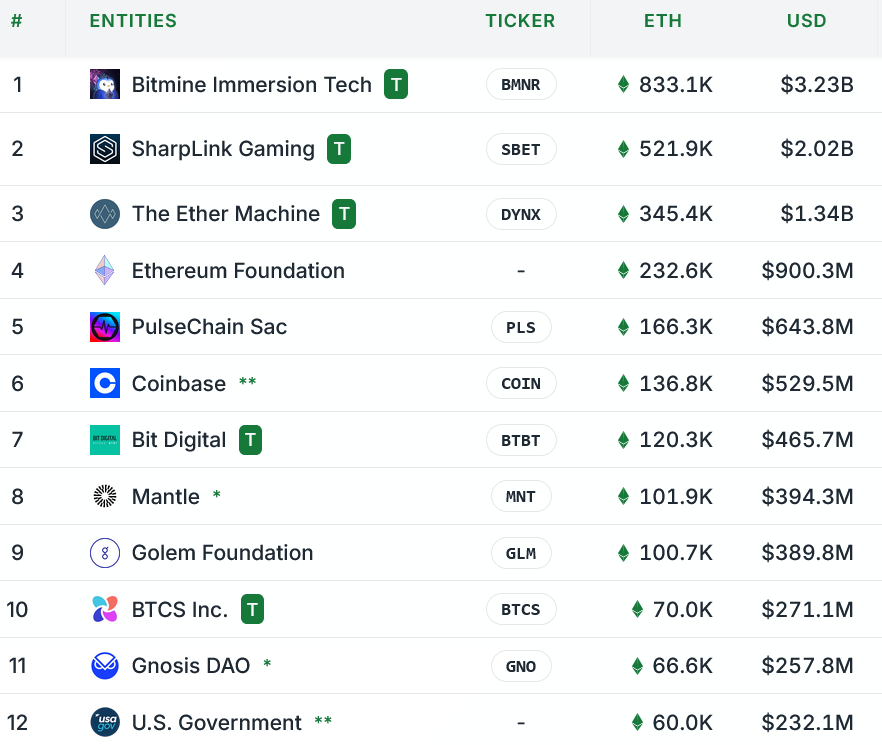

ETH treasury firms now hold nearly $12 billion

The market for public companies that hold Ether has ballooned to $11.77 billion, led by BitMine Immersion Technologies and SharpLink Gaming .

BitMine holds 833,100 ETH worth $3.2 billion — the fourth-largest holdings among public companies that hold any cryptocurrency.

SharpLink and The Ether Machine hold $2 billion and $1.34 billion worth of ETH, respectively, while the Ethereum Foundation and PulseChain round out the top five.

The 12 largest ETH treasury holders. Source: StrategicETHReserve.xyz

ETH making a comeback

ETH has seen a mixed year so far, falling from around $3,685 in January to a low of $1,470 on April 9, before rallying more than 163% to its current price of $3,870 .

The trend of ETH treasury firms has been a notable catalyst behind the token’s resurgence. Its price rally has helped ETH close the gap on Bitcoin and Solana , which have led the current bull cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes