Date: Thu, Aug 07, 2025 | 07:28 AM GMT

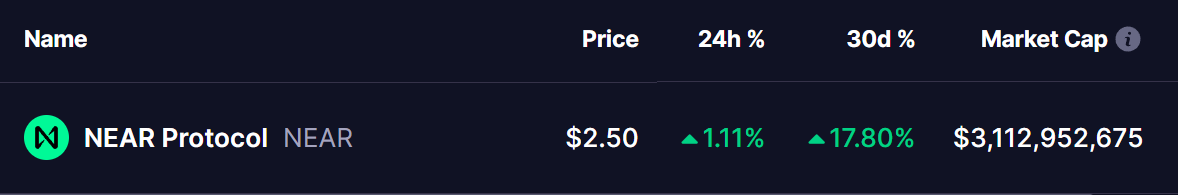

The cryptocurrency market is showing signs of a slight recovery after the recent sharp decline, with Ethereum (ETH) bouncing back to around $3,700 from its recent low of $3,357. Following this, several altcoins have joined the rebound — including Near Protocol (NEAR).

NEAR has turned green today, and its chart is now displaying an emerging fractal pattern that closely resembles a recent bullish structure seen in Mantle (MNT), hinting at a potential upside move.

Source: Coinmarketcap

Source: Coinmarketcap

NEAR Mirrors MNT’s Structure

A closer look at the daily charts of Mantle (MNT) and NEAR reveals an emerging fractal pattern — with NEAR now tracing the same bullish path that MNT recently completed.

In MNT’s case, the token broke out of a falling wedge pattern, staged a pullback, and formed a Bearish ABCD harmonic pattern. After a strong bounce from point C, MNT reclaimed both the 100-day and 200-day moving averages and rallied nearly 40% toward point D.

MNT and NEAR Fractal Chart/Coinsprobe (Source: Tradingview)

MNT and NEAR Fractal Chart/Coinsprobe (Source: Tradingview)

NEAR appears to be following the same technical roadmap.

After breaking out of its falling wedge, NEAR formed a similar ABCD harmonic structure. It recently bounced from point C at $2.30 and is now testing resistance at the 100-day moving average, which currently sits at $2.53.

What’s Next for NEAR?

If this fractal continues to play out like MNT’s, a confirmed break above the 100-day MA could act as the trigger for a move toward the Potential Reversal Zone (PRZ) near $3.28 — representing a possible 31% upside from current levels.