Staked and Undervalued: Polkadot’s Bullish Case in a Hot Altcoin Market

Polkadot could be the overlooked “dark horse” of this cycle, with strong staking metrics, bullish technical patterns, and potential catalysts on the horizon. However, lasting growth depends on expanding real-world adoption and ecosystem use.

Polkadot (DOT) has been overshadowed in the current altcoin frenzy. However, DOT is forecast to stage a strong breakout with over 50% of its supply locked in staking and an expanding ecosystem.

If it can capitalize on market sentiment and capital inflows, DOT’s price will rise to $5.30, possibly reaching $10 by September 2025.

Is DOT The Market’s Dark Horse in This Cycle?

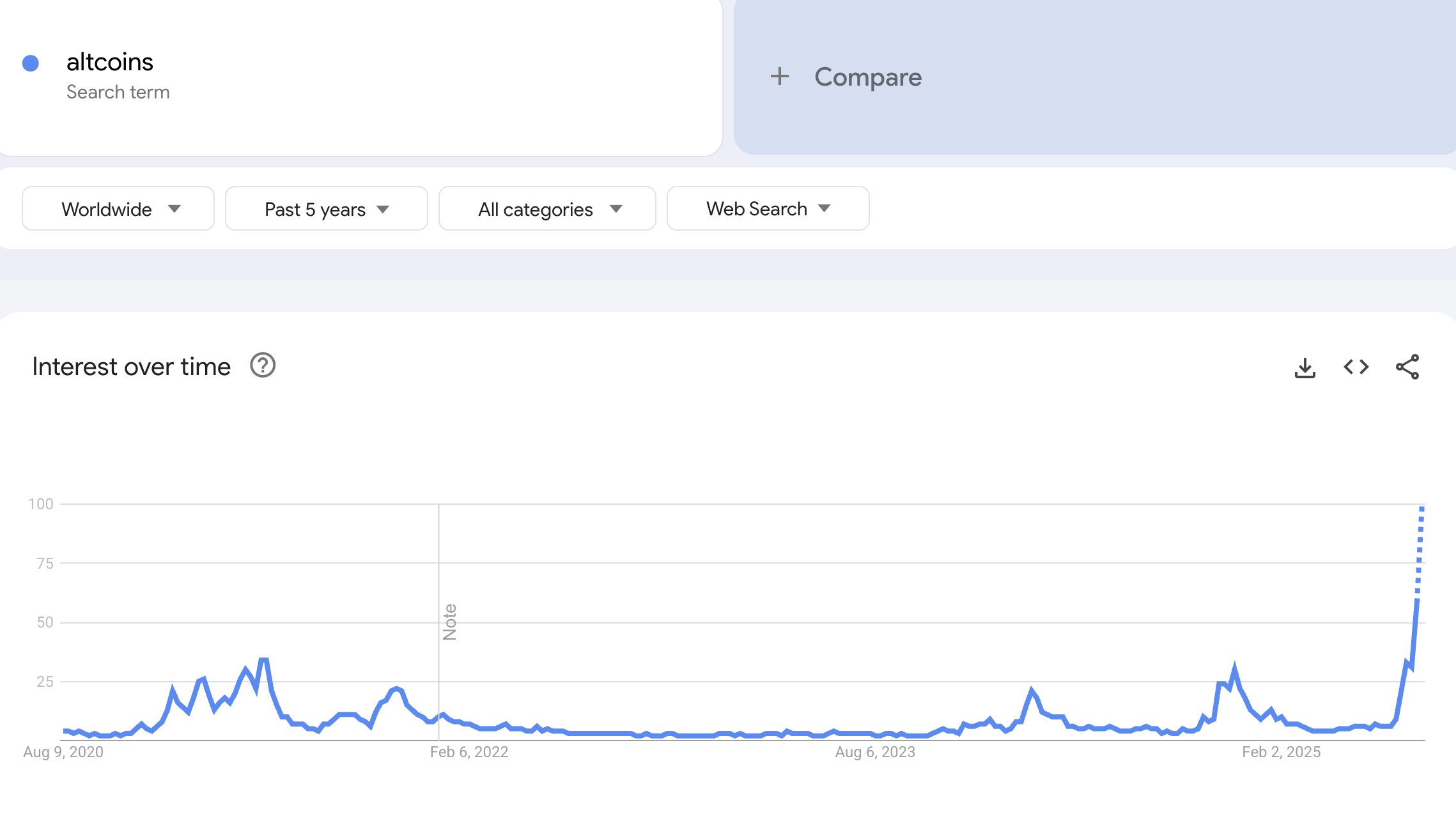

At present, altcoins are capturing the market’s attention. Searches for “altcoin” on Google Trends have hit a record high.

Search interest for altcoin. Source:

Google Trends

Search interest for altcoin. Source:

Google Trends

Against this backdrop, Polkadot (DOT) appears to be overlooked in the current bullish cycle. DOT is trading around $4.15, over 92% below its all-time high in 2021. This deep decline has led many investors to doubt the project’s potential.

In addition, a user on X highlighted lingering issues in the project’s tokenomics. DOT experiences a high inflation rate and relatively large internal staking rewards. However, weak demand drivers outside staking indicate that pressure from new token issuance persists.

Nevertheless, recent analyses suggest that DOT is well-positioned for an upswing, supported by an expanding ecosystem and bullish technical indicators.

Data shows the network remains active and stable, with over half of DOT’s total supply locked in staking. This is a key factor in reducing sell pressure and creating conditions for price recovery.

Analysts Eye $10 by September 2025

From a technical standpoint, the short-term outlook appears promising. After breaking through the $4.30 resistance level and forming a higher low, DOT has confirmed the potential continuation of its uptrend. Analysis from LennaertSnyder projects the next reasonable target at the $5.30 peak.

Meanwhile, Joao Wedson believes the market may have already accumulated enough tokens. He suggests that prices are now simply waiting for a positive catalyst to trigger a strong rally that could wipe out short sellers. Such a catalyst could be the approval of a DOT ETF.

“DOT (Polkadot) has all the chances to be the next altcoin to liquidate the bears. Market makers have probably accumulated enough, and I believe some news will soon emerge to explain the effect. But the cause has already been set!” Joao commented.

Some analysts, such as CryptonautX, are even eyeing a breakout toward $10 by September 2025 if the current bullish momentum holds. Achieving this would require a combination of factors: improved real-world demand for DOT, fresh capital inflows, and major announcements from the project.

DOT could hit $10 by September 2025. Source:

CryptonautX

DOT could hit $10 by September 2025. Source:

CryptonautX

In the long run, Polkadot must prove that its parachain ecosystem and cross-chain connectivity technology can attract more users, developers, and liquidity to ensure DOT’s value is not solely reliant on staking activity.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.

Stunning $204 Million USDT Transfer Ignites Market Speculation