Ethereum Ecosystem Awakening: LDO Surges 60% in a Single Week, Is the "Staking King" Due for a Value Reassessment?

The SEC has clarified that liquidity staking does not involve securities issuance and sale, easing regulatory concerns for projects like Lido at a regulatory level.

Original Article Title: "LDO Surges Over 60% in a Single Week, Is ETH's "Prince" Finally Finding Its Value?"

Original Article Author: Azuma, Odaily Planet Daily

The leader in the liquidity staking track, Lido (LDO), has recently experienced a significant surge. According to OKX data, as of 10:00 on August 11(东八区), LDO was trading at 1.52 USDT, with a 24-hour gain of 14.21% and a staggering 64.5% increase in the past week.

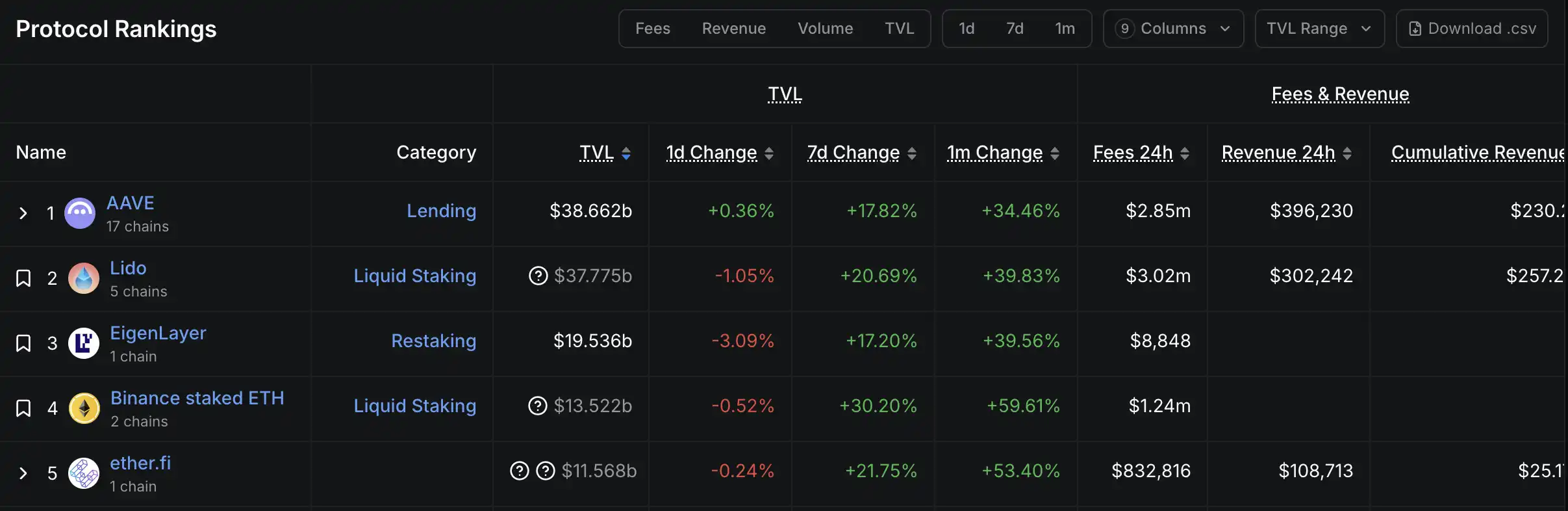

As the largest liquidity staking protocol in the Ethereum ecosystem, Lido has long held the top position in the total value locked (TVL) rankings of the Ethereum ecosystem and even the entire on-chain ecosystem. Although it has been overtaken by the rapid growth of Aave driven by the USDe stablecoin-based asset recycling, Lido remains one of the most influential protocols in the entire Ethereum ecosystem.

Regarding the recent surge in LDO, the logic can be attributed to two main levels: macro and micro.

Macro: Regulatory Clarity, Staking ETF Advancement

Firstly, at the macro level, on August 6, the U.S. Securities and Exchange Commission (SEC) officially issued a statement on liquidity staking activities, stating: "'Liquidity staking activities' related to protocol staking do not involve the issuance and sale of securities unless the assets deposited include cryptographic assets that are part of an investment contract or are subject to an investment contract. Participants in liquidity staking activities do not need to register transactions with the SEC under the Securities Act, nor do they need to comply with the Securities Act's registration exemptions for these liquidity staking activities."

In June 2024, when Gary Gensler was still at the helm of the SEC, the SEC accused liquidity staking projects such as Lido and Rocket Pool of being securities. On that day, LDO plummeted more than 10% due to this bearish news and remained in a slump for a considerable period thereafter. However, just one year later, this statement from the new SEC clarified that their business model does not involve securities, effectively easing the regulatory constraints on the subsequent operation and development of such projects.

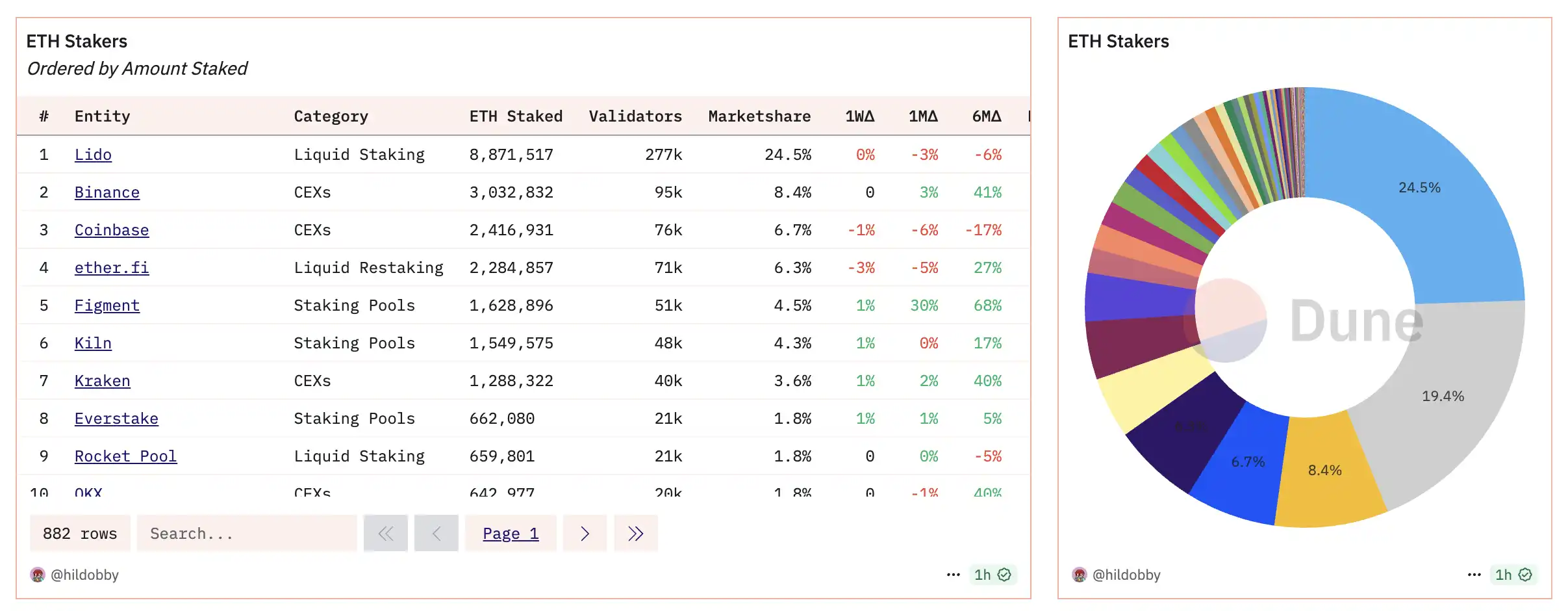

In addition to the regulatory shift, another key development recently related to the staking track is that BlackRock has submitted an application to the SEC to introduce a staking mechanism in its spot Ethereum ETF, although this application is still under review, the expectation is that approval will not be too difficult based on the SEC's stance. The market widely anticipates that with the approval of the staking ETF, Lido, which currently holds nearly 25% of the Ethereum staking share, is expected to receive a business boost and attract additional funds.

Micro Perspective: LDO Buyback Plan Finally Takes the Stage

Compared to the indirect impact at the macro level, the recent discussions about the LDO buyback plan may be the direct factor affecting the coin's price trend in the short term.

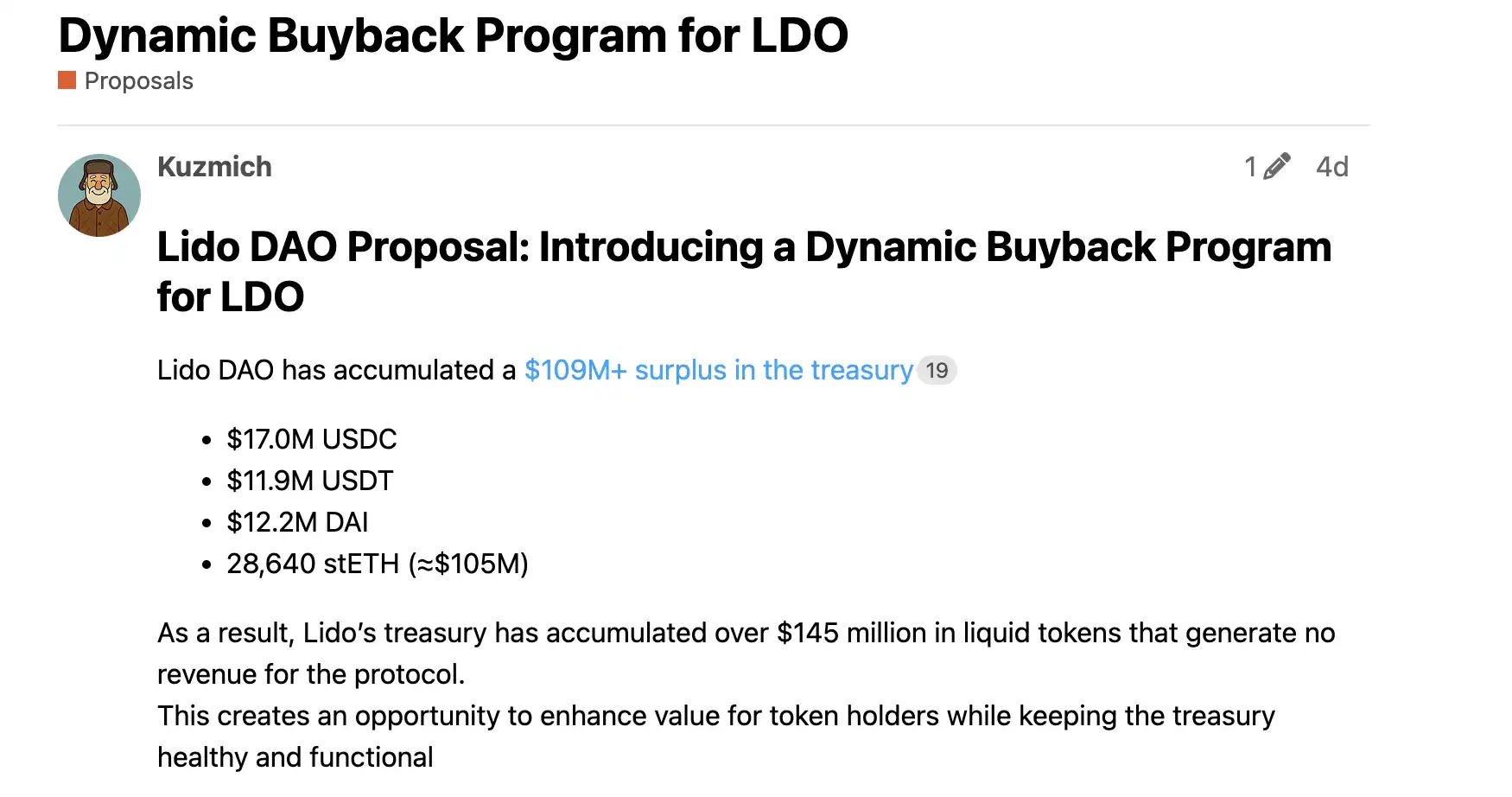

On August 7(东八区), Lido community member Kuzmich submitted a proposal regarding the "LDO Buyback Plan" on the governance forum. The proposal mentioned that the Lido treasury currently holds $145 million worth of liquid assets (17 million USDC, 11.9 million USDT, 12.2 DAI, 28,640 stETH), but these assets have not been generating revenue for the protocol.

The proposal suggests that Lido should dynamically execute an LDO buyback based on the treasury balance to improve the protocol's fund utilization model, boost the LDO price, and thereby restore market confidence in the value of LDO. Specifically, the proposal suggests that based on the current treasury reserve size, 70% of the liquid assets should be used for periodic LDO buybacks, while 30% should be retained in the treasury for operational and strategic needs. When the treasury's liquid assets decrease to between $50-85 million, the ratio will adjust to 50% buyback / 50% retention; when the treasury's liquid assets fall below $50 million, the ratio will adjust to 0% buyback / 100% retention (pausing buybacks until the threshold is met again).

According to the plan on the Lido governance forum, if successful, the proposal will collect community feedback on the forum from August 7(东八区) to 14(东八区); then discuss in the Lido token holder call on August 14(东八区); subsequently revise the proposal based on feedback from August 15(东八区) to 24(东八区); and finally submit it to Snapshot for voting on August 25(东八区)。

While there is some opposition within the community forum at present, apart from a few community members who insist that "buyback is just a short-term game," the majority of users' concerns are focused on the specific details of the plan, such as whether the tokens will be burned after the buyback, as well as the unclear initiation and execution methods of the buyback.

Considering that the proposal is still in its early stages, it is expected that further details will be modified after the call discussions, coupled with the recent unusually strong upward movement in the LDO price. It is optimistically anticipated that this proposal or other buyback plans derived from this proposal discussion will receive a certain level of community support.

Is ETH's Crown Prince Finally Ready for Price Discovery?

As one of the recognized ETH ecosystem Betas, LDO's performance over a long period of time has been somewhat lackluster.

While AAVE soared above $300 on its buyback momentum, ENA surged with its borrowing business flywheel and treasury plan (see "Nearly 50% Rise in a Week, Is ENA Becoming ETH's Largest Beta?"); and PENDLE opened up new horizons of imagination with Boros (see "Funding Rates Now Tradable Assets, How Will Pendle Sub-Platform Boros Disrupt the Arbitrage Market?"), LDO has been in a relatively weak state for quite some time. Despite the long-awaited promise of a "staking ETF," it has so far failed to drive LDO's price performance over a relatively extended period.

Under the current dual macro and micro stimuli, LDO finally shows some signs of a trend reversal. Could this be the beginning of price discovery for this ETH "Crown Prince"? It's still too early to tell, but there is at least some glimmer of hope.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple advances protocol safety with new XRP Ledger payment engine specification

Tempo Introduces Crypto-Native Transactions to Scale Stablecoin Payments On-chain

Uniform Labs revolutionizes the liquidity of tokenized assets with Multiliquid

Noah and Fin.com revolutionize global transfers: virtual accounts and stablecoins for hundreds of thousands of users