Dogecoin News: Is DOGE About to Pump Hard?

Dogecoin price has entered August with a recovery that is starting to draw attention from traders and long-term holders alike. This rebound is not just a price action story; it is backed by stable network performance and favorable on-chain conditions. With DOGE price currently priced at 0.1726 USD, up 5.19 percent over the past 24 hours and 4.30 percent over the past week, momentum is tilting back toward the bulls after a choppy start to the month.

Dogecoin Price Prediction: Technical structure signals a possible breakout

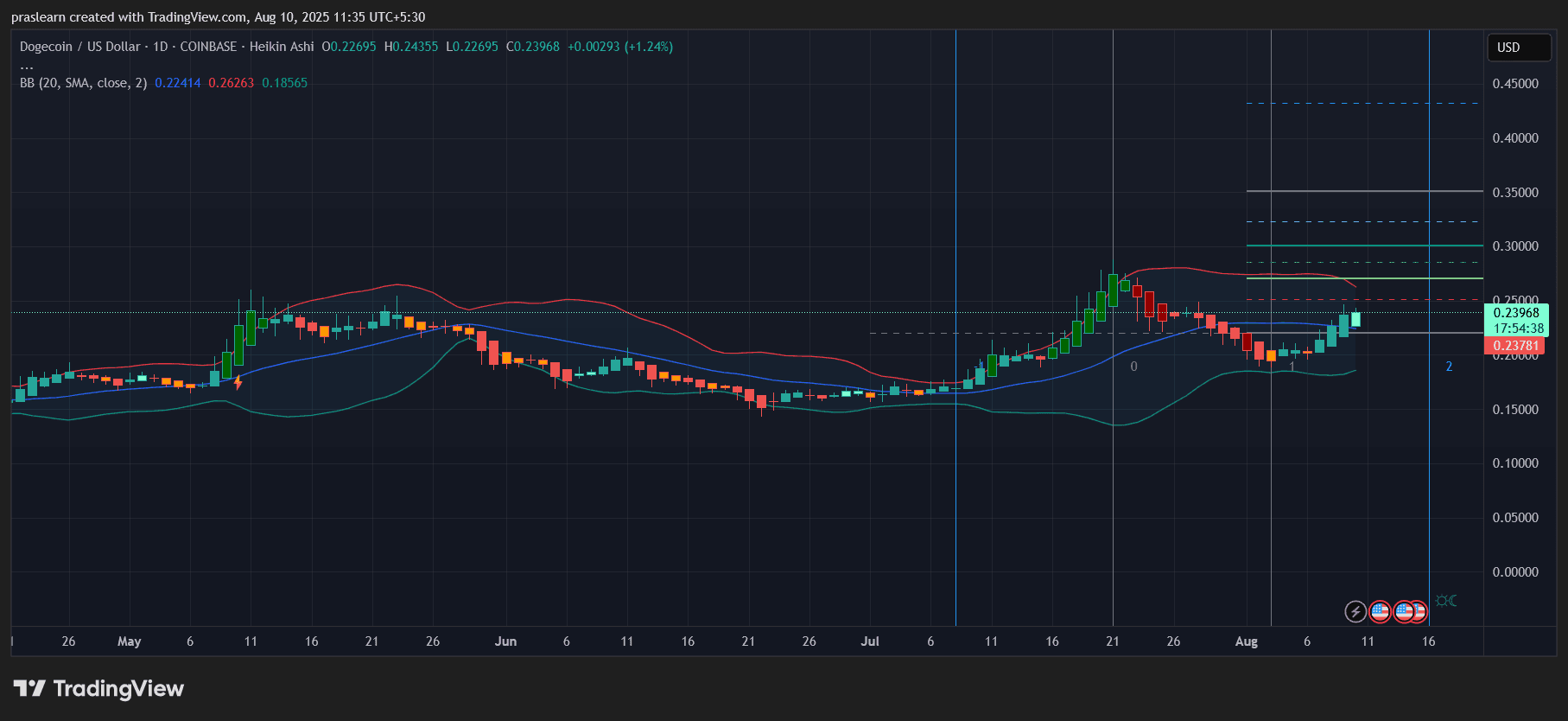

DOGE/USD Daily Chart- TradingView

DOGE/USD Daily Chart- TradingView

The daily chart shows that Dogecoin found a firm base at the 0.185 support zone, an area that has repeatedly attracted buying interest. From there, price has climbed back above the 20-day simple moving average, often the first step in flipping short-term momentum from bearish to bullish. The current challenge lies at the 0.245 resistance, which coincides with the upper Bollinger Band. This level is critical because it marked previous rejection points during past rallies.

Bollinger Bands are starting to expand after weeks of narrowing. Band expansion following a support bounce typically indicates that volatility is returning, often leading to a decisive directional move. If DOGE can close above 0.245 with strong volume, the technical setup favors a push toward 0.285 and potentially 0.305. In a more aggressive scenario, a high-momentum breakout could stretch toward 0.35, especially if the wider crypto market is supportive.

Moving averages and momentum indicators

The 20-day moving average has already been reclaimed, and the 50-day is now the next objective. A close above both would confirm the shift in market structure and attract more momentum traders. If the 20-day crosses above the 50-day, that bullish crossover would be an additional technical confirmation. On the momentum side, indicators such as RSI and MACD should be monitored for divergence or confirmation, as these could either validate or challenge the breakout narrative.

Risk levels to watch

The bullish setup would be invalidated if price fails to break 0.245 and instead retreats below 0.224. In that case, DOGE would likely revisit 0.20 and potentially retest the 0.185 base. A breakdown below 0.185 would shift sentiment back toward sellers and delay any significant recovery.

Dogecoin News: Network fundamentals remain strong

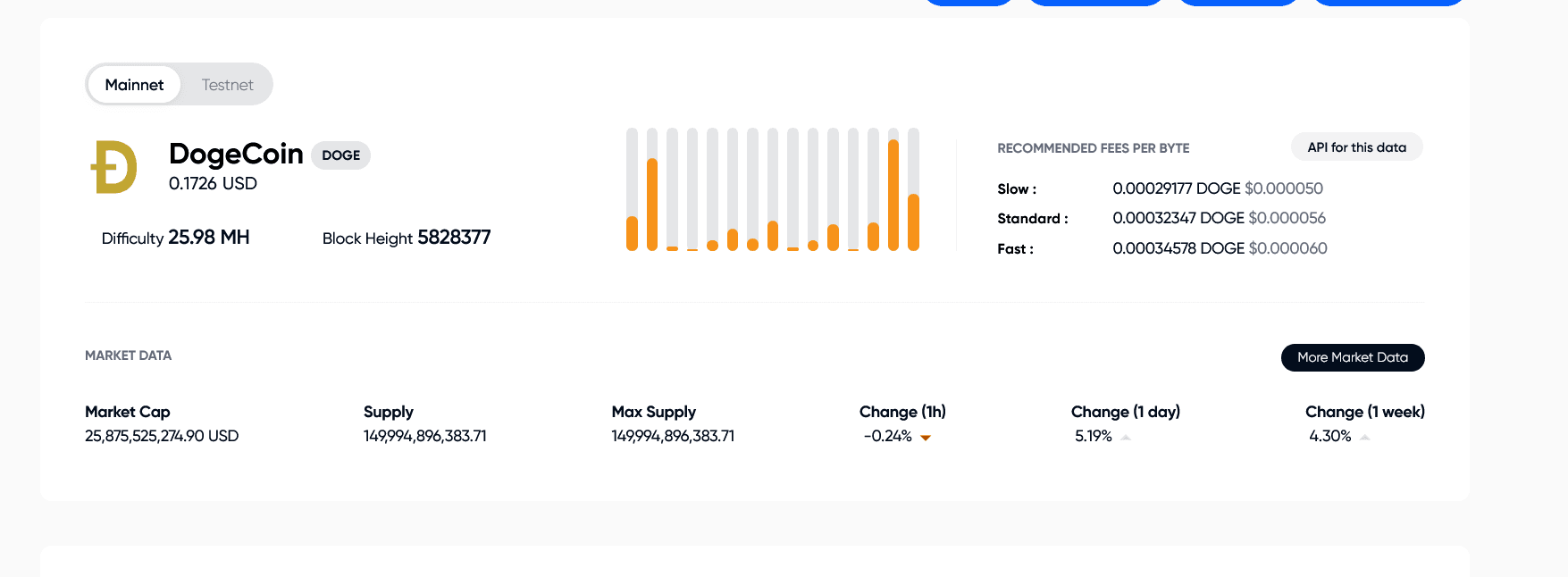

DOGE Activity: Image Source: BlockExplorer.one

DOGE Activity: Image Source: BlockExplorer.one

Beyond the chart, Dogecoin’s network health adds another layer of support for the bullish argument. Mining difficulty sits at 25.98 MH, reflecting a stable mining environment without signs of miner capitulation or security concerns. The block height of 5,828,377 confirms that block production remains consistent, a sign of operational stability.

One of Dogecoin’s enduring strengths is its extremely low transaction cost. Even the fastest transactions cost just $0.000060 per byte, making it one of the cheapest major cryptocurrencies to move across the network. This cost advantage supports its ongoing use in microtransactions, tipping, and retail payments, which can maintain organic demand for DOGE regardless of speculative trends.

The interplay between technicals and fundamentals

The combination of a bullish technical recovery and solid network metrics creates a more convincing case for a sustained move higher. Price action shows accumulation at key support, while network conditions reinforce investor confidence. This alignment means that if technical resistance is breached, the move could carry further than it would on technical momentum alone.

Dogecoin Price Prediction: Short-term and medium-term forecast

In the short term, clearing the 0.245 resistance with above-average daily volume is the key trigger. If that happens, DOGE price has room to test 0.285 within one to two weeks, followed by 0.305. If the breakout coincides with a broader rally in Bitcoin and Ethereum, the 0.35 level could be reached before sellers step in. In the medium term, holding above 0.285 would be crucial to sustain a bullish cycle that could eventually challenge the 0.40 zone.

On the other hand, failure to break 0.245 or a sudden shift in market sentiment could pull Dogecoin price back into the 0.20 to 0.185 range, turning the current rally into a short-lived bounce rather than the start of a lasting uptrend.

Dogecoin News: Final outlook

Dogecoin’s recovery is at a critical juncture. Technical charts suggest that the groundwork for a breakout is being laid, with moving averages, Bollinger Bands, and support levels aligning in favor of buyers. Network stability, low fees, and healthy mining activity further strengthen the case for a continuation of the rally. The next move will depend on how price reacts to the 0.245 resistance. Break above it with conviction, and DOGE could be on its way toward 0.30 and beyond. Fail to clear it, and the market may be looking at another round of consolidation before the next attempt.

How to Trade Dogecoin?

- Identify your exchange – Compare fee structures and liquidity using our exchange comparison guide .

- Monitor price levels – Watch the price levels closely.

- Understand the asset – For new traders, read up on blockchain basics to appreciate the technology behind DOGE.

For live pricing and charts, visit the DOGE price page .

$DOGE, $Dogecoin, $DOGEPrice, $DogecoinPrice

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Grayscale submits IPO application: The crypto giant with $35 billion in assets under management finally approaches the US stock market

The $35 billion includes ETPs and ETFs with $33.9 billion in assets under management (mainly Bitcoin, Ethereum, and SOL related products), as well as $1.1 billion in private funds.

The $100,000 threshold is hard to hold, bitcoin leads the decline, and the risk-aversion storm fully escalates.

A wave of risk is sweeping across global assets, with US stocks plunging simultaneously.

Aztec launches public fundraising—are there still buyers after a 7-year wait?

A quick overview of the auction details and tokenomics.

Gold Rush Handbook: Why Are Top VC Benchmarks Focusing on Fomo?

Benchmark, which has previously invested in Uber, X, and Instagram, is making another move: betting on the minimalist social crypto trading app fomo.