Ethereum Whales and Public Companies Are Buying Big — Is $7,000 Next for ETH?

Ethereum’s supply squeeze, fueled by corporate accumulation, whale activity, and record staking, is setting the stage for a potential rally toward $7,000. Analysts highlight $4,400 as the key breakout point for short-term momentum.

Data shows that many public companies and crypto whales are ramping up their ETH holdings, while on-chain activity is heating up.

These factors provide a solid foundation for ETH’s bullish momentum, with analysts setting short-term price targets as high as $7,000.

Positive Data

The current phase reveals that several public companies have accumulated significant amounts of ETH in their treasuries. For example, BitMine announced it is holding approximately 1,150,263 ETH (at around $4,311 per ETH).

Similarly, SharpLink (SBET) is reported to be another major player in this space, holding roughly 521,939 ETH.

In addition, an eye-catching transaction reported by OnchainLens showed that a whale has accumulated nearly 60,000 ETH across multiple platforms. Ethereum ETFs broke $1 billion in net inflows on August 11, with BlackRock’s ETHA leading the charge, signaling institutional interest.

At the infrastructure layer, on-chain data indicates that the amount of ETH locked for staking has reached an all-time high. Token Terminal recorded staking value exceeding $150 billion. At the same time, ETH reserves on exchanges have dropped to a record low of about 18.9 million ETH, according to Axel_bitblaze69.

Together, these indicators reduce the available supply for sale and can catalyze price growth.

Tokenized assets are also heavily concentrated on Ethereum. Token Terminal reported that roughly 58% of publicly tokenized assets are on Ethereum, reinforcing the view that Ether directly benefits from capital inflows into RWAs and tokenization.

Short-term ETH price targets

Alongside these positive on-chain indicators, ETH also forms a promising technical pattern. Analyst Gert van Legen observed that ETH has fully broken out above a Descending Broadening Wedge pattern on the weekly chart.

“Next target: all-time high at $4,860. Ready to attack,” Gert van Legen stated optimistically.

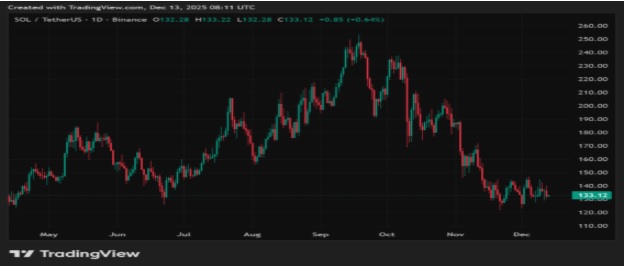

1W ETH chart. Source:

Gert van Legen

1W ETH chart. Source:

Gert van Legen

Using Pricing Bands, analyst Ali also projected that Ethereum’s next targets are $5,210 and $6,946. With ETH currently trading around $4,300, the price would need to rise between 14% and 63% to reach these targets.

Sharing a similar outlook with Ali, analyst VirtualBacon believes ETH could reach $6,000–$7,000 this year. He noted that the price rally to $4,300 has opened the door for much higher levels by year-end.

“If #Bitcoin pushes toward $150K and ETH/BTC climbs to 0.044, $ETH could hit $6,000–$7,000 this year. My conservative target? $6,600,” VirtualBacon stated.

From another bullish perspective, analyst Crypto Patel also saw strong short-term upside potential for Ethereum, especially if it breaks above the $4,400 level.

The combination of strong spot market demand, active derivatives trading, with high open interest and significant short positions, and reduced supply due to staking and exchange outflows creates ideal conditions for a sharp rally—potentially in a parabolic form.

However, Patel cautions that selling pressure could emerge if the price fails to break above $4,400 and instead reverses downward.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Alarming Surge: South Korean Crypto Exchanges Face Record 1.15 Million Hacking Attempts

CMTA Adopts Chainlink Interoperability Standard for Cross-Chain Tokenized Assets

Unshakable Conviction: Why LD Capital’s Founder Sees Strong ETH Fundamentals Amid Market Volatility