Ethereum Foundation Denies Role in $12.8M ETH Sell-Off Amid Growing Corporate Holdings

Ethereum Foundation co-Executive Director Hsiao-Wei Wang has dismissed speculation that the organization was behind a recent $12.8 million Ethereum (ETH) sale, following heightened on-chain scrutiny.

Ethereum Foundation co-Executive Director Hsiao-Wei Wang has dismissed speculation that the organization was behind a recent $12.8 million Ethereum (ETH) sale, following heightened on-chain scrutiny.

In an X post , Wang clarified that the transactions—totaling 2,975 ETH across two separate sales—were not conducted by the Foundation. The wallet involved had previously received ETH from a Foundation-linked address in 2017, fueling assumptions of its involvement. However, Wang explained that the address is no longer under the Foundation’s control.

“It was not the Ethereum Foundation’s operation.”

She said.

It was not the Ethereum Foundation’s operation.

Fun fact: Back in 2014, ~9% of the ETH supply was allocated to the EF; now EF holds under 0.3% of the total supply. So you can probably find tons of addresses linked to EF after ten years.

— hww.eth | Hsiao-Wei Wang (@hwwonx) August 13, 2025

She also noted that while roughly 9% of ETH’s total supply was allocated to the Foundation during Ethereum’s early period, its holdings have been significantly reduced over time. Foundation-controlled addresses now collectively hold less than 0.3% of the supply, with many early-era wallets still active but independent from the organization.

The Ethereum Foundation has a documented history of selling ETH, often triggering debate within the community. Recent months have seen a deliberate strategy to pare down its influence, including a notable July sale of around 10,000 ETH to Nasdaq-listed SharpLink Gaming. That deal, executed directly on-chain to avoid market disruption, made SharpLink the second-largest corporate holder of ETH.

This shift comes amid a surge in corporate Ethereum treasuries, which have amassed more than $14 billion worth of ETH in just a few months. Ethereum co-founder Vitalik Buterin has expressed mixed feelings about the trend, warning that while corporate ownership can expand Ethereum’s mainstream reach, heavy leveraging against these reserves could create systemic risks. Overextended positions, he cautioned, might trigger forced liquidations during downturns, amplifying volatility and undermining market stability.

Despite the concerns, Ethereum’s market performance remains strong. As of publication, ETH is trading at $4,776—up 30% over the past week and just 2.35% short of its all-time high, according to CoinGhecko data.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Best Crypto Presales: New Crypto Coins Set to Lead the Market Recovery

Tezos Art Ecosystem Growth in 2025: Flagship Events, Institutional Programs, and Artist Sales

Urgent Warning: Japan’s Crippling Crypto Tax Reform Risks Global Irrelevance

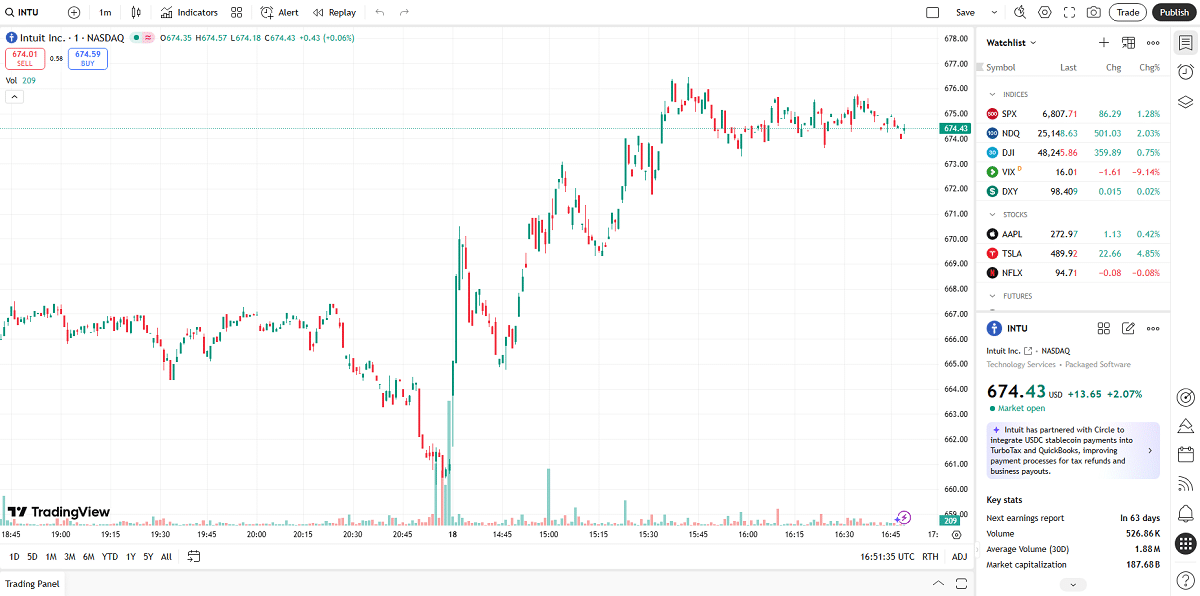

Circle Partners Intuit to Bring Stablecoin Services to Credit Karma, Turbotax, Quickbooks