Google Play’s new crypto rules could lock DeFi apps out of major markets

Google Play introduces new rules that require crypto developers to obtain banking licenses in several major jurisdictions.

- Google Play will require crypto apps to obtain licenses.

- U.S., the EU, and Japan, among several jurisdictions affected.

- DeFi apps could suffer under these rules, as they typically don’t have licenses.

Google has taken a step that could significantly impact access to DeFi apps and wallets. On August 13, Google Play released new requirements for crypto exchange and wallet apps. To remain available on its app store in several major jurisdictions, apps will have to obtain the appropriate licenses.

The U.S., the EU, Canada, U.K., Japan, Hong Kong, South Korea, Israel, South Africa, and the UAE are among the affected jurisdictions. In each of these, developers will have to register with a government entity either as a crypto service provider or as a bank.

For example, in the U.S., developers must be registered with FinCEN as a Money Services Business or as a chartered banking entity. In the European Union, developers will have to register as a virtual asset service provider under the MiCA regulations.

DeFi apps under threat

In its guidelines, Google Play did not distinguish between centralized and decentralized crypto exchanges. This means that DeFi exchanges, which typically do not have corporate entities to register with regulators, could soon find themselves removed from the Google Play Store.

If a decentralized exchange like Uniswap or PancakeSwap fails to obtain a license, users would only be able to access it through web browsers. Furthermore, the DEXs would not be able to argue that they are not targeting users in the U.S. and the EU directly, and would be delisted by default.

The same rules apply to custodial and non-custodial wallets. This could push many open-source wallets off the Play Store, making it significantly harder for regular users to download them on their devices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

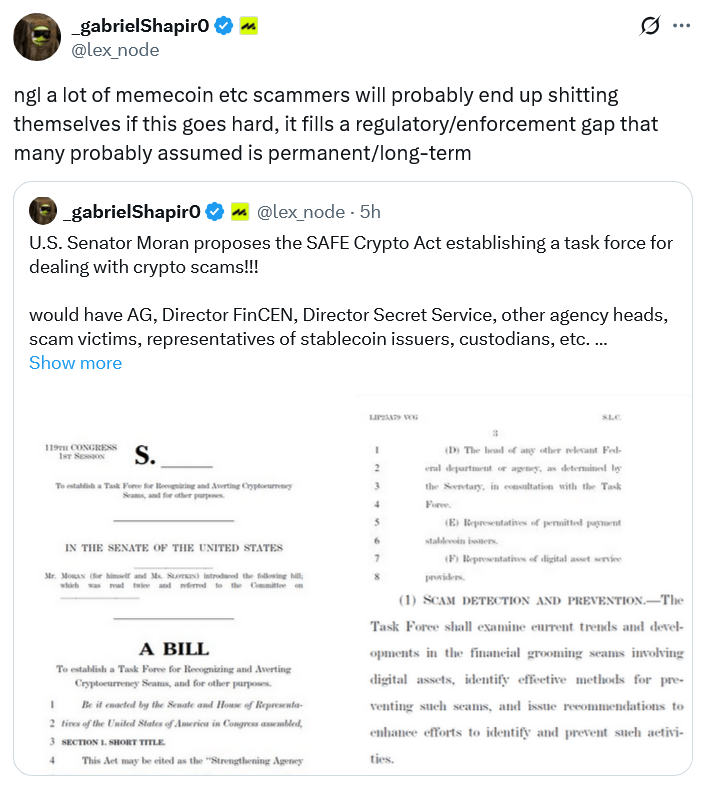

Crypto lawyer: The SAFE crypto bill will make scammers tremble.

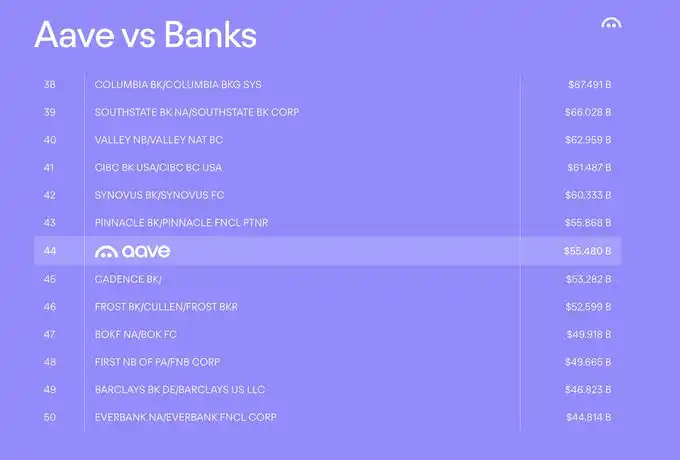

Aave founder outlines key focuses for 2026: Aave V4, Horizon, and mobile platforms