CrediX disappears after $4,5 million attack, raising suspicions of a scam

- CrediX Loses $4,5 Million in Attack

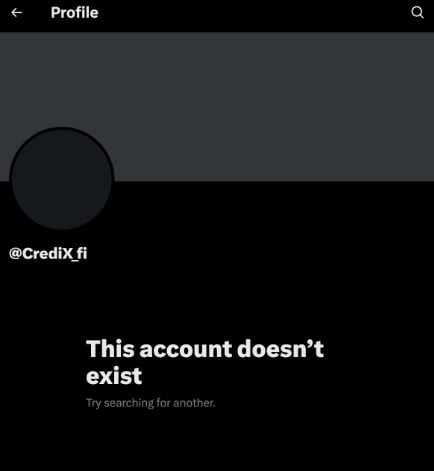

- CrediX's website and social media are offline

- CertiK warns of possible exit scam

The team behind decentralized finance (DeFi) platform CrediX has gone missing after suffering a hack that resulted in the loss of approximately $4,5 million. Since August 4, the project website remains offline and the official account on X (formerly Twitter) is inactive, according to a warning from blockchain security company CertiK.

The incident occurred after an administrative wallet was compromised and exploited to abuse bridge functions. The attacker managed to mint unbacked tokens and drain the liquidity pool's assets, subsequently transferring the funds from the Sonic network to Ethereum, where they were concentrated in a few addresses.

A few hours after the attack, CrediX stated that it would refund users within 24 to 48 hours and that withdrawals would be processed through smart contracts. However, the project's front-end never returned to operation, and no recovery plan was disclosed, raising suspicions of an exit scam.

In the cryptocurrency sector, the term exit scam is used when project operators abruptly cease operations and disappear with investors' funds, often after simulating a hack or performing a rug pull. This typically involves shutting down websites and social media channels, as well as completely cutting off communication with the community.

Similar cases have already occurred in other DeFi projects. In May 2023, DF Fintoch lost approximately $32 million worth of users, while Swamprum DEX, on the Arbitrum network, lost $3 million in the same month. These events reinforce the risks associated with protocols that lack robust security audits or clear governance mechanisms.

With the disappearance of CrediX and the lack of communication from its developers, investors and tracking companies continue to monitor the addresses linked to the attack, seeking to identify movements that could indicate attempts to launder or convert the stolen funds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Espresso co-founder’s decade in crypto: I wanted to disrupt Wall Street’s flaws, but witnessed a transformation into a casino instead

Everything you've been hoping for may have already arrived; it just looks different from what you expected.

Solana Foundation Steps In as Kamino and Jupiter Lend Dispute Intensifies

Bitcoin Firms Confront the Boomerang Effect of Excessive Leverage

Ethereum Burns $18B, Yet Its Supply Keeps Growing