Key Notes

- Ethereum price broke above $4,330 for the first time since 2021 as institutional treasury accumulation intensifies.

- Fundamental Global filed a $5B SEC shelf registration to fund its 10% ETH network ownership target.

- ETH funding rates surged 316% in three days, signaling persistent aggressive long positioning among short-term traders.

The Ethereum price climbed past $4,330 on Saturday, August 10, its first retest of this level since the late 2021 bull cycle. This latest ETH price uptick fits the same corporate treasury narrative that dominated headlines over the past month, led recently by firms like SharpLink Gaming.

In the latest wave of imminent institutional inflow, Nasdaq-listed Fundamental Global, soon to be renamed FG Nexus, has filed a $5 billion shelf registration with the US Securities and Exchange Commission to fund its Ethereum treasury strategy.

Ethereum Price Action and Fundamental Global’s Ambition

According to the official announcement , the company is targeting ownership of 10% of the entire ETH supply, positioning itself as potentially the largest corporate holder of the world’s second-largest cryptocurrency asset.

This level of accumulation would place FG Nexus alongside or ahead of other corporate ETH heavyweights, including BitMine , which holds $3.5 billion in ETH, and SharpLink , with $2.2 billion.

The shelf registration, one of the largest ever filed for a digital asset treasury program, includes an “at-the-market” prospectus authorizing up to $4 billion in common stock sales.

This flexible structure allows the firm to raise capital incrementally and deploy into ETH during favorable market conditions, with the remaining $1 billion capacity available via preferred shares, debt, or other securities.

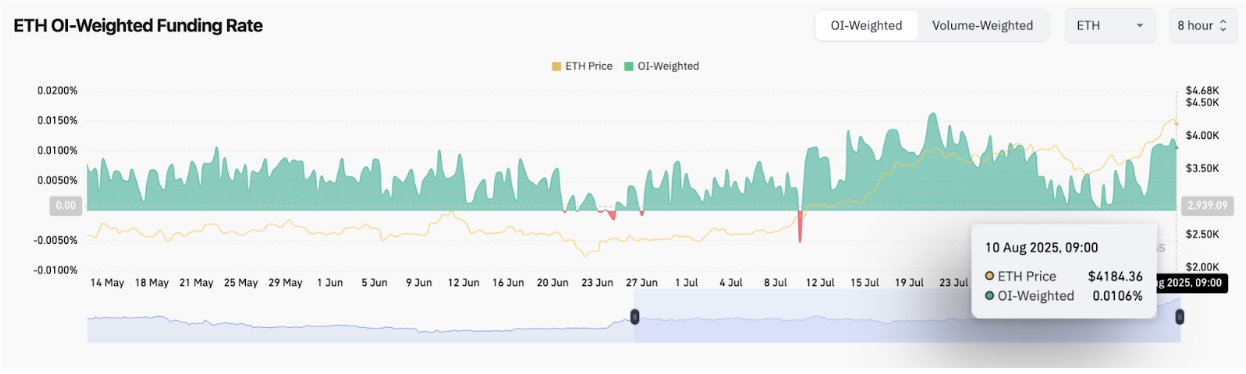

Ethereum (ETH) Funding Rates vs Price | Coinglass, Aug 10, 2025

Despite holding double-digit gains over the past week, Ethereum traders reacted to the latest with more aggressive bullish positions. According to Coinglass data , ETH perpetual futures funding rates have soared 320% in just three days, rising from 0.0024% on August 7 to 0.012% by press time.

Funding rates represent the periodic fee paid between long and short traders to keep leveraged positions open. A sharp increase, as seen here, signals that the majority of short-term long traders are willing to pay higher fees to maintain their bullish bets, reflecting firm expectations that the ETH price rally will advance further.

ETH Price Forecast: Bulls Eye $4,600 Breakout While $3,950 Remains Key Support

From a technical standpoint, Ethereum’s breakout above $4,330 and consistent consolidation above the upper Bollinger Band on the daily chart signal strong bullish momentum. At press time, ETH price rally remains supported by the middle band (20-day moving average) near $3,765, while the MACD shows widening positive histogram bars, indicating sustained upward momentum.

next