Bitcoin to $144,000? BTC Faces Next Big Test at This Key Level

Bitcoin rose as high as $124,533 on Aug. 14 before taking a hit following July’s hotter-than-expected wholesale inflation data.

The July consumer price index was broadly in line with market expectations, though the core reading that excludes food and energy edged higher to 3.1%, slightly over Wall Street estimates. However, the July producer price index, which measures wholesale items, showed a surprise strong 0.9% monthly gain, the most in nearly three years.

Around the time of writing, BTC was trading down 0.77% in the last 24 hours to $117,741, following Friday's drop to a low of $116,859.

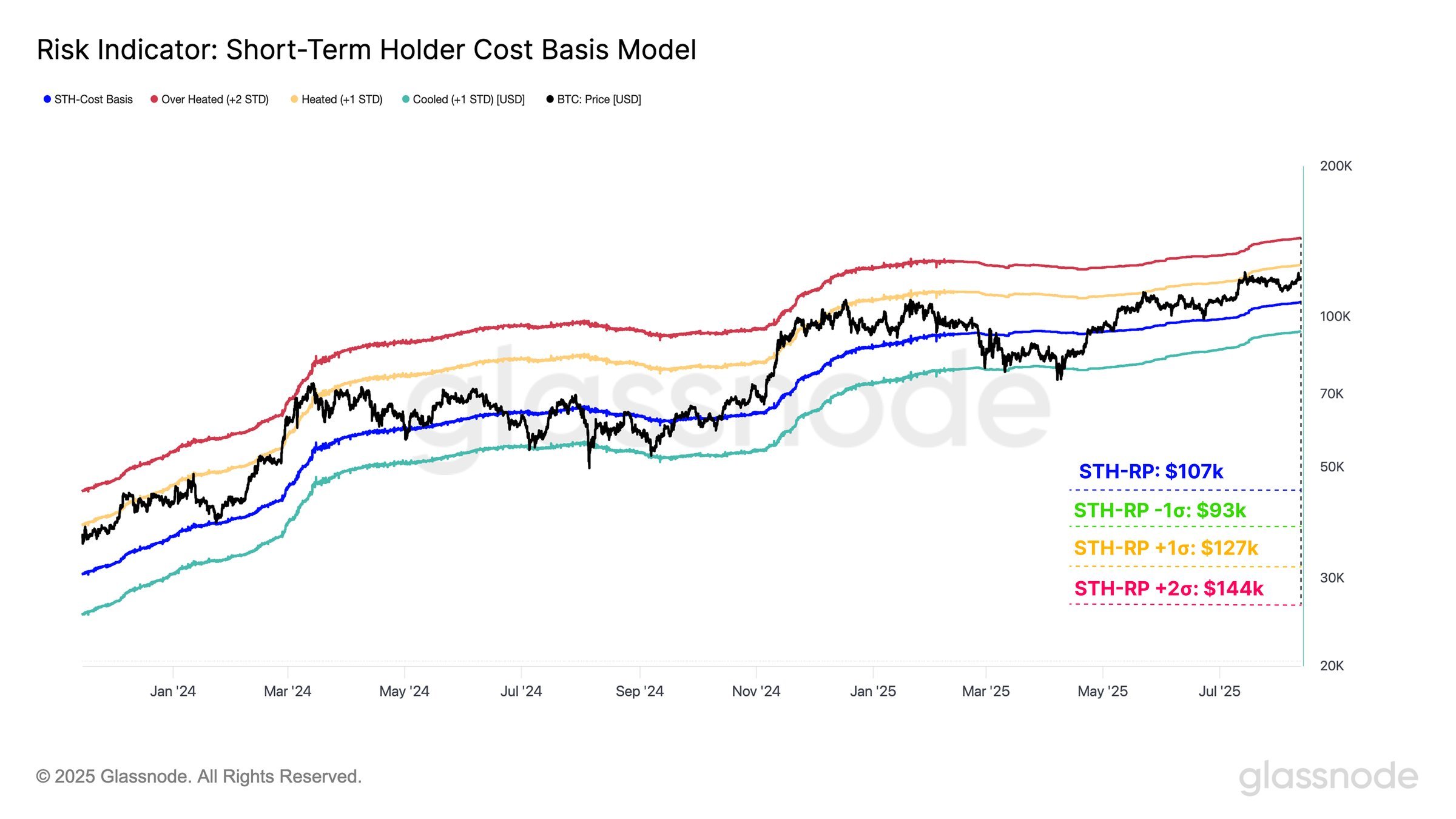

On what comes next, BTC’s average entry price for newer investors and its standard deviation bands can help to identify overheated zones.

According to Glassnode data, the short-term holder realized price (STH RP) for Bitcoin (BTC) currently sits at $107,000, which represents the average on-chain acquisition price of Bitcoin (BTC).

The STH RP +1σ level is at $127,000, and it is a major key resistance for Bitcoin to surmount, with a breakout opening the path to $144,000, which coincides with the short-term holder realized price +2σ, a level where prior market tops saw increased selling pressure. Short-term holder realized price standard deviation bands +1σ and +2σ coincide with heated and overheated zones, respectively.

Bitcoin has not yet reached these levels, suggesting that the current rally might still have room to run.

Fed signals closely watched

Federal Reserve President Austan Goolsbee spoke on Friday about mixed inflation numbers, with the ongoing instability showing doubts for reduced rates.

The Fed’s annual meeting of the world’s central bankers in Jackson Hole, Wyoming, from Aug. 21-23, has historically been used for the Fed to signal policy shifts and will be watched closely by investors next week.

Markets expect the FOMC to vote to decrease the benchmark federal funds rate by a quarter percentage point in September, from 4.25% to 4.50%. However, there are concerns about what happens next, with 55% odds of another cut in October and only a 43% chance of a third move in December.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aster announces a $10 million trading competition, combined with Stage 4 airdrop and Rocket Launch incentives, driving multi-layered growth in platform depth and liquidity.

After achieving strong performance in Stage 3, Stage 4 (Harvest) airdrop plan was launched, and the “Double Harvest” trading competition with a total reward of 10 million USD will be introduced on November 17.

Mars Morning News | Federal Reserve officials send strong hawkish signals again, December rate cut in doubt

The crypto market has generally declined, with bitcoin and ethereum prices falling and altcoins experiencing significant drops. Hawkish signals from the Federal Reserve have affected market sentiment, and multiple project tokens are about to be unlocked. Early ethereum investors have made substantial profits, and expectations for a continued gold bull market persist. Summary generated by Mars AI. The accuracy and completeness of this summary, generated by the Mars AI model, are still being iteratively improved.

IOTA collaborates on the ADAPT project: Building the future of digital trade in Africa together

IOTA is collaborating with the World Economic Forum and the Tony Blair Institute for Global Change on the ADAPT project. ADAPT is a pan-African digital trade initiative led by the African Continental Free Trade Area. Through digital public infrastructure, ADAPT connects identity, data, and finance to enable trusted, efficient, and inclusive trade across Africa.