Date: Fri, Aug 15, 2025 | 05:15 AM GMT

The cryptocurrency market is experiencing a pullback following the latest U.S. Producer Price Index (PPI) data release, which triggered a wave of sight selling pressure. Ethereum (ETH) has cooled from above $4,700 to around $4,600, weighing on major altcoins — including Arbitrum (ARB).

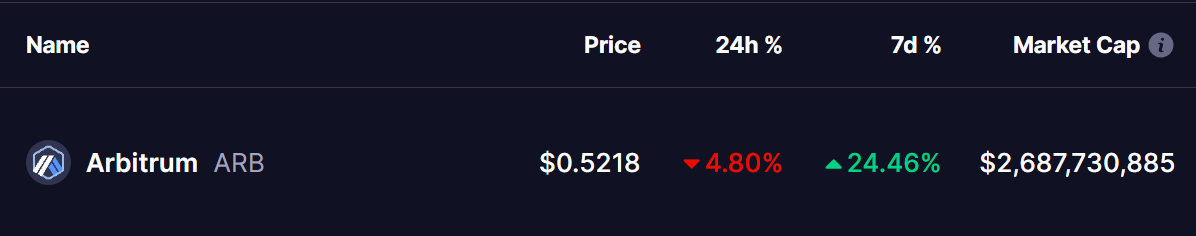

ARB is currently down 5% on the day, trimming its weekly gain to 23%. While short-term sentiment has shifted to the downside, the technical picture on the daily chart suggests this dip could be a classic bullish retest rather than a trend reversal.

Source: Coinmarketcap

Source: Coinmarketcap

Retesting the Cup and Handle Breakout

A clear Cup and Handle pattern — a well-regarded bullish continuation setup — has formed on ARB’s daily chart. After rounding out the “cup” and completing the smaller “handle” consolidation, ARB broke through the neckline resistance near $0.4850. That breakout sparked a rapid move to $0.57 before profit-taking set in.

Arbitrum (ARB) Daily Chart/Coinsprobe (Source: Tradingview)

Arbitrum (ARB) Daily Chart/Coinsprobe (Source: Tradingview)

Today’s pullback has brought the price back toward the neckline zone around $0.4850, which now serves as a key support level. This area also aligns with a structural breakout retest — a common technical occurrence before another leg higher. At the time of writing, ARB trades near $0.5222, holding above the critical breakout threshold.

What’s Next for ARB?

If bulls successfully defend the $0.4850 support zone and momentum returns, ARB could make a renewed push toward its $0.57 high. A sustained breakout beyond that level would open the door to the next measured target near $0.70 — representing nearly 40% potential upside from current prices.

However, failure to hold above the neckline could invalidate the bullish structure and push ARB back into its previous consolidation range. For now, traders will be closely watching the $0.4850–$0.50 zone for signs of renewed buyer interest.