BiyaPay Analyst: Top Three ETH Microstrategy Holdings Surpass Ethereum Foundation, Vitalik Warns of Excessive Leverage Risk

According to Foresight News, BiyaPay analysts report that Ethereum founder Vitalik recently stated that although Ethereum treasury companies have expanded channels for investors to acquire ETH, he warned that improper handling could lead to “over-leveraged games.” However, the market does not seem to have paid much attention to Vitalik’s warning. Instead, the holdings of the three major ETH micro-strategy entities have already surpassed those of the Ethereum Foundation, and many investors are focusing more on figures like Tom Lee.

Vitalik’s concerns are mainly centered on the risks that leverage might bring. In contrast, the Ethereum Foundation continues to sell ETH, which could pose an even greater risk to the market. Meanwhile, companies such as the US-listed SBET and BitMine are accumulating coins through leveraged strategies. It appears that market participants are more interested in increasing their ETH holdings to achieve returns, rather than worrying about the potential risks of leverage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Juventus shares surge nearly 14% after rejecting Tether's acquisition offer

JPMorgan launches its first tokenized money market fund

JPMorgan to launch its first tokenized money market fund on Ethereum, with a seed fund size of 100 millions

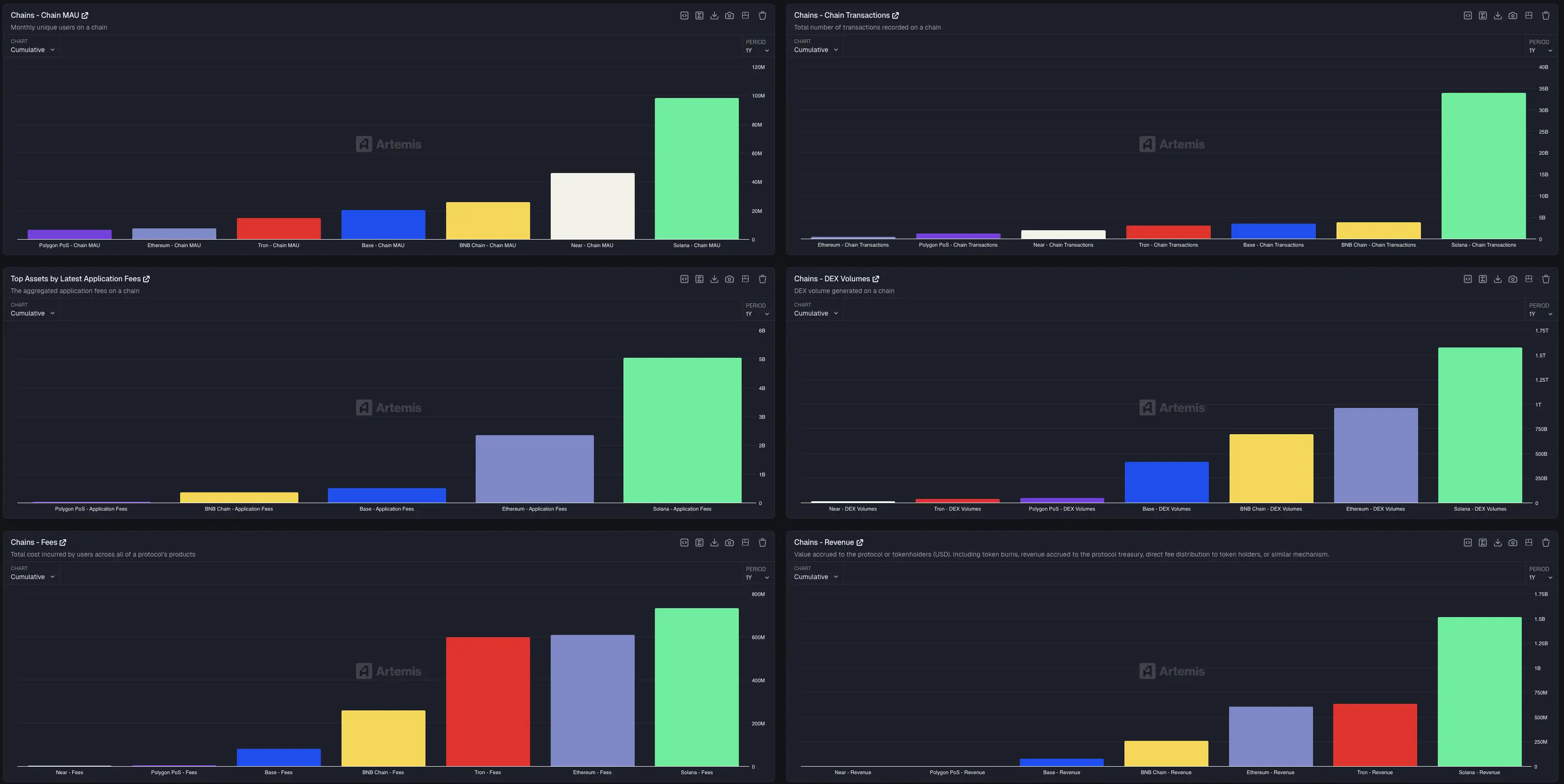

Artemis CEO: Solana leads the market in key on-chain metrics, with transaction volume 18 times that of BNB