XRP Price Finds Support at $3 Even as Whales Note $1.2 Billion Sell-Off

XRP holds at $3 despite whale sell-offs; retail investors buying to stabilize price, but support at $3.07 is crucial for recovery.

XRP has shown significant volatility in recent days, reflecting uncertain investor sentiment. Despite major price fluctuations, XRP is holding steady around $3.00, mainly due to the mixed actions of investors.

Whales’ decisions to sell a large amount of XRP are influencing the price movement.

XRP Whales Spell Trouble

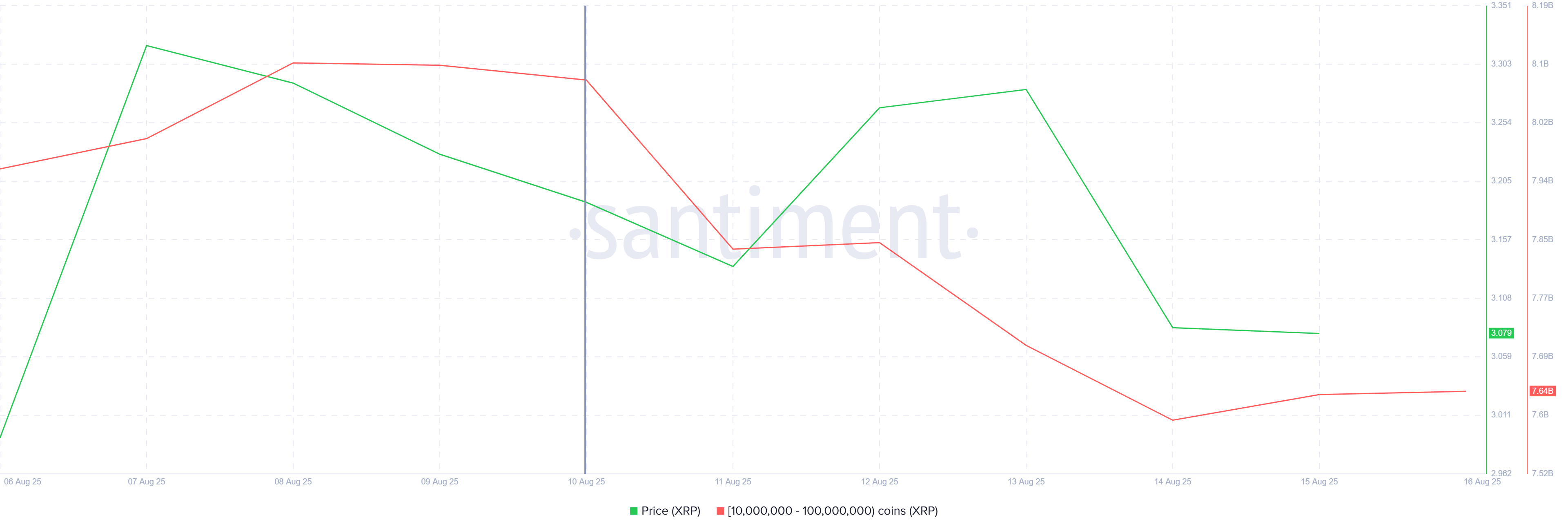

The selling pressure from whales is evident, as large holders are reducing their positions. Over the past week, addresses holding between 10 million and 100 million XRP have sold approximately 400 million XRP, worth over $1.2 billion.

This move has contributed to the uncertain price movements, pushing the market into a period of volatility.

XRP Whale Holdings. Source:

XRP Whale Holdings. Source:

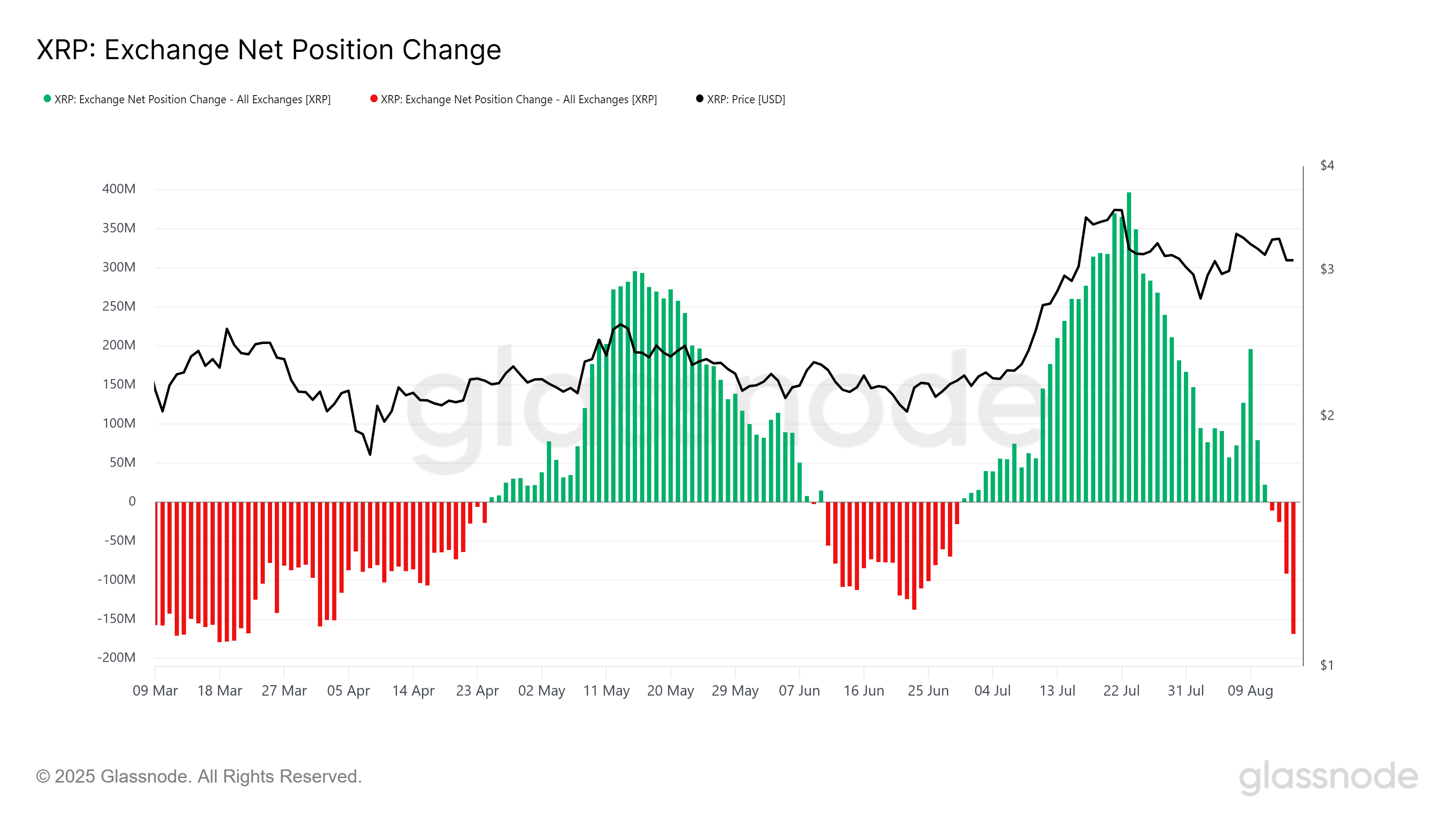

Despite the selling by whales, the XRP supply on exchanges has decreased. This means that other small investors might be actively working to stabilize the price.

In the last 24 hours, 77 million XRP, valued at $231 million, were withdrawn from crypto exchanges. This continued accumulation by investors supports the price and prevents XRP from making a sharp decline below the $3.00 level.

Investors’ behavior seems to counteract the large-scale selling by whales, which provides a foundation for potential price recovery. While whales dominate the market’s selling pressure, other smaller investors are helping keep the XRP price steady.

XRP Exchange Position. Source:

XRP Exchange Position. Source:

The active buying behavior of these investors, combined with a positive net position, is crucial in holding the price above key support levels. These efforts could lead to a potential upward movement.

XRP Price Is Vulnerable

At the time of writing, XRP is trading at $3.09, holding above the support level of $3.07. The recent price action indicates that XRP is unlikely to fall below $3.00, especially with strong support in place. This stability is essential for a potential recovery.

If XRP can secure $3.12 as its next support level, it could rise to $3.41, recovering some of its recent losses. The buying activity from retail investors may help push the price toward this higher level, signaling a potential rebound in the short term.

XRP Price Analysis. Source:

XRP Price Analysis. Source:

However, if the whales’ selling pressure continues to intensify, XRP could fall through the support at $3.07. In this case, XRP might dip to $2.91, invalidating the bullish outlook and potentially triggering further declines in price.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Passkey Wallet: The “Tesla Moment” for Crypto Wallets

The real transformation lies not in better protecting keys, but in making them impossible to steal. Welcome to the era of Passkey wallets.

The market is not driven by individuals, but dominated by emotions: how trading psychology determines price trends

Crypto Coins Surge: Major Unlocks Impact Short-Term Market Dynamics

In Brief Crypto market anticipates large-scale unlocks, exceeding $309 million in total market value. Significant cliff-type unlocks involve ZK and ZRO, impacting market dynamics. RAIN, SOL, TRUMP, and WLD highlight notable linear unlocks within the same period.

Bitcoin Stable But Fragile Ahead Of BoJ Decision