Google Play to Enforce Licensing Rules for Crypto Wallet Providers in US, EU and Beyond

Google Play is tightening oversight on cryptocurrency wallet providers, with a new policy requiring licensing and compliance with “industry standards” in more than 15 jurisdictions — including the United States and European Union.

Google Play is tightening oversight on cryptocurrency wallet providers, with a new policy requiring licensing and compliance with “industry standards” in more than 15 jurisdictions — including the United States and European Union.

The updated rules , which take effect on October 29, will not apply to non-custodial wallets.

Under the revised framework, developers operating in the US must register with local regulators as either a money services business or a money transmitter. EU-based providers will need to secure registration as a crypto-asset service provider (CASP).

In the US, firms registered with the Financial Crimes Enforcement Network (FinCEN) are subject to strict obligations, such as implementing a written Anti-Money Laundering (AML) program. These requirements could pave the way for expanded Know Your Customer (KYC) checks and other compliance measures across the industry.

Source:

Google

Source:

Google

Responding to criticism from the crypto community, Google clarified via X that non-custodial wallets remain outside the scope of its Cryptocurrency Exchanges and Software Wallets Policy. The company added that it is updating its Help Center to reflect this exemption.

Google Play’s relationship with the crypto sector has been turbulent. In 2018, it banned crypto mining apps; in 2020, it removed the Bitcoin Blast game and delisted crypto news apps from outlets like Cointelegraph and Coindesk without explanation. The platform also barred eight so-called “deceptive” crypto apps in 2021, accusing them of tricking users into paying for a fraudulent cloud service.

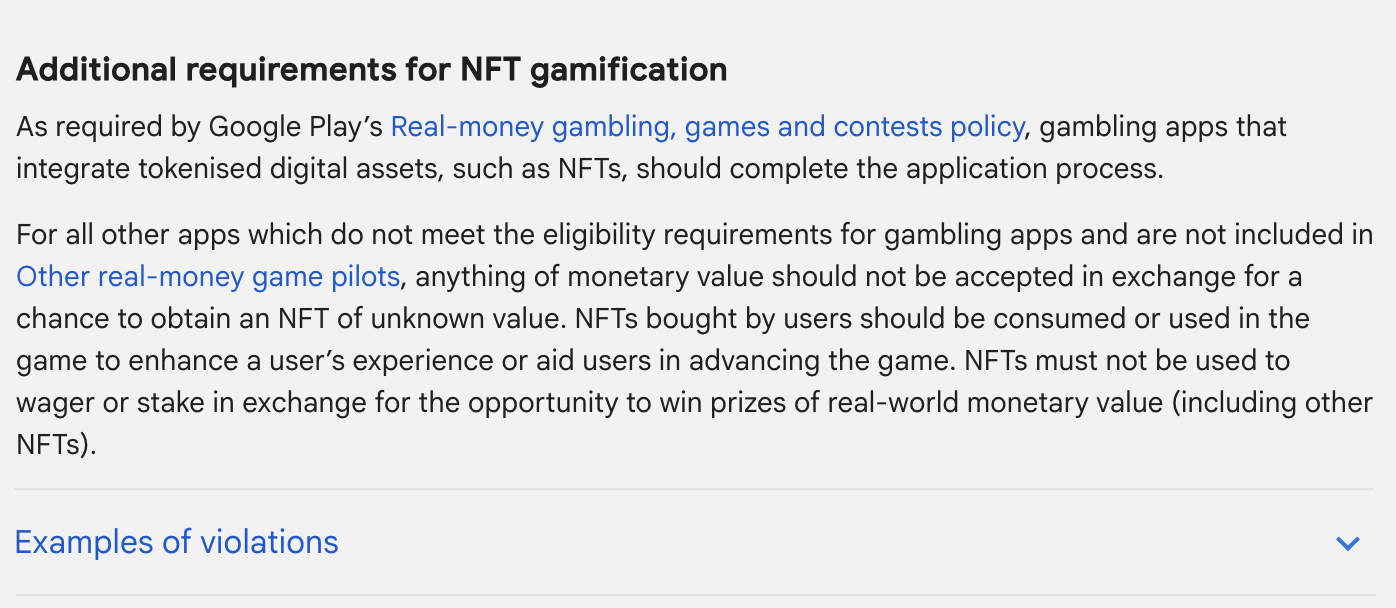

In 2023, Google shifted course slightly, allowing non-fungible token (NFT) games under certain conditions, including mandatory disclosure of NFT features, a ban on gambling mechanics, and the removal of “loot box” systems that deliver random rewards.

According to Google Play’s blockchain content guidelines, four categories of applications currently face heightened scrutiny: cryptocurrency exchanges and software wallets, crypto wallets, tokenized digital asset distribution platforms, and NFT gamification apps.

Notably, Google uncovers new malware ‘LOSTKEYS’ used by russian-backed coldriver group in sophisticated attacks targeting high-profile Western individuals and organizations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Digital Euro Breakthrough: ECB Completes Crucial Technical Preparations, Lagarde Reveals

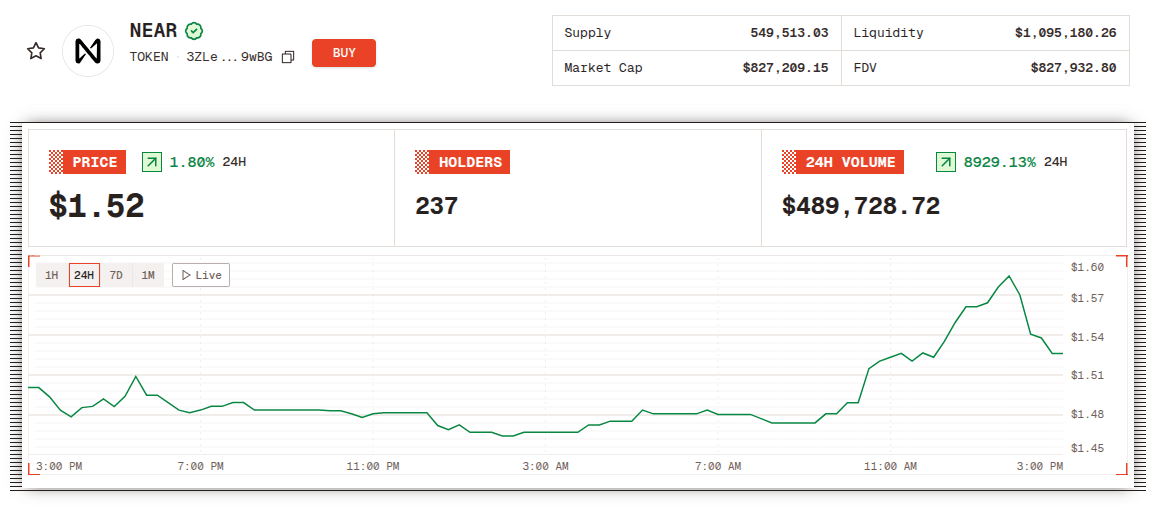

NEAR Is Now Live on Solana as “Attention Is All You Need” Post Goes Viral

Market Strategist: Everyone Gave Up On XRP. Here’s Why

Best Crypto Presales: New Crypto Coins Set to Lead the Market Recovery