Harvard University Adds Bitcoin Exposure Through BlackRock ETF

Harvard Management Company disclosed a $116 million investment in BlackRock's iShares Bitcoin ETF. According to Cointelegraph, the university's endowment fund held 1.9 million shares of the Bitcoin ETF as of June 30. The position ranks as Harvard's fifth-largest equity holding after Microsoft, Amazon, Booking Holdings, and Meta.

Harvard's $53.2 billion endowment remains the largest among US universities. The Bitcoin ETF investment represents approximately 0.2% of the total endowment value. Harvard Management Company filed the disclosure with the Securities and Exchange Commission on Friday. The investment occurred during the second quarter of 2025.

University Endowments Enter Digital Asset Space

Harvard joins other prestigious institutions adding Bitcoin exposure to their portfolios. Pensions & Investments reported Brown University purchased $4.9 million worth of BlackRock's Bitcoin ETF during the same period. Emory University became the first endowment to invest in Bitcoin ETFs in 2024, acquiring $15 million in Grayscale Bitcoin Mini Trust shares.

These allocations remain small percentages of total endowment assets. Brown's Bitcoin position represents less than 0.07% of its $7.2 billion endowment. Harvard's investment reflects broader institutional acceptance of cryptocurrency as an alternative asset class. Bitcoin ETFs provide regulated exposure without direct custody requirements.

We previously reported that national Bitcoin reserves can fund university research programs, creating sustainable innovation cycles. University adoptions create research pathways that advance cryptographic technology and blockchain development.

BlackRock Bitcoin ETF Drives Institutional Growth

BlackRock's Bitcoin ETF has become the most successful ETF launch in history. Bloomberg revealed the fund generates more annual revenue than BlackRock's S&P 500 ETF despite being nine times smaller. The Bitcoin ETF accumulated over $86 billion in assets within 18 months of launch.

University endowment adoptions reflect changing perceptions about Bitcoin's role in portfolio diversification. Traditional institutions previously avoided cryptocurrency due to volatility and regulatory uncertainty. SEC approval of spot Bitcoin ETFs in January 2024 removed operational barriers for conservative investors.

The trend extends beyond academic institutions to pension funds and insurance companies. State of Wisconsin Investment Board holds $170 million in Bitcoin ETFs. Michigan Retirement System also reported cryptocurrency ETF positions. Institutional participation validates Bitcoin's position as a legitimate asset class.

BlackRock's Bitcoin ETF attracted over 1,300 institutional holders including banks, trusts, and family offices. The fund processes more trading volume than competing Bitcoin ETFs combined. Harvard's investment places the university among the top 30 institutional holders of the fund. This institutional backing provides liquidity and price stability for the broader Bitcoin market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Tether financial analysis: Needs an additional $4.5 billion in reserves to maintain stability

If a stricter and fully punitive approach is applied to $BTC, the capital shortfall could range from 1.25 billion to 2.5 billion USD.

The fundraising flywheel has stalled, and crypto treasury companies are losing their ability to buy the dip.

Although the treasury companies appear to have ample resources, the disappearance of stock price premiums has cut off their financing channels, causing them to lose their ability to buy the dip.

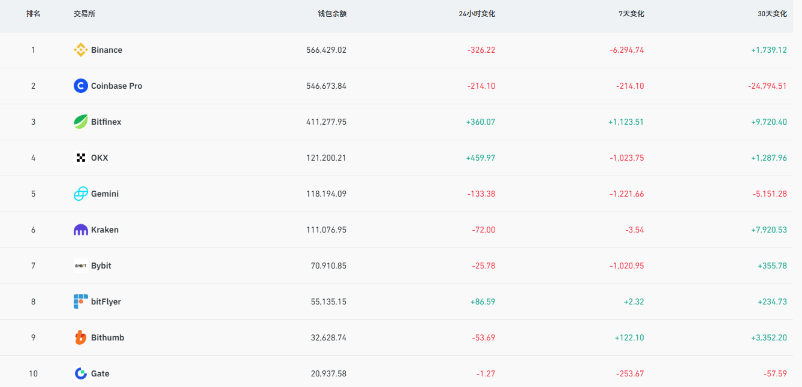

Nearly 10,000 bitcoins withdrawn from exchanges, is the market about to change direction?