Bitwise CIO outlines four catalysts the crypto market hasn’t priced in, from government bitcoin buys to ‘ICOs 2.0’

Quick Take Crypto is booming amid positive regulation, corporate acquisitions, compounding ETF inflows, and renewed Ethereum momentum. However, according to Bitwise CIO Matt Hougan, there are still major developments the market hasn’t fully priced in — and they could push prices substantially higher.

With both BTC and ETH hovering around all-time highs , the crypto market is in a bullish mood. However, there are still four big developments that haven't been priced in, according to Bitwise CIO Matt Hougan.

"There's a lot to be excited about in crypto right now," Hougan wrote in a memo to clients late Wednesday. "Regulation and legislation are moving in a positive direction; stablecoins are taking off; corporate purchases of crypto are soaring; institutions are slowly but surely adding crypto to their portfolios via ETFs; and Ethereum has gotten its mojo back, injecting some much-needed altcoin energy into the broader crypto market."

The issue is that these developments are well-known, even if their scale is underestimated, Hougan explained, arguing that there are significant upside surprises in store for the market through the end of the year — enough to push prices substantially higher.

What is the market still overlooking?

The first factor is the prospect of more governments buying bitcoin this year, the Bitwise CIO argued. At the start of 2025, the expected drivers of bitcoin demand were ETFs, corporations, and governments — "The Three Horsemen of Bitcoin Demand," as Hougan describes it. So far, ETFs have bought 183,126 BTC ($22 billion) for clients, and corporate treasuries have added 354,744 BTC ($43 billion) to their balance sheets, far outpacing the 100,697 BTC ($12 billion) mined this year, helping to push prices up 27%, he said.

However, government adoption has been slow. The U.S. Strategic Bitcoin Reserve only holds seized bitcoin, and other moves, including Pakistan's creation of its own bitcoin reserve and Abu Dhabi's investment in bitcoin ETFs , while notable, have been small. Nevertheless, based on the conversations Bitwise has been having, central banks like the Czech Republic and others are quietly moving, and even a few notable announcements could set up a major catalyst for next year, with that realization alone lifting prices much further, Hougan argued.

Second, the fact that bitcoin is changing hands near all-time highs despite historically high interest rates is unusual. While the market already expects some rate cuts by year-end, the bigger story is that the Trump administration is signaling a push for both a much weaker dollar and a much more dovish Federal Reserve, Hougan said. The appointment of Stephen Miran to the Fed's Board of Governors, an advocate for a new "Mar-a-Lago Accord" of lower rates and dollar devaluation through money printing, also hints at deeper cuts than currently priced in. "Not three rate cuts. Try six. Or eight," Hougan claimed — a scenario in which bitcoin could see significant upside.

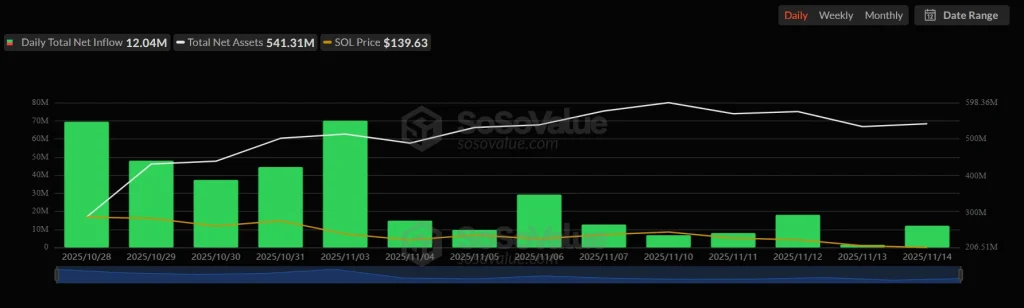

Third, bitcoin volatility has fallen sharply since spot ETFs launched in January 2024, making it roughly as stable as high-volatility tech stocks like Nvidia. Lower volatility is prompting institutional investors to consider larger allocations — now starting at 5% or more of portfolios — and is fueling accelerating ETF inflows, $5.6 billion since July alone, with Hougan expecting that trend to accelerate in the fall.

Bitcoin rolling 30-day volatility. Source: Bitwise Asset Management with data from Coin Metrics .Data from Dec. 31, 2012, to Aug. 10, 2025. Note: The green shading shows the period since the launch of spot bitcoin ETFs.

"Markets don't rise on good news. They rise on good news that is not priced in," The Bitwise CIO concluded. "I think the market in general underappreciates the scale of the bull market taking place in crypto. But I also think it's overlooking some specific catalysts that will play out in the months and years to come."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana Price Drops to $140, Is a Fall to $134 the Next Move?

Dogecoin Price Sinks to New Lows, Can Bulls Regain $0.171 Soon?

Is Ethereum Starting Its Own Bitcoin-Style Supercycle? Tom Lee Weighs In

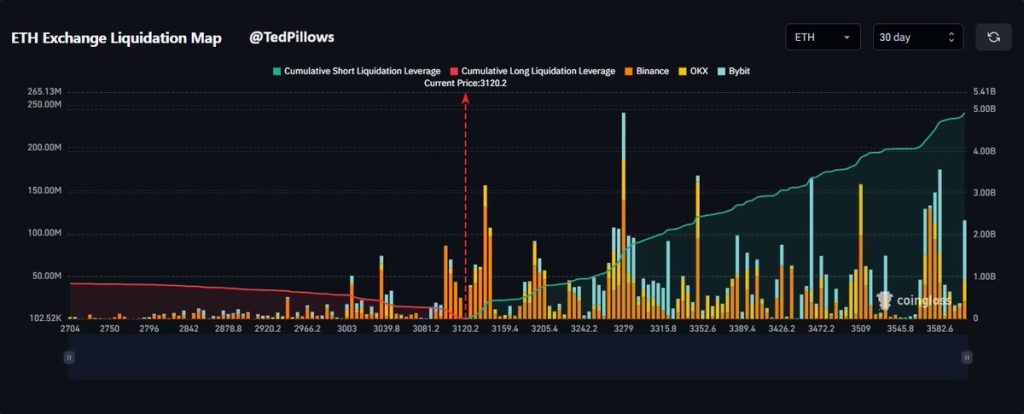

Ethereum Price Analysis: ETH Eyes $3,600 Liquidation Zone as BTC Crashes—Is a 12% Rebound Coming?