Data: Ethereum Spot ETFs Saw $327 Million Net Inflows Last Week, Marking 13 Consecutive Weeks of Net Inflows

According to ChainCatcher, citing SoSoValue data, during last week's trading days (Eastern Time, August 4 to August 8), Ethereum spot ETFs saw a net inflow of $327 million for the week. Notably, all nine ETFs recorded net inflows.

The Ethereum spot ETF with the highest weekly net inflow was Fidelity's FETH, with a weekly net inflow of $109 million. To date, FETH's total historical net inflow has reached $2.37 billion. The next highest was BlackRock's ETF ETHA, with a weekly net inflow of $105 million, bringing ETHA's total historical net inflow to $9.85 billion.

As of press time, the total net asset value of Ethereum spot ETFs stands at $23.38 billion, with the ETF net asset ratio (market value as a percentage of Ethereum's total market cap) at 4.77%. The cumulative historical net inflow has reached $9.82 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

JPMorgan launches its first tokenized money market fund

JPMorgan to launch its first tokenized money market fund on Ethereum, with a seed fund size of 100 millions

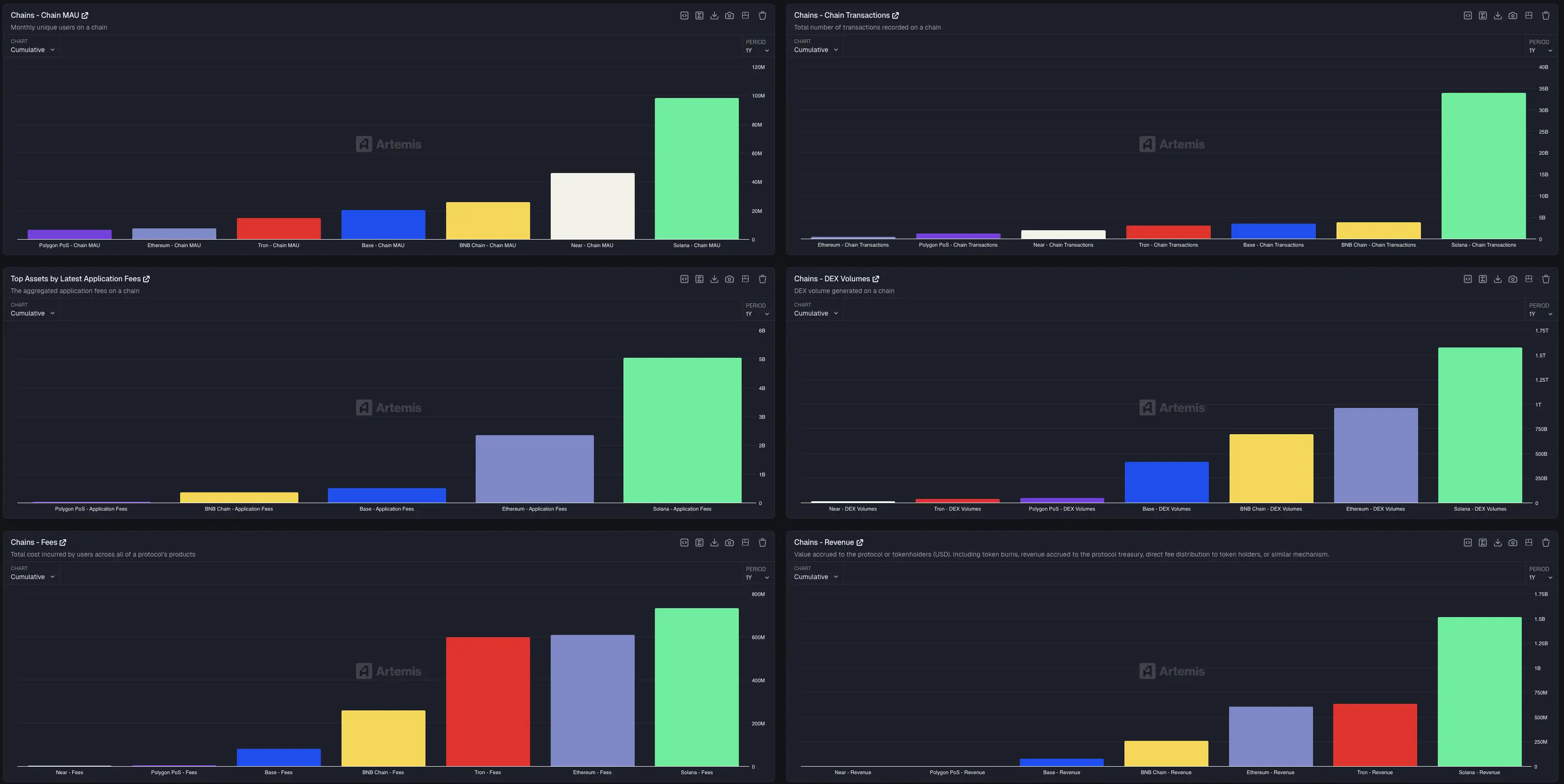

Artemis CEO: Solana leads the market in key on-chain metrics, with transaction volume 18 times that of BNB