Massive Crypto Moves: $7.9B in Options Expire, $2B USDT Minted in 24 Hours

Record Inflows Options Expiry Shake the Market

In the past 24 hours, the crypto market has seen activity levels not witnessed in years. According to analysts, $5.9 billion in Bitcoin and Ethereum options are set to expire today. Options expiry events of this size often result in heightened volatility as traders close, roll over, or hedge positions.

Meanwhile, others reported the minting of $1 billion USDT today alone, contributing to a massive $2 billion minted in the past 24 hours. Stablecoin inflows of this scale typically signal fresh buying power entering the market, and whales appear to be loading up.

Whale Activity Market Sentiment

Other analysts described the current whale accumulation as “buying like never seen before in history.” Large investors are often early movers in market cycles, and such aggressive stablecoin deployment suggests confidence in a near-term price surge.

Bitcoin Ethereum Price Predictions

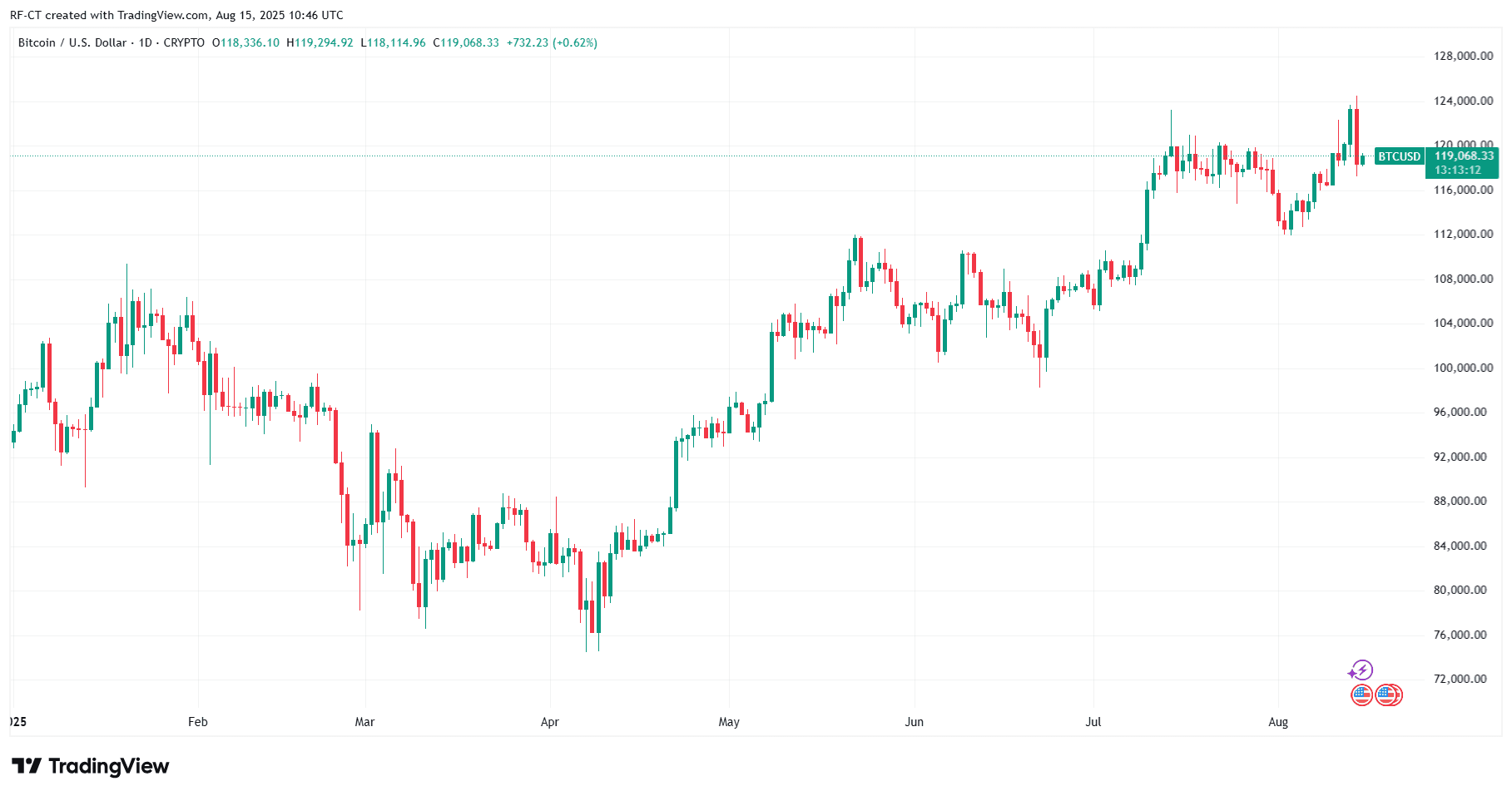

Bitcoin (BTC):

- Bullish scenario: If fresh liquidity fuels a post-expiry breakout, BTC could reclaim $118K quickly, with a push toward $122K–$125K possible in the coming week.

- Bearish scenario: Failure to hold $115K support after expiry could see a correction toward $111K–$109K before buyers step in again.

By TradingView - BTCUSD_2025-08-15 (YTD)

By TradingView - BTCUSD_2025-08-15 (YTD)

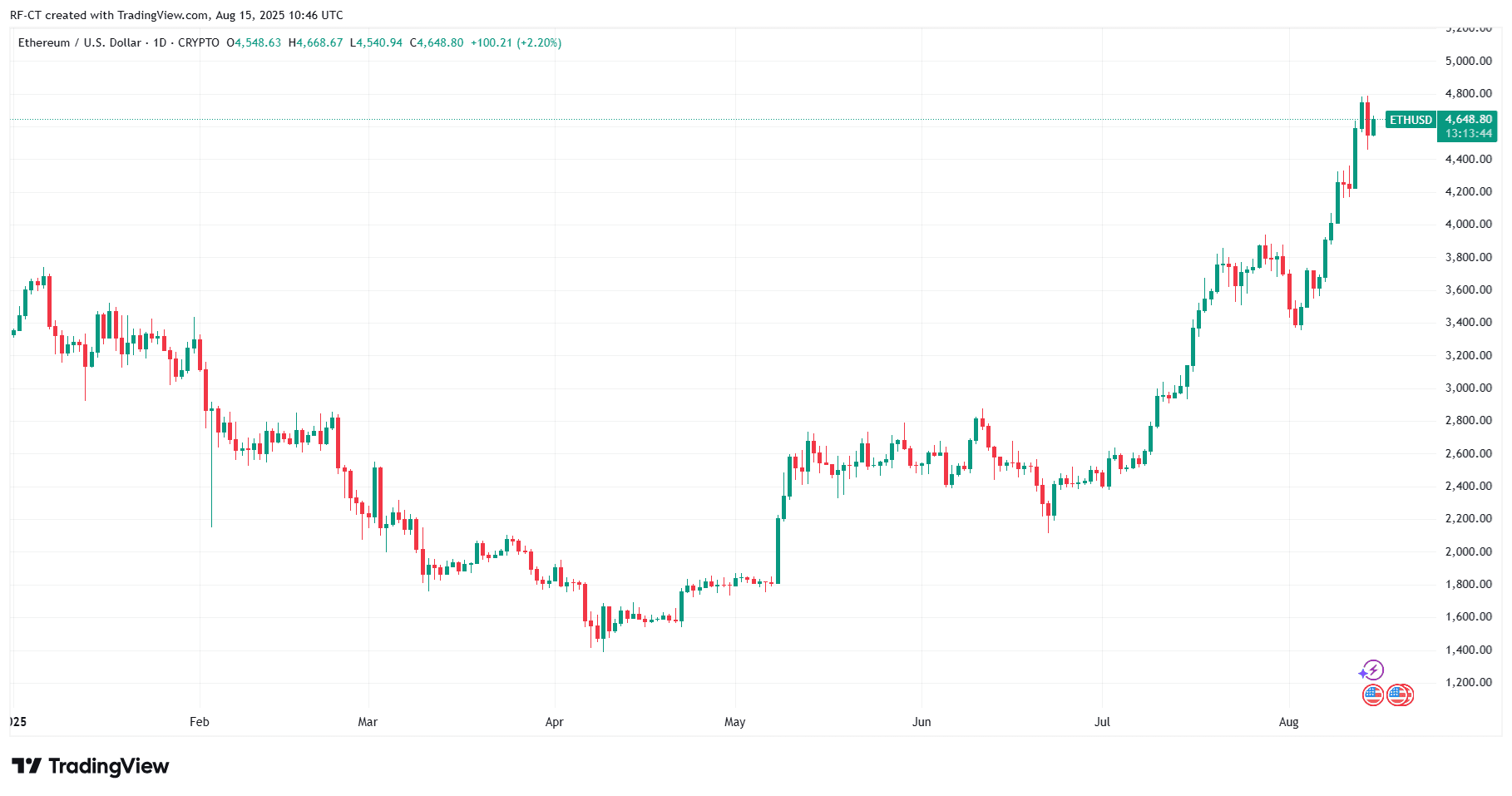

Ethereum (ETH):

- Bullish scenario: ETH could retest $4,350, with a breakout eyeing $4,500–$4,650 if momentum sustains.

- Bearish scenario: A drop below $4,100 could trigger a pullback to the $3,950–$3,900 range.

By TradingView - ETHUSD_2025-08-15 (YTD)

By TradingView - ETHUSD_2025-08-15 (YTD)

Scenario Analysis: What to Expect Next

- High Volatility Window: With options expiry and $2B in new USDT liquidity, sharp price swings are likely within the next 48 hours.

- Liquidity-Driven Breakouts: If whales maintain buying pressure, BTC and ETH could enter a short-term rally phase, breaking key resistance levels.

- Fakeout Risk: Rapid gains could be followed by profit-taking, so traders should monitor volume and open interest for confirmation.

💡 Trading Tip: Large stablecoin mints often precede rallies, but pairing them with technical confirmation, such as breakout closes on high volume, is essential for avoiding bull traps.

$BTC, $ETH, $USDT

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ECB shifts stance! Will interest rate hikes resume in 2026?

In the debate over "further tightening" versus "maintaining the status quo," divisions within the European Central Bank are becoming increasingly public. Investors have largely ruled out the possibility of the ECB cutting interest rates in 2026.

On the eve of Do Kwon's trial, $1.8 billion is being wagered on his sentence

Dead fundamentals, vibrant speculation.

Space Review|When the US Dollar Weakens and Liquidity Recovers: Cryptocurrency Market Trend Analysis and TRON Ecosystem Strategy

This article reviews the identification of macro turning points and the capital rotation patterns in the crypto market, and delves into specific allocation strategies and practical approaches for the TRON ecosystem during market cycles.

30-Year Wall Street Veteran: Lessons from Horse Racing, Poker, and Investment Legends That Inspired My Bitcoin Insights

What I focus on is not the price of bitcoin itself, but rather the position allocation of the group of people I am most familiar with—those who possess significant wealth, are well-educated, and have successfully achieved compounding returns on capital over decades.