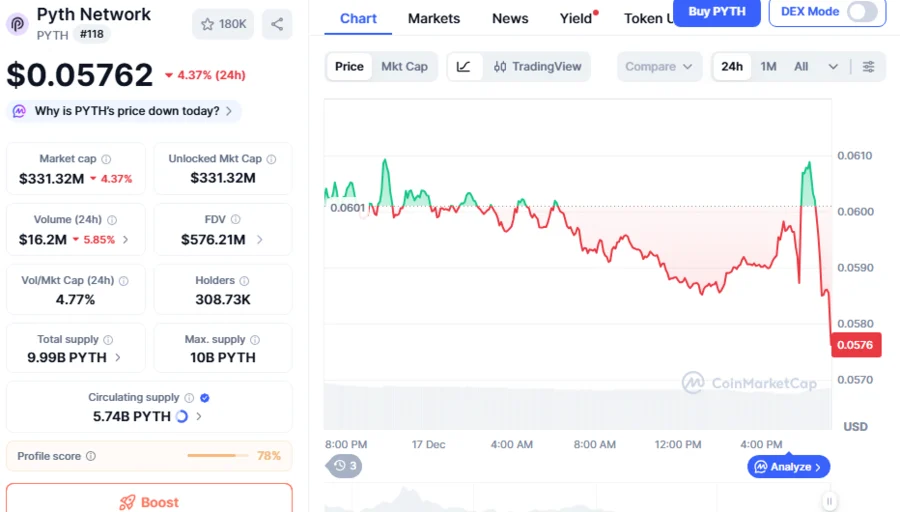

- Solana formed a falling wedge breakout followed by a rectangle pattern suggesting strong continuation ahead

- Chart analysis shows medium-term target near $270 with a longer extension pointing toward $330 level

- Key support remains above $183 and holding this range is vital for momentum toward projected price goals

Solana (SOL) is trading near $183.19 as its latest chart pattern suggests potential upside toward $270 and $330. The structure combines a falling wedge breakout with a rectangle consolidation, signaling continuation of bullish momentum. These targets are based on measured moves from the completed formations.

Falling Wedge Marks Early Reversal

From late 2024 into early 2025, SOL’s price trended downward within a defined falling wedge pattern. This structure, outlined in red, formed as lower highs and lower lows compressed toward a convergence point. The wedge bottomed in April 2025 before price broke upward, indicating a reversal from the extended downtrend.

Measured from the wedge’s widest point, the breakout projection aligned with a recovery above the $160 range. Following this move, SOL entered a new consolidation phase, transitioning from the reversal into a potential continuation setup. The initial breakout set the stage for the next bullish pattern to develop.

Rectangle Consolidation Signals Continuation

After rallying from the falling wedge, SOL’s price action created a rectangle formation, marked in orange. This structure developed between approximately $132 and $183, representing a period of sideways consolidation. The breakout from this rectangle carried price back toward the current $183 level.

Technical analysis often treats rectangles as continuation patterns. Applying a measured move from the rectangle’s height produces an immediate target near $270. This aligns with one of the key price projections indicated in the chart. Sustained trading above the rectangle’s upper boundary confirms the pattern’s validity.

Volume trends during the rectangle phase showed balance between buyers and sellers, typical of such formations. Once buyers regained control, momentum shifted upward, supporting the breakout projection.

Extended Target Near $330 in Sight

Beyond the $270 objective, the chart displays an extended target close to $330, marked in blue. This projection is derived from the larger overall pattern, which incorporates the combined effects of the falling wedge and rectangle breakout .

The technical pathway to $330 involves holding support above $183 and building momentum past $270 resistance. Achieving these milestones could open the way to the higher extension. The chart’s symmetrical formation suggests that the bullish impulse may still be in its early stages.

If SOL maintains its trajectory, the $330 level could mark the completion of the broader technical setup. However, this requires sustained buyer participation and the absence of significant reversal signals.

With both medium-term and longer-term targets visible, traders are focusing on the key levels outlined in the chart. Will Solana’s current structure be the catalyst that propels it toward these projected highs?