XRPL EVM, the sidechain that was supposed to bring Ethereum smart contracts compatibility to the XRP Ledger ecosystem, has 4 chains with $100k TVL.

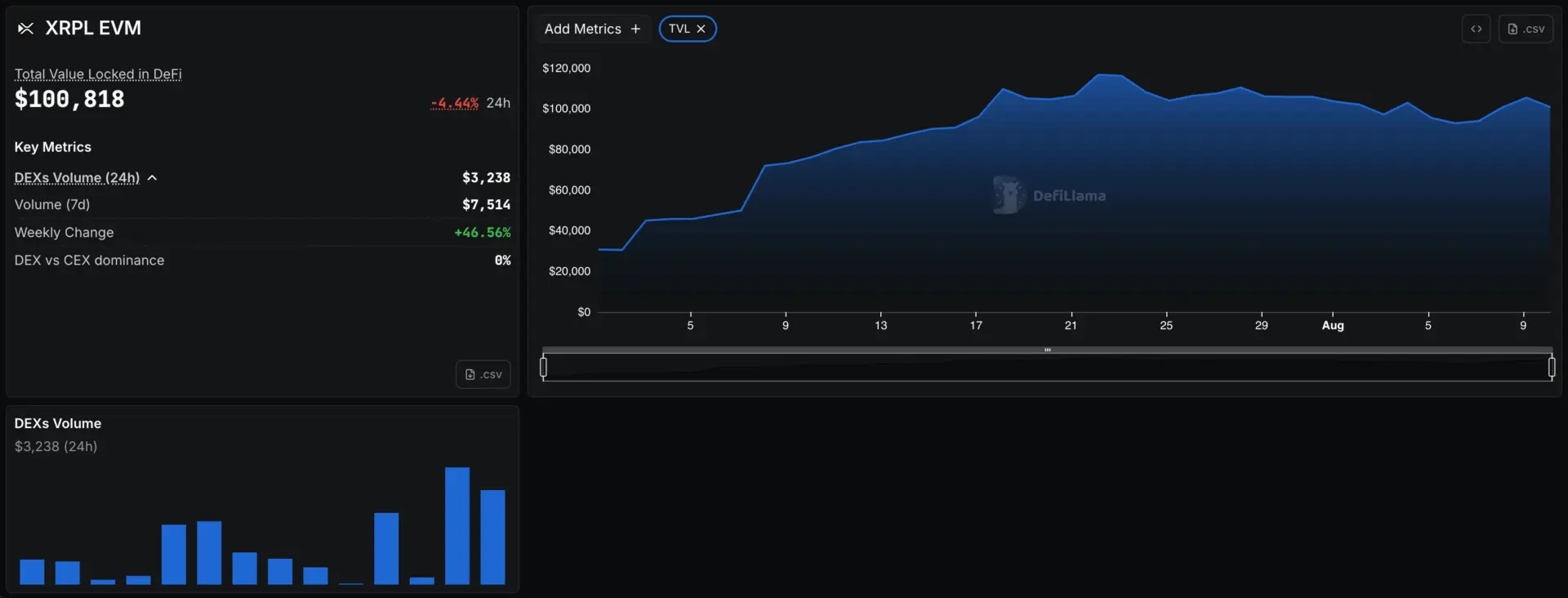

DeFiLlama’s latest data paints a pretty bleak picture for XRPL EVM . The sidechain currently hosts just three DEXs and a single launchpad—the total value locked across them sits at only $100,818.

Even more underwhelming, the combined 24-hour trading volume is a mere $3,238 — and every dollar of that came from Moai Finance. The other listed chains — Riddle, XRiSE33 Network, and SurgeDefi — recorded zero trading activity in the same period.

Ripple’s XRPL EVM sidechain off to a tough start

It’s a tough look for a project that launched on June 30 with bold promises. XRPL EVM positioned itself as “a new era of cross-chain DeFi.” It’s aiming to lure Solidity developers to build, port, and deploy EVM dApps while “tapping into XRPL’s deep liquidity and 12+ years of operational stability.”

Developer Report data shows XRPL EVM has just 168 developers, compared to Ethereum’s 8,448 — a difference of about 98% fewer developers. The numbers don’t lie — with its tiny TVL and near-zero trading activity, the XRPL EVM sidechain has failed to attract real traction.

XRPL EVM on-chain data. Source: DeFiLlama .

XRPL EVM on-chain data. Source: DeFiLlama .

RLUSD is underperforming too

RLUSD, Ripple’s stablecoin , is underperforming too. It hasn’t even crossed the $1 billion mark, sitting at just $642 million in market cap. About 10.25% of that is on the XRPL Ledger, roughly $65.81 million. That’s only 0.024% of the $271 billion stablecoin market. For context, USDT sits at $164 billion and USDC holds $65 billion.

Ripple has been making big moves and rubbing shoulders with politicians. The company bought stablecoin platform Rail for $200 million. Brad Garlinghouse, Ripple’s CEO, testified before the U.S. Senate Banking Committee to call for clear rules on digital assets and stablecoins.

In January, Garlinghouse and CLO Stuart Alderoty had a private dinner with President-elect Donald Trump at Mar-a-Lago. Garlinghouse called it “a great dinner” and “a strong start to 2025.” A few months later in March, Garlinghouse attended Trump’s crypto summit at the White House. He praised the president’s vision of a “multichain world” and welcomed XRP’s inclusion in a proposed U.S. crypto reserve.

Ripple’s lobbying seemed to pay off when Congress passed the GENIUS Act, the first U.S. stablecoin law, which Trump signed on July 18. Alderoty was at the White House for the signing, calling it “the most crypto-forward Administration we’ve ever seen.”

The momentum continued with a major win in August when the SEC ended its long-running lawsuit against Ripple, with the company paying a $125 million fine.

But despite these milestones, the market response to Ripple’s own products has been underwhelming. Both the XRPL EVM sidechain and Ripple’s RLUSD stablecoin have failed to gain major adoption.

KEY Difference Wire helps crypto brands break through and dominate headlines fast