Bull Run Crypto 2025 : The crazy numbers that announce a historic cycle

What if 2025 marked the most spectacular explosion in crypto history? Billions are flowing into ETFs, US regulation is opening the door wide for investors, and technical signals announce a devastating altcoin wave. The coming months could be a turning point… and those who will be ready could come out winners.

In Brief

- Bitcoin and Ethereum ETFs attract $17 billion in 60 days, boosting liquidity and prices.

- Favorable US regulation and rapidly growing stablecoins strengthen institutional adoption.

- ETH breaks $4,000, BTC dominance falls, signaling a possible crypto explosion.

Billions $ Rain Down on Bitcoin and Ethereum

The spot ETFs for Bitcoin and Ethereum are recording a capital inflow of historic proportions. In 60 days, $17 billion has been injected into the crypto market, including $12.8 billion in July alone. That represents $600 million per day, twice the usual average, even surpassing the performance of the very popular S&P 500 ETF.

This massive influx directly improves liquidity and supports the valuations of major crypto assets.

Washington Opens the Door to the Crypto Bull Run

The United States adopts a resolutely favorable stance toward the crypto ecosystem. To this end, the GENIUS Act, legislation on stablecoins, establishes a clear framework for their issuance and use. Additionally, 401(k) retirement plans can now include digital assets. These measures facilitate institutional capital access and strengthen the sector’s legitimacy.

Moreover, stablecoins see their capitalization rise between $270 and $282 billion. This capital acts as a power reserve for crypto markets, facilitating tokenization and DeFi activity. Maple Finance and SyrupFi platforms are among the main holders of value in stablecoins.

This ongoing expansion reflects the strength of on-chain flows.

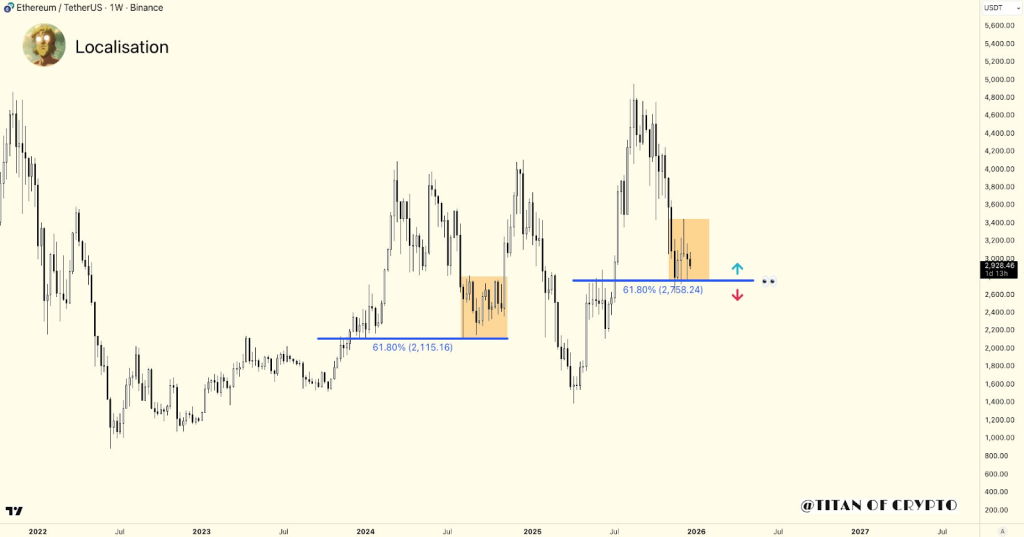

ETH Soars, BTC Falls Back: Altcoins Prepare

Ethereum climbs back above $4,000, approaching its 2021 all-time high. Meanwhile, Bitcoin dominance falls for the first time since 2024, paving the way for a possible rotation towards altcoins, triggering a powerful crypto bull run . As Ryan Lee, chief analyst at Bitget, thinks:

Bitcoin dominance fell from 62% to less than 58%, a sign of rotation towards altcoins. If this momentum continues, with Ethereum and several other major cryptos outperforming, the market could enter a true altseason.

Furthermore, liquidity, now concentrated on BTC and ETH via centralized exchanges, creates a favorable ground for a shift towards secondary crypto assets.

Harvard, Trump… The Heavyweights Bet on Crypto

The market currently benefits from growing institutional support. Harvard has invested more than $116 million in BlackRock’s Bitcoin IBIT ETF. On the political side, Donald Trump and several influential figures display their support for the crypto ecosystem. These signals strengthen the market’s credibility and encourage traditional capital to take the plunge.

The unprecedented alignment between capital flows, favorable regulation, technical signals, and institutional support gives the crypto market a rarely achieved momentum. If these conditions hold, 2025 could go down in history as the year of the super-cycle. The question now is when this energy will translate into an altcoin explosion. In the meantime, Ethereum shatters CME records and heads straight towards $5000 .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum’s TVL Could Explode in 2026 as Stablecoins and RWAs Expand

10x Research Outlines Key Events That Could Move Crypto in 2026

Ethereum Price at Critical Levels: Breakout or Breakdown Next?

Bitcoin Dominance Suggests a Mini Altcoin Season in Early January 2026