XRP is showing bullish potential with the recent MVRV golden cross and a significant drop in the NVT ratio, indicating improved transaction efficiency and possible price rallies ahead.

-

XRP’s MVRV golden cross historically precedes substantial price rallies.

-

The NVT ratio’s decline suggests improved transaction efficiency.

-

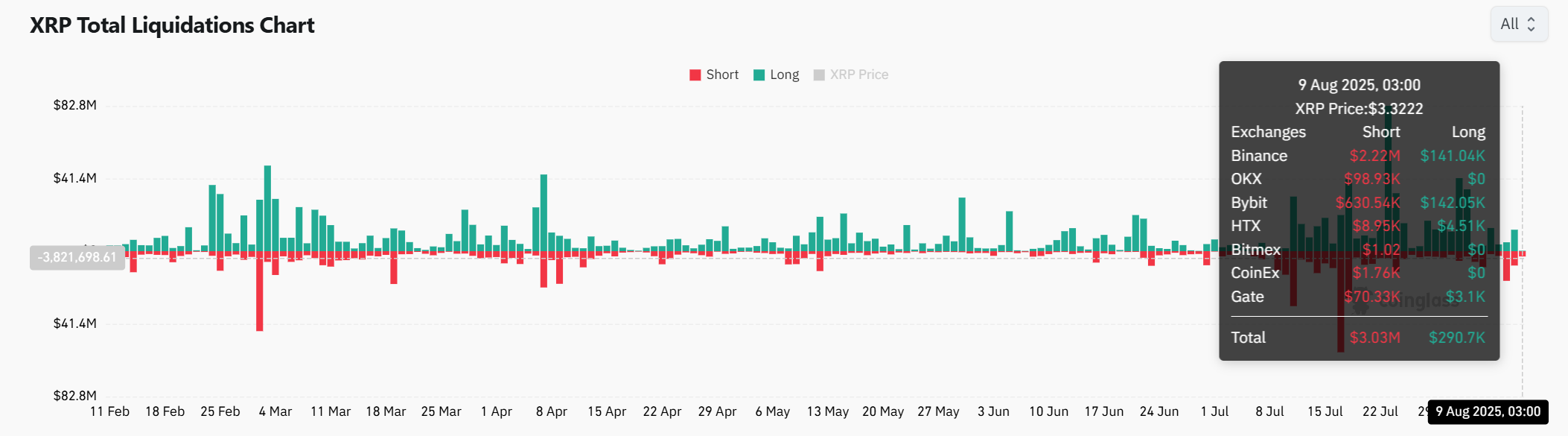

Short squeezes are adding upward pressure on XRP’s price.

Discover how XRP’s MVRV golden cross and NVT ratio improvements signal bullish trends in the crypto market.

What is XRP’s MVRV Golden Cross?

The MVRV golden cross occurs when the market value of XRP surpasses its realized value, indicating potential undervaluation. This technical event has historically led to price increases of up to 630%.

How Does the NVT Ratio Affect XRP’s Price?

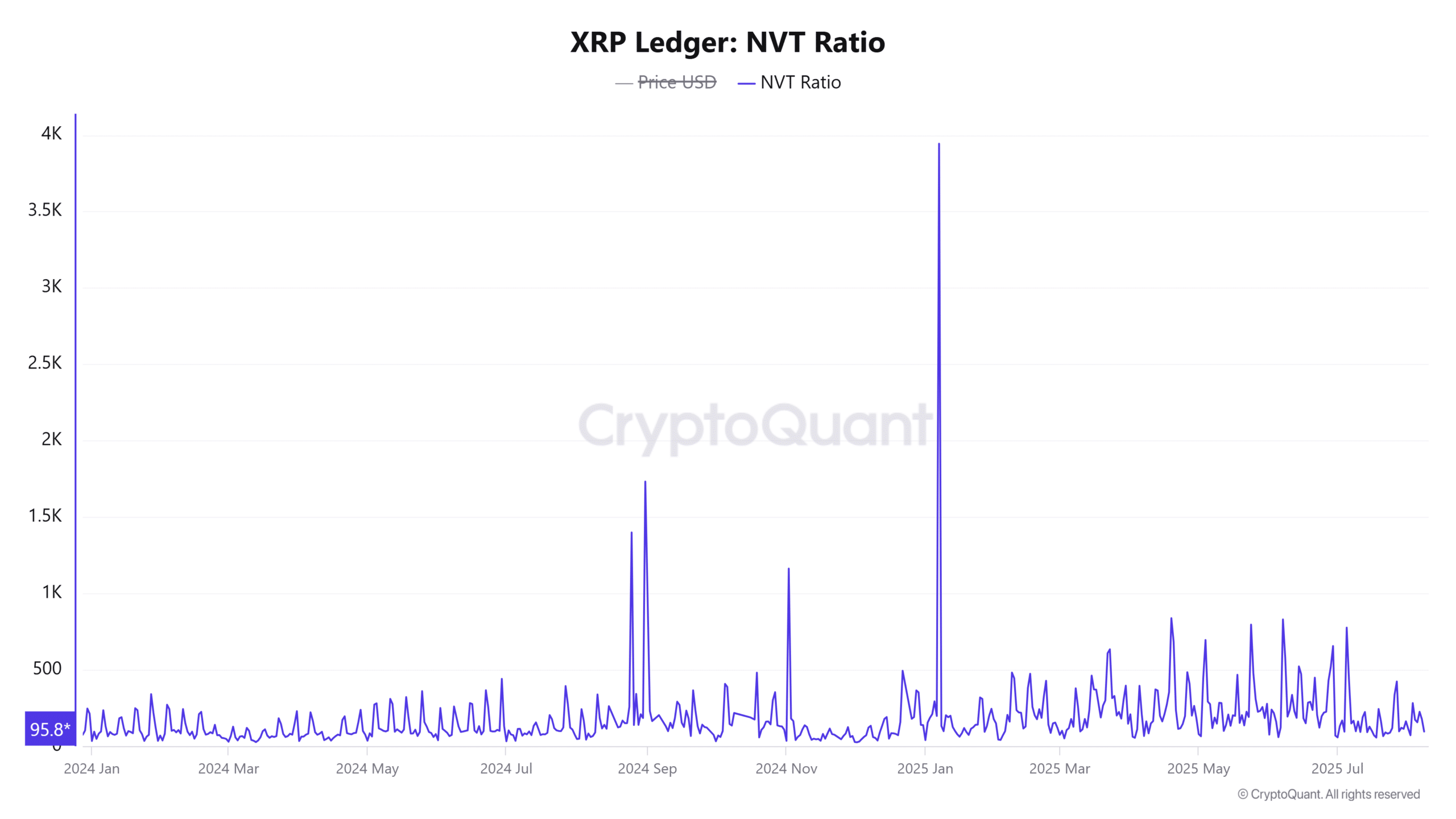

The NVT ratio measures the relationship between XRP’s market value and its transaction volume. A recent drop of 46.1% to 95.88 suggests enhanced transaction efficiency, often preceding bullish price movements.

Frequently Asked Questions

What is the significance of the NVT ratio?

The NVT ratio’s decline indicates that XRP’s market value aligns better with its transaction volume, suggesting improved network efficiency.

How can short squeezes impact XRP’s price?

Short squeezes can lead to rapid price increases as bearish traders are forced to buy back positions, adding upward pressure on XRP.

Key Takeaways

- XRP’s MVRV golden cross indicates a bullish trend, historically leading to significant price increases.

- NVT Ratio decline suggests improved transaction efficiency, enhancing investor confidence.

- Short squeezes may trigger rapid price spikes, adding volatility to the market.

Conclusion

XRP’s recent bullish indicators, including the MVRV golden cross and improved NVT ratio, suggest a strong potential for price rallies. To maintain momentum, XRP must break above key resistance levels, paving the way for future gains.

-

XRP shows strong bullish potential with recent technical indicators.

-

Improved NVT ratio suggests better transaction efficiency.

-

Short squeezes are pushing prices higher, creating volatility.

Explore how XRP’s market indicators can influence future price movements.

Will Fibonacci resistance hold back XRP’s bullish momentum?

The daily chart places XRP near the 0.618 Fibonacci retracement at $3.30, with immediate resistance at $3.46 and $3.66. A breakout above these levels could lead to a price target of $4.23.

However, recent rejections near the 0.786 level at $3.46 indicate supply pressure. Sustained buying volume will be essential for further upward movement.

Source: TradingView

Could THIS decline fuel stronger network efficiency?

XRP’s NVT Ratio has plunged by 46.1% in the past 24 hours, dropping to 95.88. This decline suggests the asset’s market value is now more in line with the transaction volume on the network.

Historically, lower NVT values indicate higher transaction efficiency and stronger on-chain activity, which can often precede bullish price action.

This shift may enhance investor confidence, particularly when combined with technical setups pointing to potential upside.

Source: CryptoQuant

Are short squeezes giving bulls the upper hand?

Liquidation data showed shorts faced $3.03 million in losses against just $290K for longs, forcing bearish traders to buy back positions.

Such short squeezes can trigger rapid price spikes when the bias is already bullish.

Source: CoinGlass

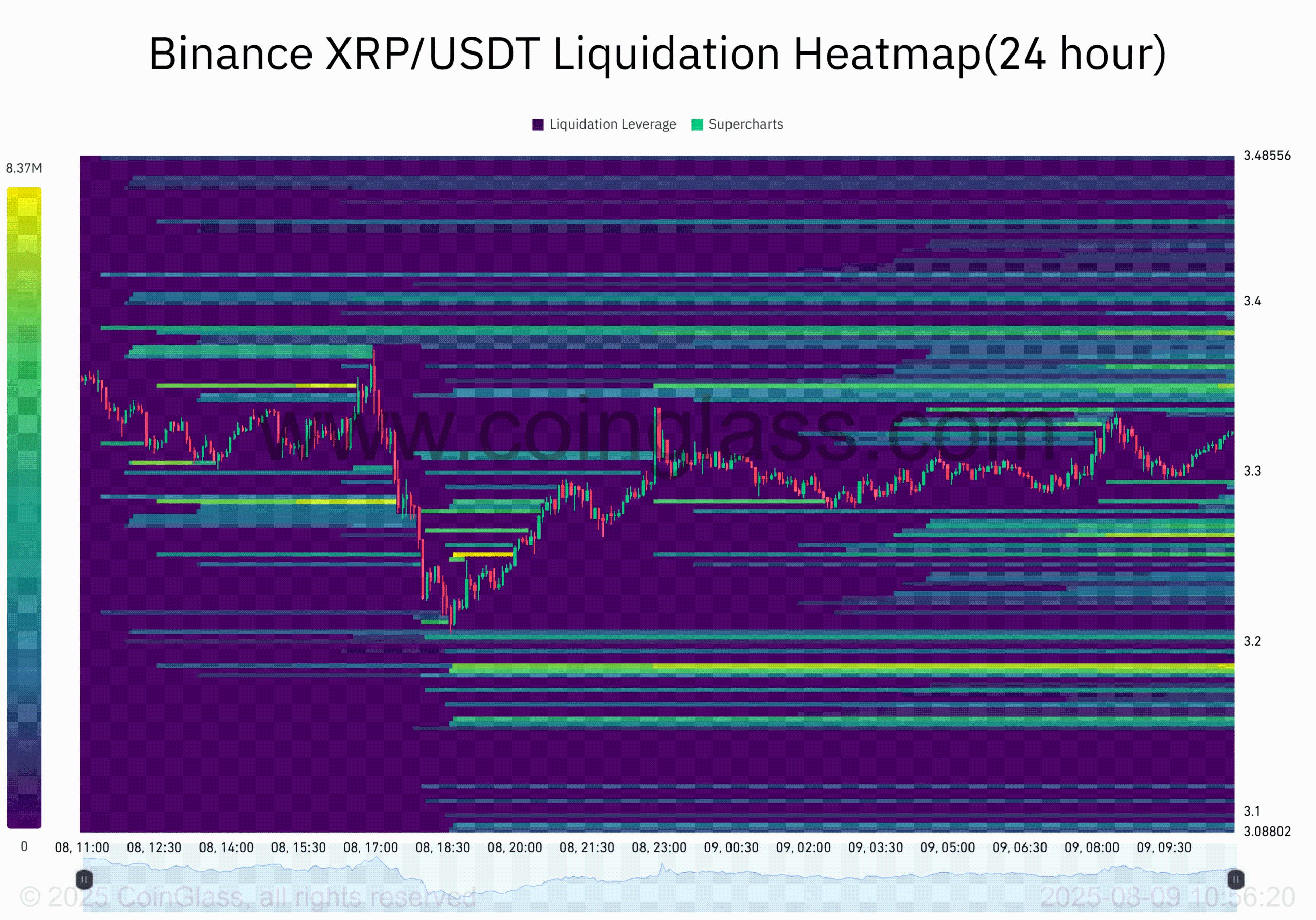

Will the $3.40 zone act as the next breakout trigger?

Binance Liquidation Heatmap data highlighted dense liquidity clusters between $3.40 and $3.48, suggesting a breakout above this range could trigger significant market reactions.

These levels coincide with key short-term resistances, making them important battlegrounds for bulls and bears.

Source: CoinGlass

Can XRP’s golden cross replicate past rallies?

With bullish technical indicators, improved on-chain efficiency, and favorable liquidation trends, XRP is showing strong potential for continued upward movement.

The recent reappearance of the MVRV golden cross further strengthens the bullish outlook.

However, to maintain this momentum, XRP must decisively break above the $3.46 resistance level.

If this barrier is cleared with substantial buying pressure, historical patterns suggest the token could be on track for another major rally in the coming weeks.