Key Insights

- Dogecoin surpassed the $0.23 resistance level after two weeks, setting up potential support that could drive its price toward $2.

- ETF approval odds jumped from 51 to 71%, prompting whales to accumulate DOGE between $0.18 and $0.23.

- Whales opened over $12 million in long positions within 24 hours, indicating confidence in sustained price momentum.

Dogecoin traded at $0.24 on August 9, gaining 7.75% in 24 hours. The cryptocurrency moved above the $0.23 level, a price point that acted as strong resistance for the past two weeks. Market analysts now expect bulls to attempt to convert this level into support.

Analyst Crypto Patel highlighted that Dogecoin has already built support at lower levels, including $1.50. He noted that the likelihood of prices falling below $0.15 remains low. This view has been reinforced by increased buying activity from large holders in a range between $0.18 and $0.23.

Strategic Accumulation Zone Attracts Whales

On-chain data shows that whales have been accumulating DOGE within the identified zone. These positions suggest confidence in future price growth. If the accumulation continues, Patel believes the cryptocurrency could rally to $2 in the short term, with more potential gains projected for the long term.

Source: TradingView

Source: TradingView

Market sentiment received a boost after Polymarket data showed the odds of the US Securities and Exchange Commission approving a spot Dogecoin ETF rose sharply. The probability moved from 51% to 71% in one day.

Policy Shift Adds to Optimism

Reports from CoinGape linked this optimism to a policy shift allowing cryptocurrency investments in US 401(k) retirement plans. This change could expand market access and increase demand for DOGE.

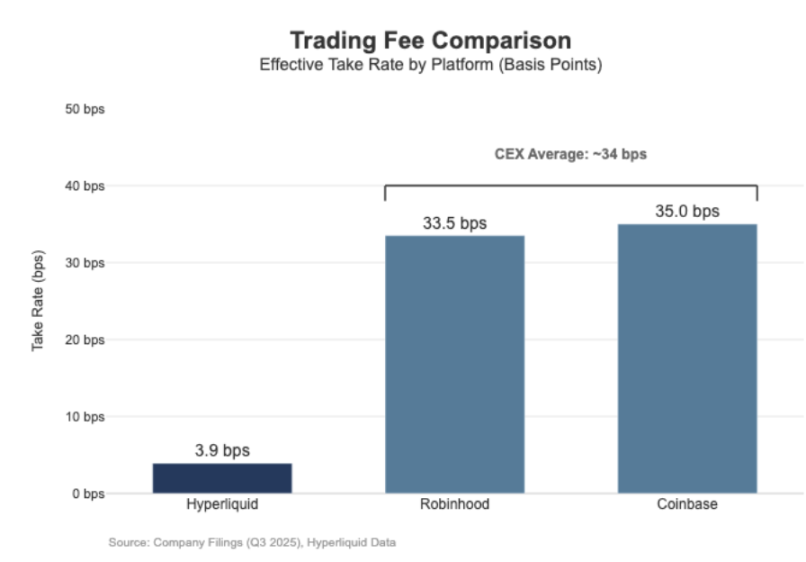

Data from Hyperliquid revealed that whales opened more than $12 million worth of long positions on Dogecoin in 24 hours. This move suggests large traders are positioning for a potential breakout while DOGE retests previous resistance zones.

With resistance levels breaking and ETF speculation rising, the combination of whale activity and policy developments is setting the stage for possible higher price targets in the coming months.