Date: Wed, Aug 13, 2025 | 10:35 AM GMT

The cryptocurrency market is in full bullish swing as Ethereum (ETH) broke above the $4,700 mark for the first time since 2021. This 30% weekly surge has boosted sentiment across the sector, spilling over into major memecoins — most notably Pepe (PEPE).

PEPE has jumped 11% today, extending its weekly gains to 21%. More importantly, its latest price action is forming a familiar, high-timeframe fractal pattern that could be hinting at its next explosive move.

Source: Coinmarketcap

Source: Coinmarketcap

Fractal Setup Hints at a Bullish Continuation

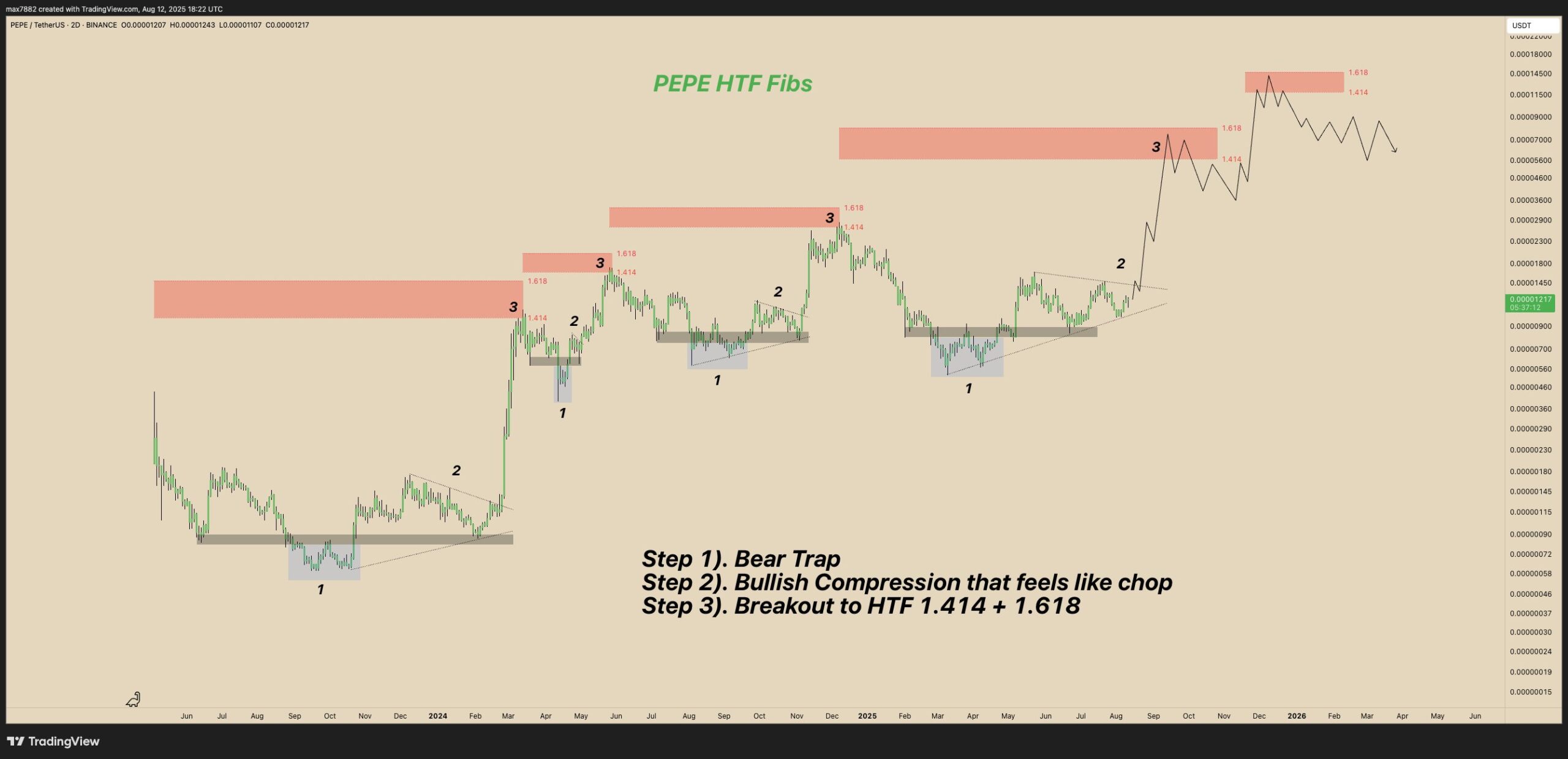

According to prominent crypto analyst Max , PEPE’s current price structure mirrors its previous multi-leg bullish breakouts. The recurring three-step pattern — outlined on the 2-day chart — has played out multiple times since 2023:

- Bear Trap – A sharp dip into support that shakes out weak hands.

- Bullish Compression – Price coils within a tightening range, often feeling like sideways “chop” to traders.

- Breakout to HTF Fib Levels – An aggressive rally toward the 1.414 and 1.618 Fibonacci extension targets.

PEPE Fractal Chart/Credits: @MaxBecauseBTC (X)

PEPE Fractal Chart/Credits: @MaxBecauseBTC (X)

This fractal has repeated at least three times in the past, each time leading to a significant markup. PEPE is now in the late stages of Step 2, consolidating within a symmetrical triangle just beneath resistance.

What’s Next for PEPE?

If the pattern continues to play out, a decisive breakout from the triangle could ignite a rally toward the next multiple Fibonacci extension zones at 1.41 and 1.61 — roughly $0.000090 and $0.0001450. Based on past rallies, this would still represent a potential 10x move from the current price.