Shiba Inu’s Most Profitable Holders: Who They Are and How They’re Acting

Shiba Inu's most profitable holders are key to SHIB's recovery; their actions could help push the price past resistance levels.

Shiba Inu (SHIB) price recently attempted a recovery from the losses observed at the end of July. While the altcoin has shown signs of resilience, the continuation of this upward momentum will heavily depend on the actions of its most profitable holders.

These long-term holders (LTHs) hold significant sway over the market’s direction, making their behavior crucial to SHIB’s potential recovery.

These Shiba Inu Holders Are Holding The Most Gains

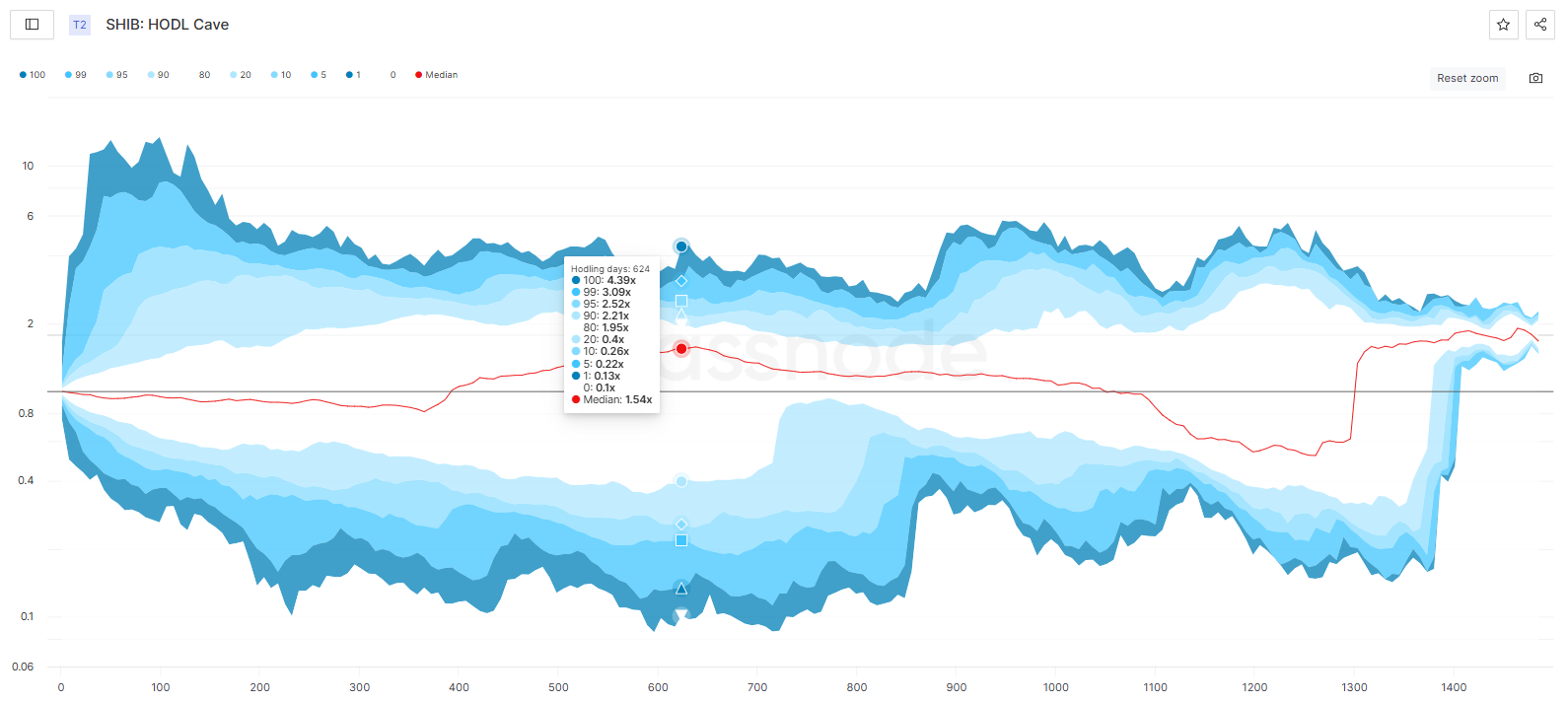

The HODL Cave analysis reveals that SHIB holders who have held their tokens for 18 to 20 months are currently the most profitable, second only to the all-time low (ATL) buyers. These long-term investors are seeing median profits ranging from 1.54x to 1.57x.

This group plays a pivotal role in SHIB’s price movement, as their actions can either support or hinder the altcoin’s recovery. These investors, categorized as LTHs, are the ones most likely to influence SHIB’s price through their decision to hold or sell their tokens.

Given the strong profitability of these holders, their actions have become essential for SHIB’s recovery. As one of the most influential groups in the market, their willingness to hold on to their tokens could help support SHIB’s price.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Shiba Inu HODL Cave. Source:

Glassnode

Shiba Inu HODL Cave. Source:

Glassnode

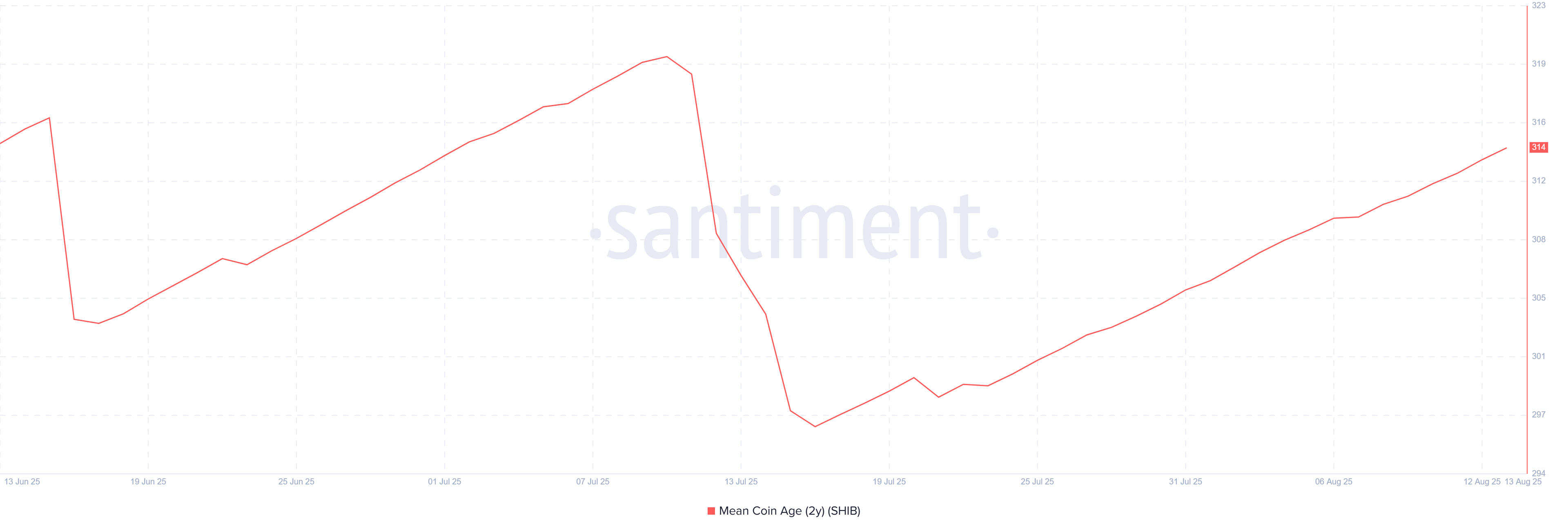

The 2-Year Mean Coin Age indicator, which tracks the movement of tokens over the past two years, shows an uptick. Over the past two months, only one instance of selling has been recorded, highlighting the ongoing resilience of SHIB’s long-term holders.

A rising Mean Coin Age typically suggests that holders are not moving their tokens. It indicates that these investors are confident and unwilling to sell at current price levels. This behavior is critical for SHIB’s recovery, as it shows that LTHs are not looking to liquidate their positions.

In contrast, a decline in the Mean Coin Age would indicate an increase in selling activity. This usually signals that holders are moving their tokens in response to price fluctuations. The continued patience and resilience of SHIB’s long-term holders will likely help stabilize and support SHIB’s price.

Shiba Inu 2-Year Mean Coin Age. Source:

Santiment

Shiba Inu 2-Year Mean Coin Age. Source:

Santiment

SHIB Price Could Push Through

At the time of writing, SHIB is trading at $0.00001366, holding above the local support of $0.00001285. The altcoin has yet to reach the crucial resistance level of $0.00001435, which marks a significant hurdle for its recovery. In order to continue its upward trend, SHIB needs to breach this resistance level and maintain momentum above it.

Breaking through $0.00001435 is essential for SHIB to make its way to $0.00001553. Reaching this level would signal the recovery of July’s losses and indicate that SHIB is back on track for further gains. The support from the most profitable holders is likely to play a pivotal role in helping SHIB break through this resistance.

Shiba Inu Price Analysis. Source:

TradingView

Shiba Inu Price Analysis. Source:

TradingView

However, if SHIB faces heavy selling pressure from skeptical holders or retail investors, it could fall below through $0.00001252. This would likely trigger a decline towards $0.00001182 or lower. The same would invalidate the bullish thesis and signal further downside for the altcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

$RAVE TGE Countdown: When Clubbing Becomes an On-Chain Economic Activity, the True Web3 Breakthrough Moment Arrives

RaveDAO is rapidly growing into an open cultural ecosystem driven by entertainment, becoming a key infrastructure for Web3 to achieve real-world adoption and mainstream breakthrough.

A "hawkish rate cut" that's not so "hawkish," and balance sheet expansion that's "not QE"

The Federal Reserve has cut interest rates by another 25 basis points as expected, still projecting one rate cut next year, and has launched an RMP to purchase $40 billion in short-term bonds.

Historic Fundraising: Real Finance Attracts $29 Million to Revolutionize RWAs