Machine learning algorithm predicts Ethereum price on August 31, 2025

Ethereum (ETH) could be on the verge of smashing its all-time high this month, with advanced AI models forecasting prices above $5,000 by August 31, 2025.

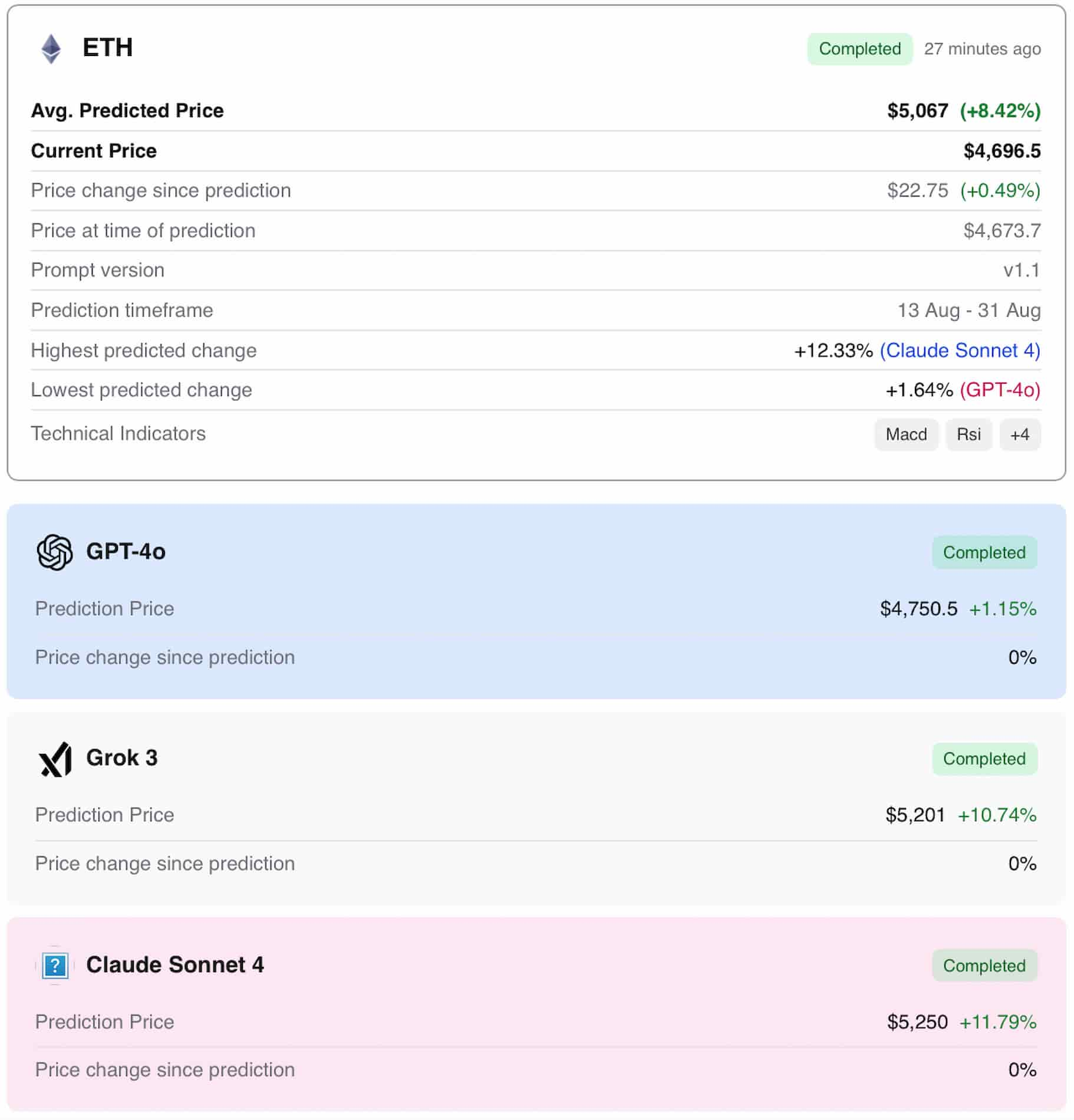

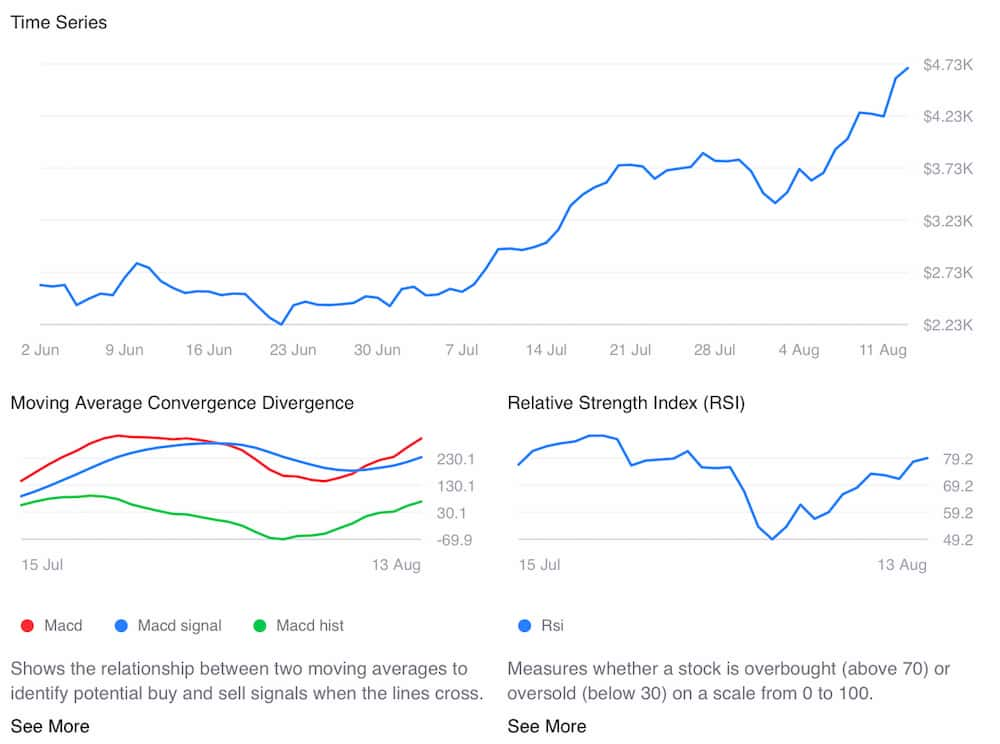

Finbold’s AI price prediction tool powered by machine learning models GPT-5, Claude 3.5 Sonnet, and Grok 3 Vision, alongside a suite of technical indicators including MACD, RSI, stochastic oscillators, and both the 50-day and 200-day moving averages, now places Ethereum’s average projected price at $5,067.

That represents an 8.42% upside from the current market level of $4,696.5.

Each of the models shows strong conviction that Ethereum will maintain its bullish momentum. Claude 3.5 Sonnet emerges as the most optimistic, projecting a price of $5,250, a 12.33% gain that would mark a clear move into uncharted territory.

Grok 3 Vision forecasts $5,201, implying a 10.74% increase and signaling that the uptrend could extend well beyond the psychological $5,000 threshold. Even the more conservative GPT-5 (GPT-4o variant) anticipates a climb to $4,750, which would still keep ETH comfortably above recent support levels.

ETH sees massive institutional inflow

The bullish projection comes as Ethereum’s rally accelerates on the back of record ETF inflows. On August 11 alone, Ethereum ETFs saw $1 billion in net inflows, led by BlackRock ($640 million), Fidelity ($270 million), and Grayscale ($80 million), according to Farside Investors. Over August 11–12, inflows topped $1.5 billion.

Arkham Intelligence data shows BlackRock’s wallet activity spiking, with multiple high-value ETH transfers from Coinbase Prime. Institutional appetite is growing, even as retail traders have been selling into strength; dynamic Santiment notes have historically preceded further upside.

Adding fuel to the rally, 180 Life Sciences Corp. a crypto-focused firm backed by Palantir co-founder Peter Thiel, recently disclosed holdings of 82,186 ETH (worth $349 million at $4,600), alongside a 250% surge in its share price.

With ETH currently trading near $4,700, just 6.4% below its November 2021 peak of $4,891 momentum indicators are flashing bullish. RSI sits above 79, suggesting strong buying pressure, while MACD remains in positive territory.

If AI projections hold, Ethereum could not only reclaim but decisively break its all-time high before the end of August, setting the stage for potential price discovery heading into Q4.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | SEC Expected to Issue "Innovation Exemptions" for the Crypto Industry in "About a Month"

The SEC is expected to issue an innovation exemption for the crypto industry. The UK "Digital Assets and Other Property Act" has come into effect. BlackRock's CEO revealed that sovereign wealth funds are buying bitcoin. Bank of America recommends clients allocate to crypto assets. Bitcoin selling pressure is nearing its end. Summary generated by Mars AI. The accuracy and completeness of this summary are still being improved as the Mars AI model continues to iterate.

a16z: Inefficient governance and dormant tokens pose a more severe quantum threat to BTC.

Deep Reflection: I Wasted Eight Years in the Crypto Industry

In recent days, an article titled "I Wasted Eight Years in the Crypto Industry" has garnered over a million views and widespread resonance on Twitter, directly addressing the gambling nature and nihilistic tendencies of cryptocurrencies. ChainCatcher now translates this article for further discussion and exchange.