Ethereum Eyes $5K Rally as CME Trading Hits Record High

The Ethereum derivatives market is experiencing an unprecedented acceleration. In July 2025, the volume of futures contracts listed on the Chicago Mercantile Exchange (CME) reached $118 billion, setting a record since their introduction. This surge reflects renewed institutional interest and could propel ETH to the top of the crypto market in August.

In Brief

- Ethereum reaches $118 billion volume on the CME in July, a historic record.

- With an open interest of $6 billion, Ethereum shows strong institutional engagement.

- If momentum continues, Ethereum could see a crypto rally to $5,000 in August.

$118 billion on the CME: Ethereum smashes all its historic records

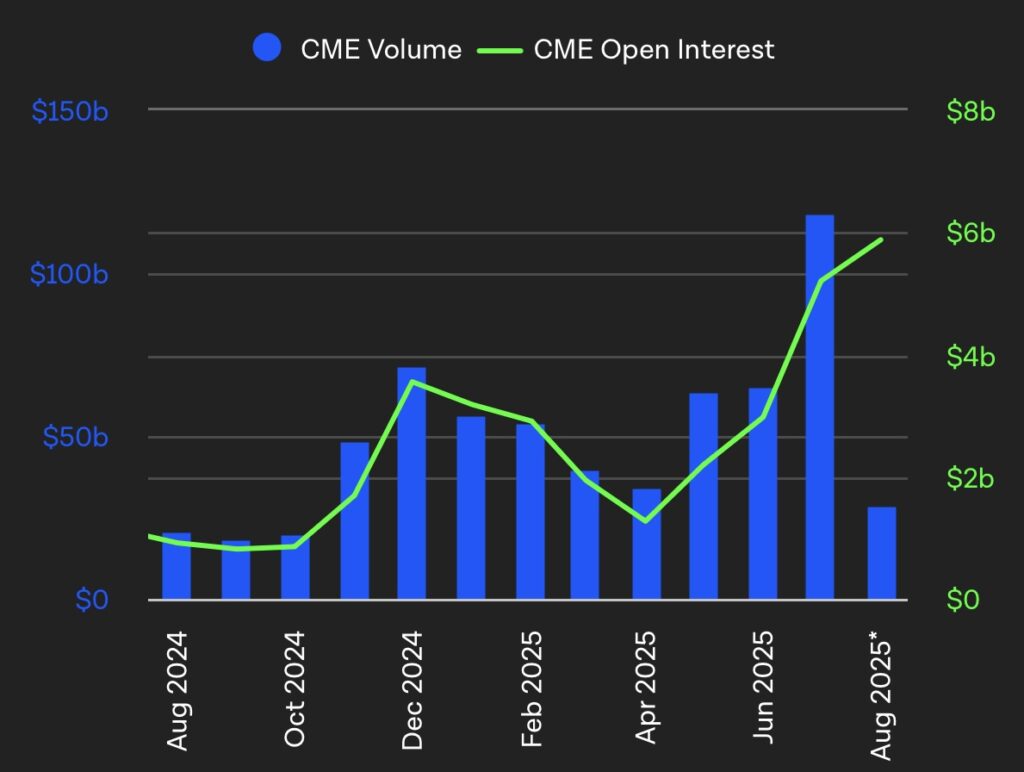

According to recent crypto data, the aggregated volume of Ethereum futures contracts on the CME increased dramatically in July to reach $118 billion. This level far exceeds previous peaks observed around $80 to $90 billion, recorded in November 2024 and January 2025.

This performance takes place in a context where the CME, a reference platform for professional investors, has established itself as an essential gateway to exposure to Ethereum. This volume increase reflects not only heightened activity but also an expansion of the participant base, ranging from hedge funds to traditional asset managers.

Record volumes and open interest at all-time highs: the institutional rush on Ethereum accelerates

Alongside the record $118 billion volume on the CME , the average monthly open interest on Ethereum, representing the total amount of open positions, rose to about $6 billion, its highest level ever recorded. This rise began in March 2025 and shows no signs of slowing.

Explosion of the CME on Ethereum and Open Interest.

Explosion of the CME on Ethereum and Open Interest.

The correlation between high volumes and rising open interest suggests recent Ethereum activity is not limited to short-term operations. On the contrary, it reflects a more durable positioning, often associated with institutional strategies. Indeed, these aim to leverage price movements over several weeks or months.

For market analysts, this combination of factors can be interpreted as a sign of strategic accumulation. This reinforces Ethereum’s role as a preferred asset in institutional crypto portfolios.

Ethereum at $5,000 in August? The signals igniting the crypto market

Can this renewed activity in the derivatives markets translate into a lasting bullish impulse for Ethereum? Historically, a simultaneous increase in volume and open interest on the CME has often preceded phases of marked volatility, both upward and downward. If the current momentum continues and institutional appetite holds, ETH could test $5000 in August.

However, this outlook will also depend on several external factors:

- The evolution of macroeconomic conditions;

- Regulatory announcements;

- Bitcoin movements, often driving bullish cycles across the entire crypto market.

With SharpLink buying $54 million in ETH and a historic $118 billion record on the CME, Ethereum now stands as the star of the derivatives markets. Institutional interest is growing and could trigger a new bullish cycle. August will therefore be decisive to see if crypto ETH is really aiming for an unprecedented peak.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin due 2026 bottom as exchange volumes grind lower: Analysis

samczsun: The Key to Crypto Protocol Security Lies in Proactive Re-Auditing

Bug bounty programs are passive measures, while security protection requires proactive advancement.

Millennials with the most cryptocurrency holdings are reaching the peak of divorce, but the law is not yet prepared.

The biggest problem faced by most parties is that they have no idea their spouse holds cryptocurrency.

Using "zero fees" as a gimmick, is Lighter's actual cost 5–10 times higher?

What standard accounts receive from Lighter is not free trading, but rather slower transactions. This delay is turned into a source of profit by faster participants.