July CPI Data Looms: What Analysts Say

Cryptocurrency markets dropped to $3.9 trillion as investors await July's Consumer Price Index data, which could determine the Federal Reserve's September rate cut decision.

Cryptocurrency markets fell from $4 trillion to $3.9 trillion as investors await July’s US inflation data. The Consumer Price Index release could impact the Federal Reserve’s September rate cut plans.

Bitcoin Retreats as Markets Turn Cautious

As of 08:00 UTC on Tuesday, Bitcoin trades around $118,900 on CoinMarketCap. The leading cryptocurrency briefly surged past $122,000 on Monday. However, it failed to hold this level as major US stock indexes closed lower.

The cautious market atmosphere stems from recent surges in risk assets. These gains came from expectations of a Federal Reserve rate cut.

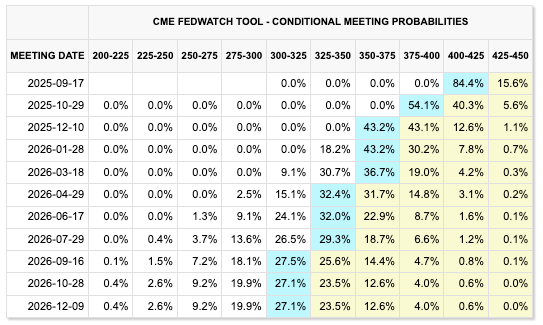

According to the CME FedWatch Tool, markets price in three rate cuts this year.

According to the CME FedWatch Tool, markets price in three rate cuts this year.

According to the CME FedWatch Tool, markets price in three rate cuts this year. A Fed rate cut would boost market liquidity. This would apply upward pressure on Bitcoin and Nasdaq prices.

However, there is a potential problem. US inflation shows no signs of falling from the 3% range. The Fed’s inflation target is 2%. Policymakers worry that cutting rates too early could reignite inflation.

Wall Street Eyes Critical CPI Data

This is why Tuesday’s July CPI release is crucial. Experts forecast a 2.8% year-over-year CPI increase. This is up slightly from the previous month’s 2.7%. The month-over-month increase is expected to be 0.2%. This slows from the prior 0.3%.

Core CPI excludes volatile food and energy prices. It is projected to remain high at 3.1% yearly and 0.3% monthly.

The July CPI figures are highly significant for the Trump administration. Major Wall Street banks say recently implemented Trump tariffs will drive July price increases.

Morgan Stanley forecasts Core CPI will rise 0.32% monthly. This accelerates from June’s 0.23% increase. The bank expects core goods to lead the price surge. Core goods are more exposed to tariffs.

Their base case is that most tariff price effects will hit over the summer. However, they add that risk leans toward gradual but sustained monthly inflation rises through year-end.

Australia and New Zealand Banking Group (ANZ) also projects a 0.32% monthly Core CPI increase. This comes from rising goods prices due to tariffs. ANZ noted the need to monitor whether core services rent inflation is falling.

Some Analysts See September Cut as Certain

Some believe a September Fed rate cut is already decided. This would happen regardless of Tuesday’s CPI data.

ING analyzed that the market consensus of a 0.3% monthly Core CPI rise justifies a September Fed cut. ING’s forecast is higher at 0.4%. They believe even this would not derail a September cut possibility.

Goldman Sachs anticipates a 0.33% monthly increase. They believe this figure, plus signs of a slowing job market, won’t constrain Fed policy decisions. They suggested that if inflation meets expectations, it could act as a “clearing event.” This would dispel market uncertainty and encourage bets on a weaker dollar.

CPI Expectations Table body { font-family: -apple-system, BlinkMacSystemFont, 'Segoe UI', Roboto, sans-serif; padding: 20px; background: #f8f9fa; } .table-container { background: white; border-radius: 12px; box-shadow: 0 4px 6px rgba(0, 0, 0, 0.05); overflow: hidden; margin-bottom: 24px; } .table-header { background: linear-gradient(135deg, #667eea 0%, #764ba2 100%); color: white; padding: 20px; text-align: center; } .table-header h2 { margin: 0; font-size: 24px; font-weight: 600; } table { width: 100%; border-collapse: collapse; font-size: 14px; } th { background: #f8f9fa; color: #495057; font-weight: 600; padding: 16px 20px; text-align: left; border-bottom: 2px solid #dee2e6; font-size: 13px; text-transform: uppercase; letter-spacing: 0.5px; } td { padding: 18px 20px; border-bottom: 1px solid #f1f3f4; vertical-align: top; } tr:hover { background: #f8f9fa; } .analyst-name { font-weight: 600; color: #2c3e50; font-size: 15px; } .cpi-value { font-weight: 700; color: #e74c3c; font-size: 16px; background: #fef2f2; padding: 6px 12px; border-radius: 6px; display: inline-block; min-width: 50px; text-align: center; } .consensus { background: #f0f9ff; } .consensus .cpi-value { background: #dbeafe; color: #1e40af; } .key-notes { color: #6b7280; font-size: 13px; line-height: 1.4; } .implications-box { background: linear-gradient(135deg, #f093fb 0%, #f5576c 100%); color: white; padding: 24px; border-radius: 12px; box-shadow: 0 4px 6px rgba(0, 0, 0, 0.05); } .implications-box h3 { margin: 0 0 16px 0; font-size: 18px; font-weight: 600; display: flex; align-items: center; } .implications-box .emoji { margin-right: 8px; font-size: 20px; } .implication-item { margin-bottom: 12px; padding: 12px 16px; background: rgba(255, 255, 255, 0.1); border-radius: 8px; backdrop-filter: blur(10px); } .implication-item:last-child { margin-bottom: 0; } .threshold { font-weight: 600; background: rgba(255, 255, 255, 0.2); padding: 2px 6px; border-radius: 4px; } @media (max-width: 768px) { table, th, td { font-size: 12px; } th, td { padding: 12px 8px; } .table-header h2 { font-size: 20px; } }July CPI Expectations by Analyst

| Wall Street Consensus | 0.3% | Baseline expectation for Fed September cut justification |

| Morgan Stanley | 0.32% | Accelerating from June’s 0.23%; core goods leading surge due to tariffs |

| ANZ Bank | 0.32% | Rising goods prices from tariffs; monitoring core services rent |

| ING | 0.4% | Higher than consensus but still supports September cut |

| Goldman Sachs | 0.33% | Combined with job market slowdown, unlikely to constrain Fed policy |

Market Implications

Market Implications

If CPI meets expectations (≤0.3%): Acts as “clearing event” reducing market uncertainty and encouraging weaker dollar bets If CPI significantly exceeds expectations (>0.4%): Could dampen September rate cut hopes and increase financial market volatility Critical threshold: Annual CPI substantially above 3% would shift investor focus to Jackson Hole Symposium for Fed’s new policy direction

Wall Street firms agree on one point. A much higher-than-expected July CPI could dampen rate cut hopes. This would increase financial market volatility.

However, a figure meeting expectations won’t be a major obstacle. The September Fed meeting rate cut would likely proceed.

If the annual July CPI comes in well above 3%, investors will focus on the Jackson Hole Symposium next Thursday. They will watch for the Fed’s new economic outlook and policy direction.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.