Bitcoin Climbs as US CPI Inflation Data Lands Below Target

Bitcoin's price saw a slight uptick following the US CPI release, showing 2.8% inflation in July. Analysts now expect a Fed rate cut in September, keeping markets on edge.

Bitcoin (BTC) price reacted to the US CPI (Consumer Price Index) data, which showed inflation came in below targets in July.

This comes as US President Donald Trump’s tariffs continue to sting, and could put the Federal Reserve (Fed) in a bind.

Inflation Rose at An Annual Rate of 2.7% in July, CPI Data Shows

The US Bureau of Labor Statistics (BLS) released the CPI data on Tuesday, showing inflation in the US rose at an annual rate of 2.7% in July.

U.S. CPI: +2.7% YEAR-OVER-YEAR (EST. +2.8%)U.S. CORE CPI: +3.1% YEAR-OVER-YEAR (EST. +3.0%)

— Tree News (@TreeNewsFeed) August 12, 2025

It marks a similar reading to June’s inflation data, which BeInCrypto reported at 2.7%.

Despite coming in below the expected 2.8%, this CPI print suggests that inflation in the US remains high. It accentuates earlier reports, which showed a rise in the US inflation basket’s high-inflation component to 40% in July 2025, the highest this year.

Data also shows a weighted share of CPI components growing faster than 4%, suggesting persistent inflationary pressure despite a recent drop from a peak of 60% in 2022.

These data, taken together, suggest tariff-induced price pressures are becoming more apparent.

Bitcoin reacted to the US economic signal, recording a modest uptick to approach $119,000. The muted reaction came as markets had already priced in the impact, given that the CPI met economists’ expectations, thereby alleviating worries.

Bitcoin (BTC) Price Performance. Source:

Bitcoin (BTC) Price Performance. Source:

Likewise, the Ethereum price rose, hitting the $4,400 mark after a surge of over 5% in the last 24 hours. Data on CoinGlass shows $40 million worth of ETH shorts were liquidated in the past 60 minutes.

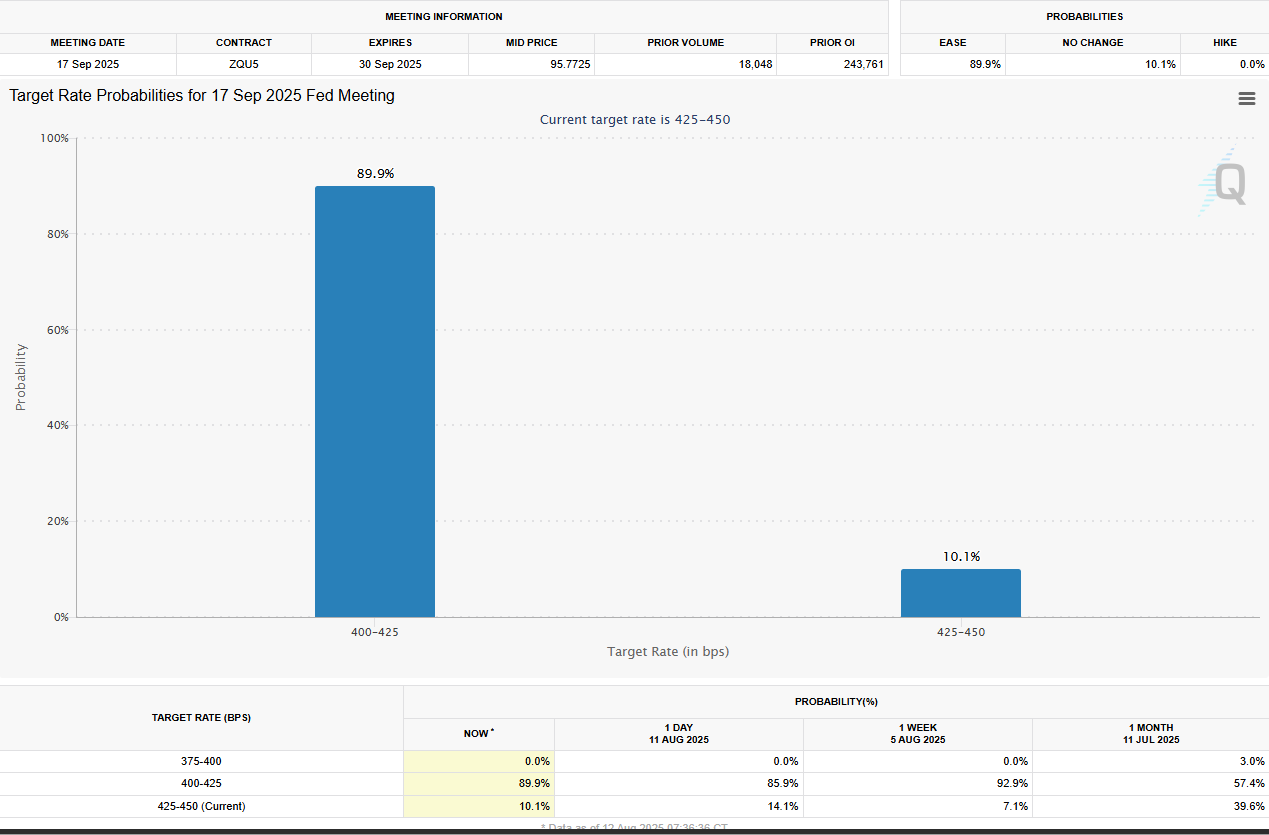

As the crypto market digests the CPI print, all eyes are on the Federal Reserve (Fed). Interest bettors see a 90% chance that policymakers will cut rates by a quarter basis point (bp) in September.

Before the US CPI, the CME FedWatch Tool showed an 84.4% chance of interest rate cuts to 4.00 to 4.25%, against a 15.6% chance of holding steady at 4.25 to 4.50%.

Interest Rate Cut Probabilities. Source:

Interest Rate Cut Probabilities. Source:

Indeed, today’s CPI report is a big deal before next month’s Fed meeting. With inflation at 2.7%, the chances of a rate cut in September remain high.

The Fed had maintained a cautious outlook, keeping interest rates steady as its 2% inflation target remains elusive.

However, despite the latest CPI print, which still puts them further away from the 2% target, their firm stance may change amidst fragility in the labour market, hence the bind.

The expectation of the Fed cutting rates in September follows the bad jobs data, which showed signs of a weakening labor market. Despite inflation rising in the US, policymakers may be forced to cut rates in pursuit of their dual mandate:

- Price stability (2% inflation target) and,

- Maximum employment.

Against this backdrop, analysts anticipated a muted reaction in the Bitcoin price after the CPI print.

“Fed have to cut rates in September due to bad job data so higher CPI won’t really affect the Fed’s decision. Lower CPI will just give more confidence,” wrote analyst Bull Theory.

Analyst Miles Deutscher echoed the sentiment, saying that overall, the Fed will cut interest rates in September.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PancakeSwap-backed prediction markets platform Probable to launch on BNB Chain

CFTC’s Historic Authorization of Spot Crypto Trading Opens New Era

Bitcoin to Hit New Highs in 2026, Grayscale’s Bold BTC Prediction

With the integration of crypto wallets, MetaMask has added support for Bitcoin.