Grayscale Files For HBAR ETF in Delaware: Price Recovery Ahead?

HBAR traders react to Grayscale’s ETF filing with optimism, but resistance at $0.27 could determine whether a recovery continues.

Hedera (HBAR) has shown a slow recovery since the beginning of the month, with its price showing signs of stabilization.

However, the recent news surrounding Grayscale’s filing for an HBAR ETF in Delaware may provide the necessary boost for a potential rebound.

HBAR Traders Have Hopes

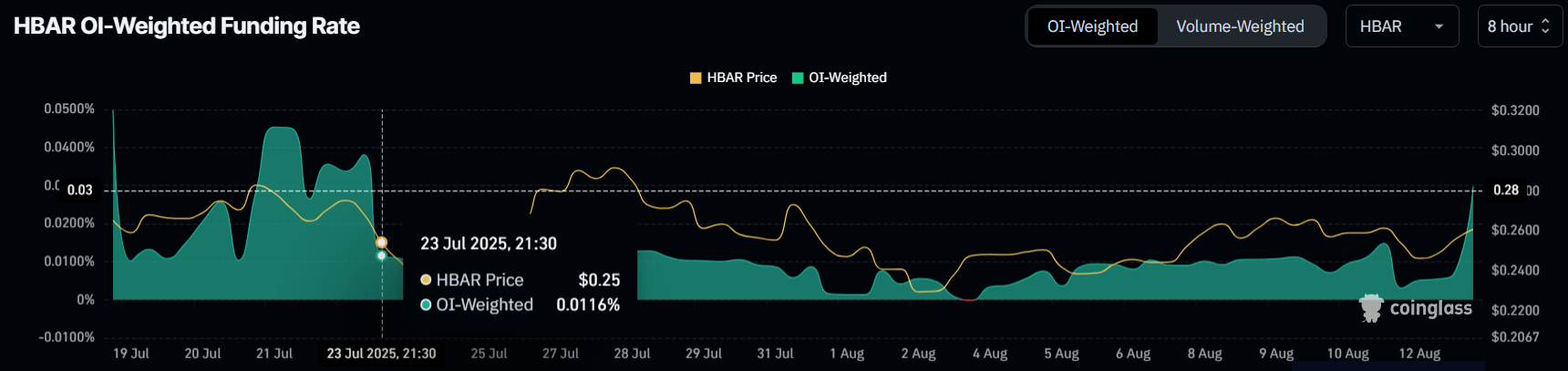

Traders have reacted positively to the report of Grayscale filing for an HBAR ETF, signaling optimism for the altcoin’s future. This excitement has been reflected in the market’s funding rate, which spiked sharply in the last 24 hours.

The funding rate reached a three-week high, indicating a surge in long contracts as traders are increasingly confident about a price rise. This sharp spike shows that HBAR traders are optimistic and also eager to capitalize on what they view as a bullish opportunity.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

HBAR Funding Rate. Source:

Coinglass

HBAR Funding Rate. Source:

Coinglass

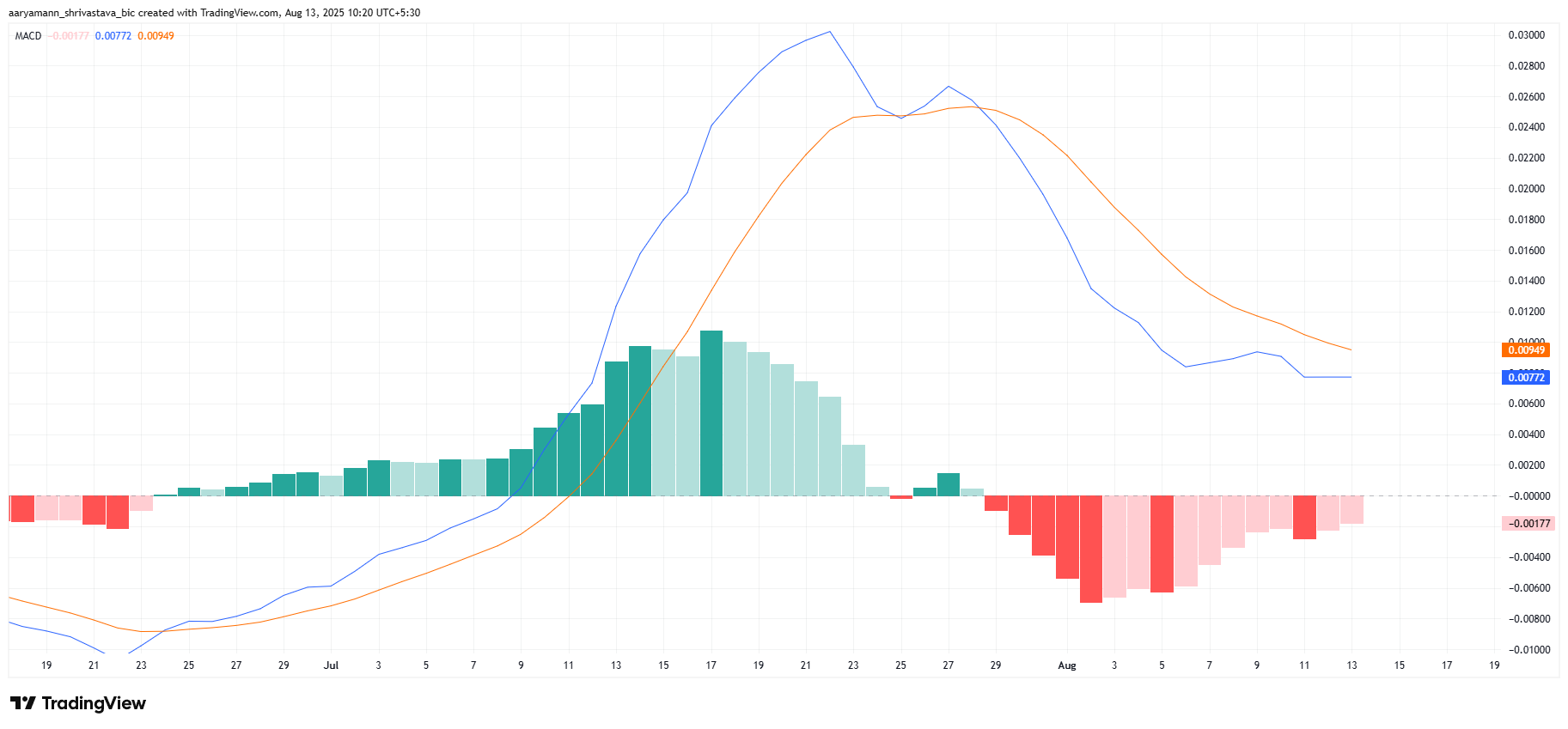

Looking at the technical indicators, the Moving Average Convergence Divergence (MACD) for HBAR is showing promising signs. The MACD is nearing a potential bullish crossover, which could signal a shift in momentum from bearish to bullish.

The histogram reflects a fading bearish trend, indicating that downward pressure is decreasing. A successful bullish crossover would confirm this shift and likely encourage further buying interest.

HBAR MACD. Source:

TradingView

HBAR MACD. Source:

TradingView

HBAR Price Faces Resistance

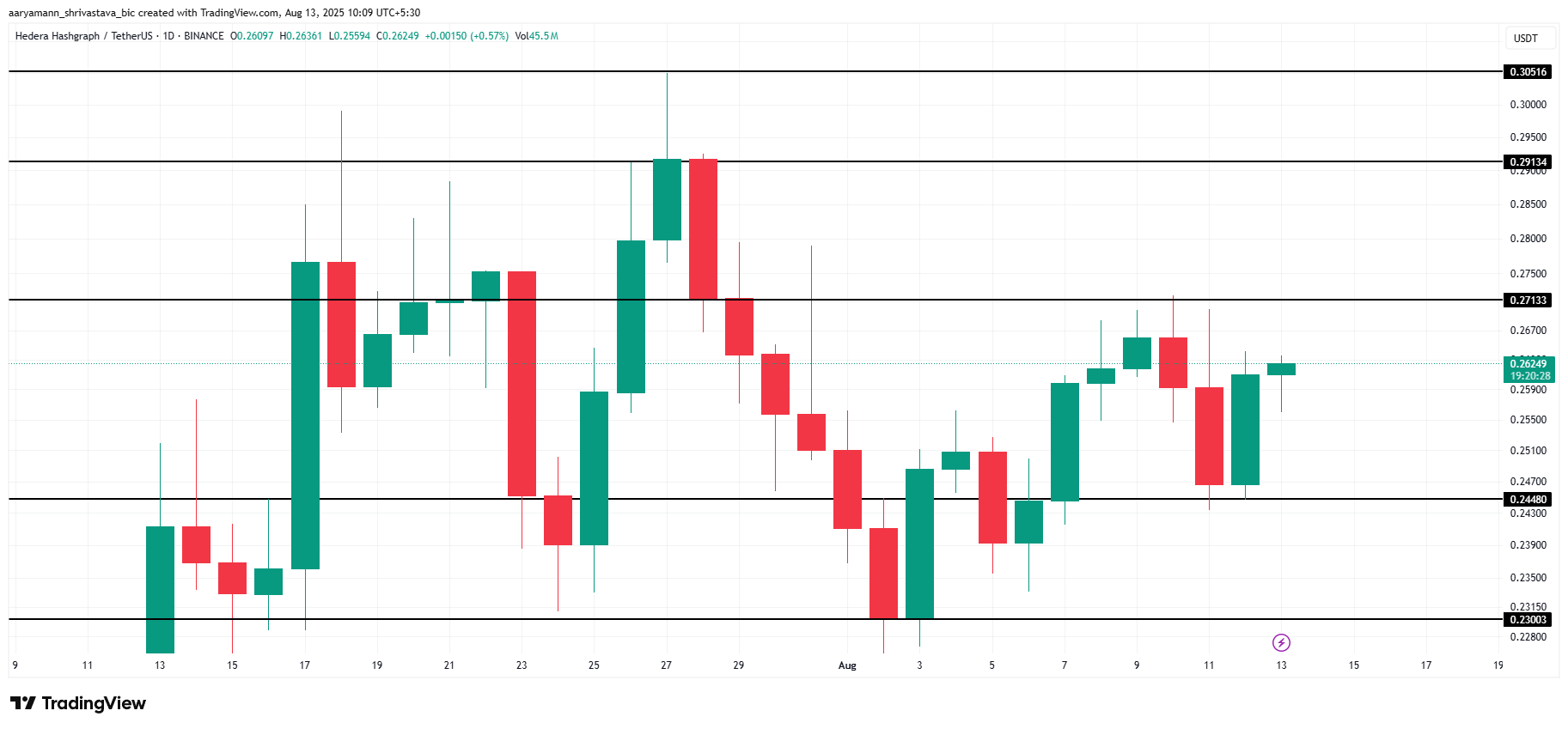

HBAR is currently changing hands at $0.26, just under the $0.27 resistance level. For HBAR to recover its losses from July, it will need to break above $0.27 and move towards $0.29.

The news surrounding the Grayscale ETF filing could help sustain this momentum, as it encourages further investment and pushes the price higher. As a result, HBAR’s price could potentially make its way to $0.30 and higher,

HBAR Price Analysis. Source:

TradingView

HBAR Price Analysis. Source:

TradingView

However, if investor sentiment changes or a shift in the broader market occurs, HBAR may face a pullback. If the altcoin fails to hold above $0.27, it could fall to $0.24 or even lower. Such a decline would invalidate the bullish outlook, signaling a further period of consolidation or decline.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.

Stunning $204 Million USDT Transfer Ignites Market Speculation