Safety Shot Invests $25M in BONK, Acquires 10% Stake in BONK.fun

Corporate treasuries have never been more open to digital assets. After bitcoin and ether, some executives are now looking towards memecoins. Among them, Safety Shot has chosen BONK, an iconic crypto of the Solana ecosystem. With an entry ticket of 25 million dollars, the company wants to turn this acquisition into a growth engine and financial innovation.

In Brief

- Safety Shot integrates $25M in BONK into its treasury, via partnership with its founders.

- BONK.fun dominates Solana with 80% of new tokens launched on the blockchain.

- Safety Shot’s goal: accumulate 5% of the total supply of the BONK memecoin.

- Safety Shot’s stock falls 51% after announcement, reflecting investor skepticism.

From energy drink to “altcoin treasury”

BONK news : Safety Shot, listed on Nasdaq, is not just a patented beverage brand. In August 2025, it took $25M of BONK as part of a partnership with its creators . In exchange, it issued $35M of convertible preferred shares, wiped out its debts and kept $15M in cash.

For Jarrett Boon, CEO of Safety Shot: “This strategic partnership represents the first step of a much broader evolution for our company. By aligning ourselves with one of the most exciting digital asset ecosystems, we are taking a bold first step“.

BONK is not a simple speculative bet. This deflationary memecoin, backed by Solana, benefits from a very active market and integration into over 400 applications. The partnership also includes reinvesting 90% of the revenues related to BONK.fun into token buybacks.

BONK: a Solana asset aiming to compete with crypto giants

If Safety Shot chose BONK, it is also for its technical foundations. Built on Solana, it offers fast and low-cost transactions, far from Ethereum congestions. Unlike Dogecoin, BONK implements a burn mechanism that reduces the circulating supply.

BONK.fun, the leading Solana token launch platform, generated $35M in fees in July and controls 80% of new deployments on the blockchain. Some days exceed 20,000 tokens created and $100M in daily volumes.

For Boon , it is above all about acquiring “a stake in a highly profitable engine“.

The stated goal: accumulate up to 5% of the total BONK supply, amounting to $115M at the current price. The presence of a key contributor, “Nom”, as strategic advisor aims to professionalize this corporate entry into the crypto world.

When corporate finance meets memecoin volatility

The bet is bold. From the announcement, Safety Shot’s stock fell 51%, a sign of a skeptical market. Analysts remind that success will depend as much on BONK’s activity as on the strategy execution. Volatility remains the main risk, but opportunities are real.

Key facts and figures to remember:

- 980,000 on-chain BONK holders according to SolScan;

- Market capitalization of 2 billion dollars;

- More than 34 listed companies now hold altcoins in treasury;

- BONK ranks among the top 10 decentralized applications worldwide by revenue.

BONK could serve as a model for other altcoins seeking to combine community engagement, scarcity, and mass adoption. But Safety Shot will have to prove that this strategy can stabilize a memecoin while generating value for its shareholders.

Meanwhile, Solana is witnessing a real rush of public companies , attracted by its speed and a booming ecosystem. In this environment where certainty remains a mirage, the flame must not flicker. Even in rough waters, some captains choose to keep course, convinced that fertile lands still lie on the horizon.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

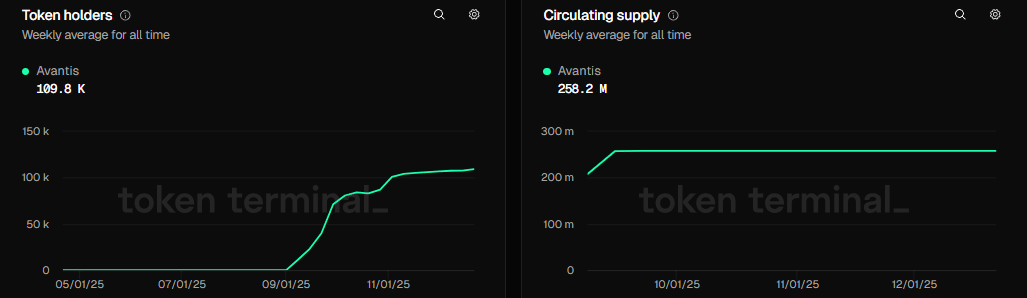

Avantis – Assessing key drivers of AVNT’s 62% weekly rally

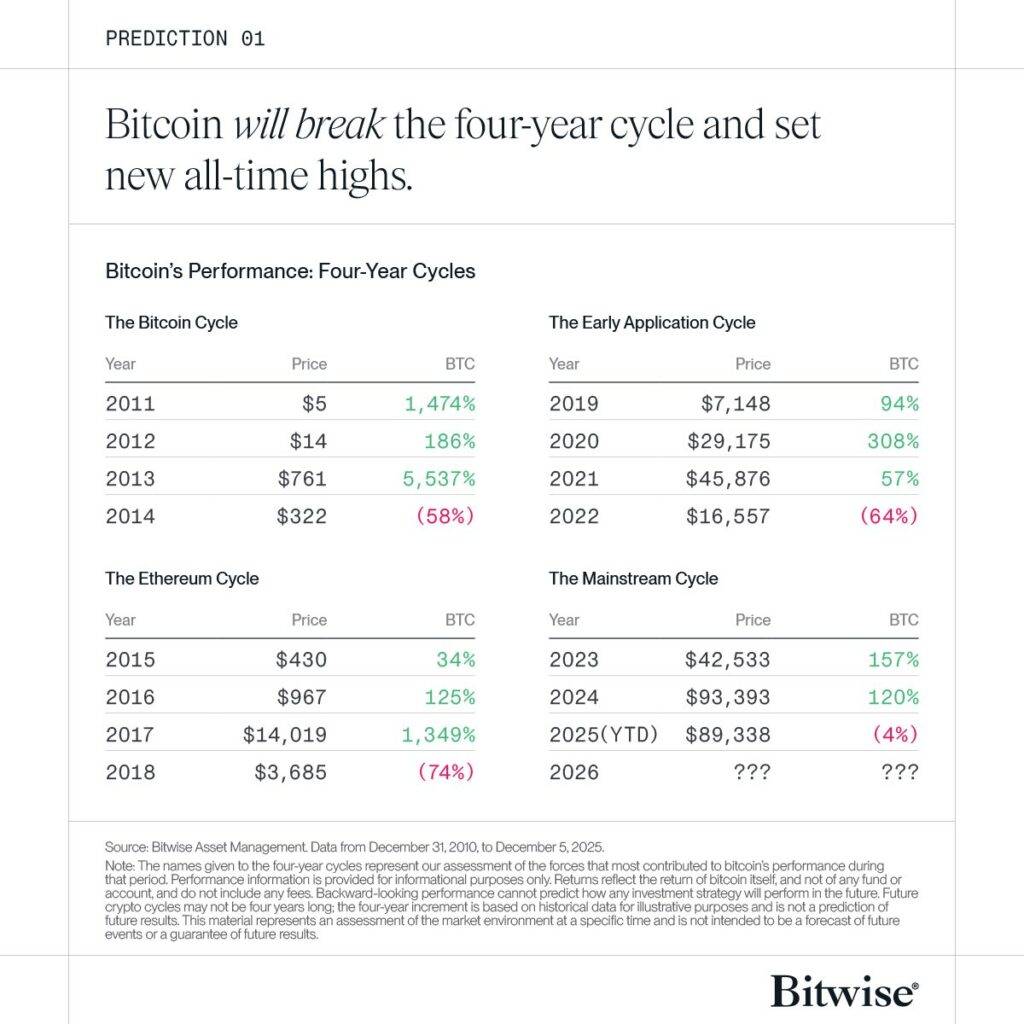

Bitcoin – Is it a case of ‘pain today, gains tomorrow’ for BTC’s price?

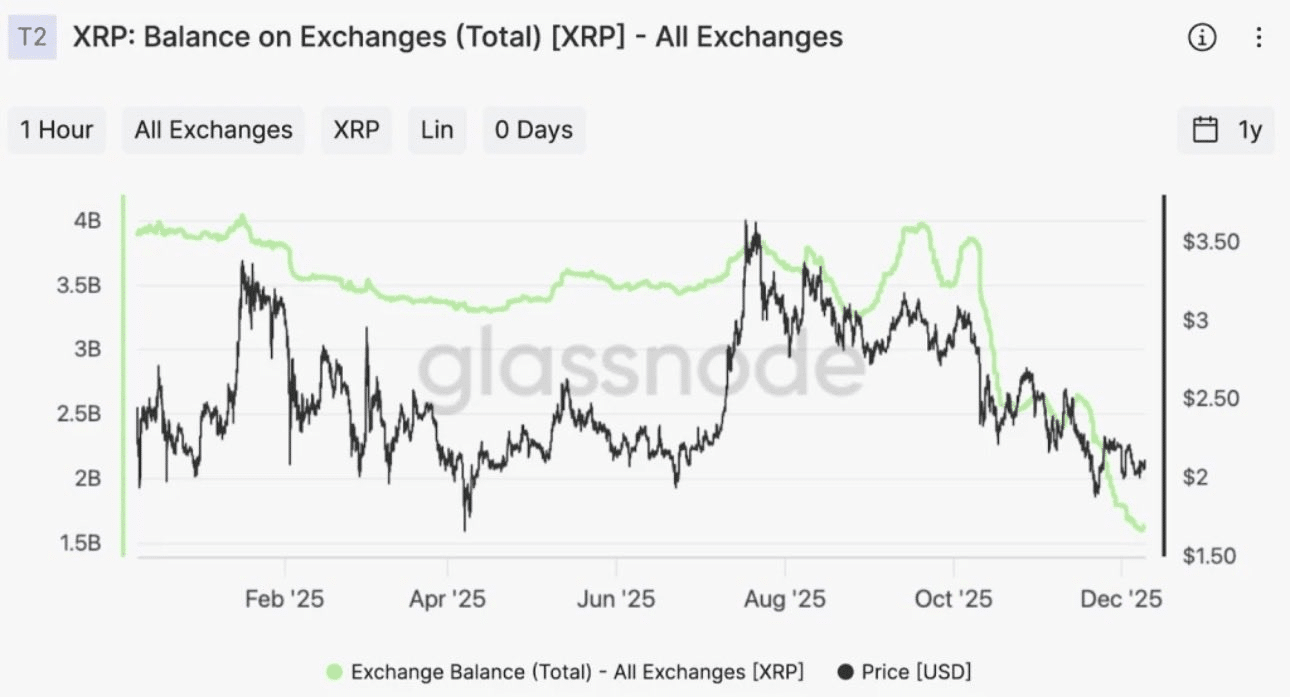

Are XRP and Cardano Losing Relevance? Mike Novogratz Explains Key Indicators as Crypto Investors Move Beyond Hype, Seek Real Utility

Reasons why XRP is poised to lead 2026 DESPITE drop below $2