Czech Police Detain Key Figure in Bitcoin Donation Scandal, Seize Assets

Czech police have reportedly detained convicted drug trafficker Tomas Jirikovsky and seized assets in an escalation of the investigation into a multi-million-dollar bitcoin donation to the Ministry of Justice that triggered a political crisis three months ago.

The National Centre for Combating Organised Crime carried out raids on Thursday as part of a case prosecutors say is now focused on suspected money laundering and illegal drug trafficking.

The investigation, overseen by the High Public Prosecutor’s Office in Olomouc, was recently separated from a broader probe disclosed in May.

Jirikovsky, identified by local media as the donor of 468 bitcoin, valued at roughly $45 million at the time, to the justice ministry, was taken into custody at a property in Breclav, according to Echo24.

The donation, made earlier this year, was accepted by then-Justice Minister Pavel Blazek without verification of its origins.

Blazek resigned in May amid mounting criticism after media revealed the funds came from Jirikovsky, a convicted darknet operator previously jailed for drug trafficking.

An audit commissioned by Blazek’s successor, Eva Decroix, concluded in July that the ministry should not have accepted the gift due to the major risk that it constituted proceeds of crime.

Prosecutors said Thursday the current investigation concerns “acts to clarify the case as well as measures to secure persons and property,” adding no further details would be released to avoid jeopardising the proceedings.

The scandal prompted a no-confidence vote in June that the government of Prime Minister Petr Fiala narrowly survived.

Opposition party ANO has since called for further ministerial resignations, including Finance Minister Zbynek Stanjura.

Decroix has pledged to publish an expanded timeline of the case this week, comprising more than 8,000 entries, as scrutiny intensifies ahead of October’s parliamentary elections.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Explosive Theta Labs Lawsuit: Former Execs Accuse CEO of Fraud and Price Manipulation

Pi Network stock price remains under pressure, momentum weakens

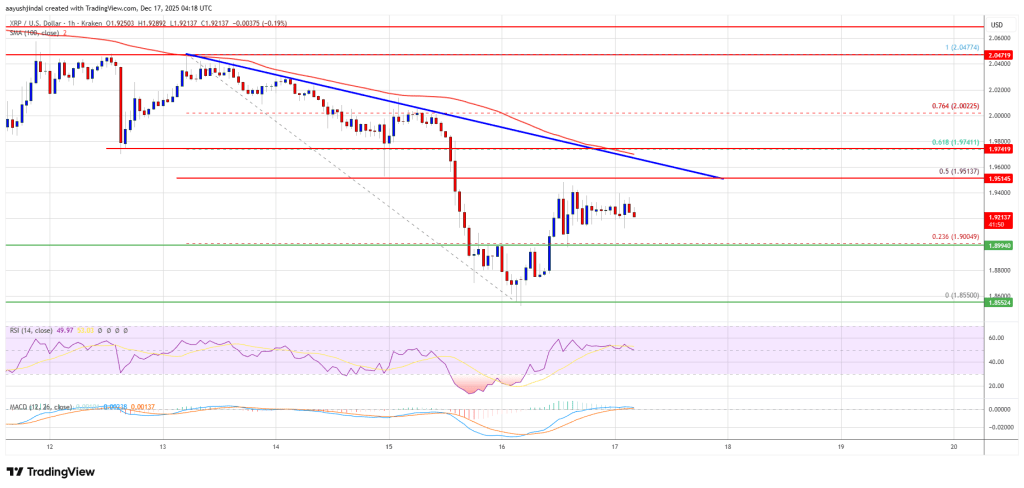

XRP price recovery appears fragile—can bulls break through the price ceiling?

Pantera: 2025 will be a year of structural progress for the crypto market