Bitcoin proxy Strategy makes smallest BTC purchase since March

Key Takeaways

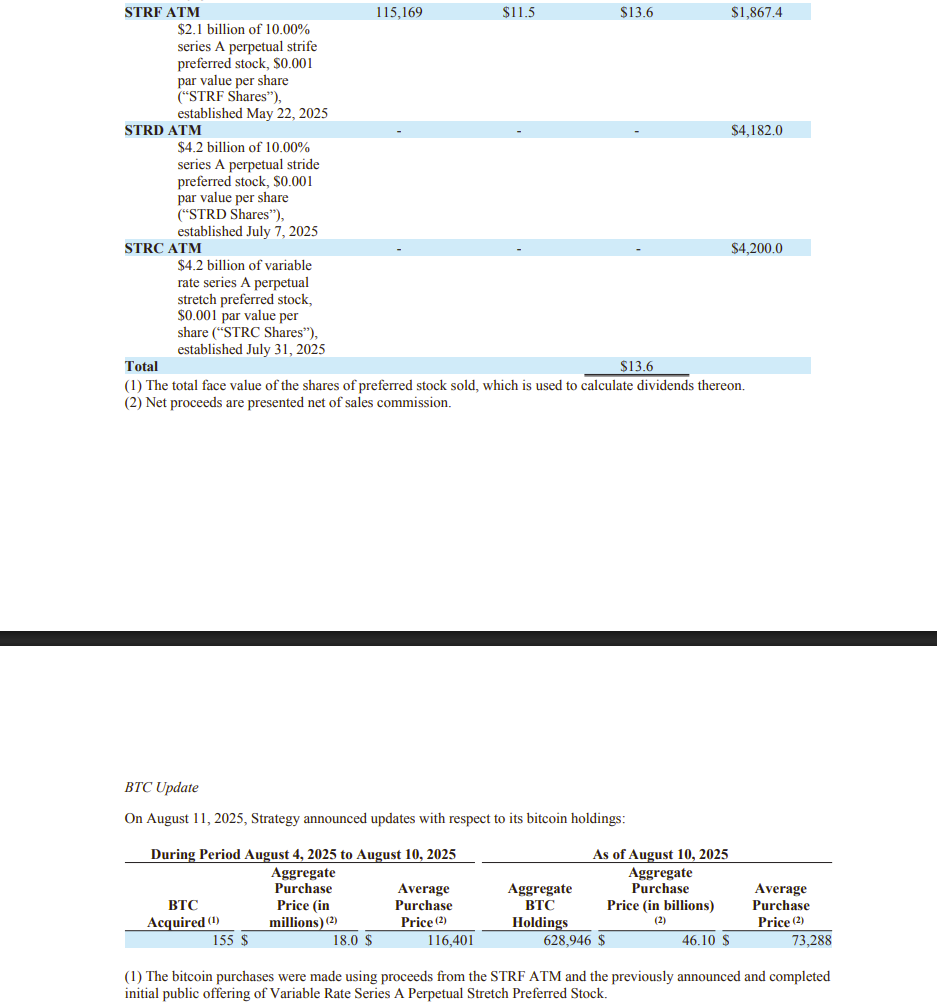

- Strategy purchased 155 additional Bitcoin for $18 million, increasing its digital asset holdings.

- The acquisition price equates to over $116,000 per Bitcoin.

Strategy, the world’s largest Bitcoin corporate holder, has resumed its BTC acquisition. The company announced Monday it had added 155 BTC to its treasury last week, its smallest purchase since mid-March.

Michael Saylor, the company’s Executive Chairman, dropped a hint about the acquisition yesterday. When Saylor puts out the Bitcoin tracker, it is often followed by an announcement within a few days.

The latest purchase, disclosed in an SEC filing , was made at an average price of $116,401 per BTC. Bitcoin briefly reclaimed $122,000 earlier today, according to TradingView.

Following the purchase, Strategy’s BTC holdings have grown to 628,791 BTC. With BTC now trading at around $119,500, the stash is valued at more than $75 billion, giving the company unrealized gains of about $29 billion.

Strategy financed its latest acquisition with proceeds from selling Series A Perpetual Strife Preferred Stock (STRF) and from the completed IPO of Variable Rate Series A Perpetual Stretch Preferred Stock. Between August 4 and 10, it sold more than 115,000 STRF shares, bringing in over 13 million dollars in net proceeds.

Strategy could potentially accumulate up to 7% of the global Bitcoin supply , as stated by Saylor. However, he insists on not aiming for total dominance, emphasizing a model that promotes decentralized participation in Bitcoin.

Saylor ardently supports the growth of Bitcoin corporate adoption and the decentralization ethos of the crypto ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

From Yen Interest Rate Hike to Mining Farm Shutdown, Why Is Bitcoin Still Falling

The market is down again, but this may not be a good buying opportunity this time.