Institutional Investors Seize Ethereum Dip with Nearly $900 Million in New Buys

Analysts say the scale and timing of these acquisitions highlight disciplined accumulation, strengthening Ethereum’s role as a leading macro asset.

Several major institutional investors are seizing the recent dip in Ethereum’s price to expand their holdings, signaling a focus on long-term exposure rather than short-term gains.

This activity suggests that the institutions are positioning for long-term exposure rather than short-term gains.

Ethereum’s Market Sentiment Edges Past Bitcoin as Accumulation Grows

Blockchain analytics from Lookonchain reveal that one unnamed institution created three new wallets last week. The firm also withdrew 92,899 ETH, worth roughly $412 million, from Kraken.

Typically, market analysts interpret such withdrawals as a bullish signal, indicating that investors are moving coins into self-custody with a long-term holding strategy.

Meanwhile, Donald Trump’s DeFi venture World Liberty also joined the buying spree.

On-chain data shows that the firm spent $8.6 million USDC to purchase 1,911 ETH at around $4,500 each. At the same time, the firm allocated another $10 million to acquire 84.5 Wrapped Bitcoin (WBTC) at $118,343 per coin.

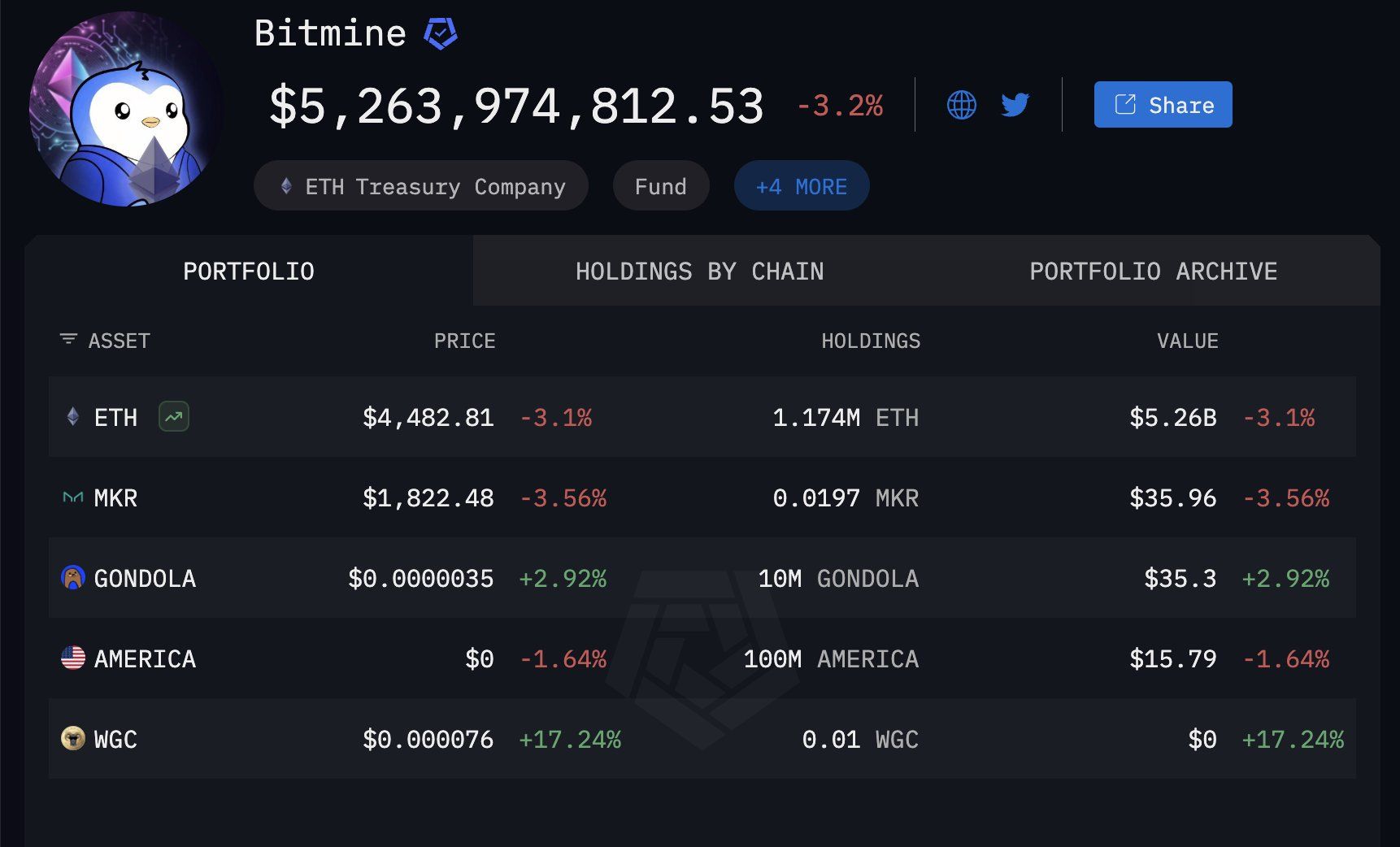

Additionally, the Ethereum-focused firm BitMine made the most significant single move during the period. Lookonchain reported that the company added 106,485 ETH to its balance sheet at a cost of $470 million.

This brings BitMine’s Ethereum treasury to 1.17 million ETH, which is now valued at roughly $5.3 billion. The Tom Lee-led firm is the largest corporate holder of an Ethereum reserve.

BitMine Ethereum Holdings. Source:

Arkham Intelligence

BitMine Ethereum Holdings. Source:

Arkham Intelligence

These institutional moves follow Ethereum’s recent correction after weeks of upward momentum that nearly brought ETH to its all-time high.

Market analysts note that the timing and scale of these institutional purchases point to a calculated accumulation strategy rather than speculative trading.

Notably, the institutional appetite is driven by rising ETF exposure and the rise of treasury companies. Together, these entities have accumulated over 10 million ETH, or around $40 billion, of the digital asset.

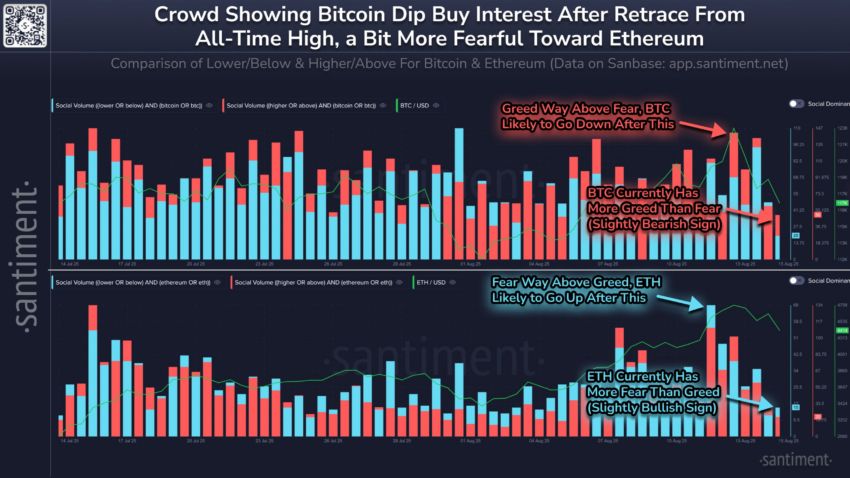

Considering this, the blockchain analytics platform Santiment suggests that Ethereum currently maintains a modest short-term advantage over Bitcoin in market sentiment.

Bitcoin and Ethereum Market Sentiments. Source:

Santiment

Bitcoin and Ethereum Market Sentiments. Source:

Santiment

Santiment’s analysis shows that Bitcoin’s rallies often generate social media hype. In contrast, Ethereum’s consistent performance over the past three months has attracted measured, patient accumulation by whales rather than public frenzy.

According to the firm, this disciplined approach suggests that institutions are positioning for sustained growth. It also reinforces Ethereum’s role as a leading macro play in the digital asset market over the next decade

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin Poised to Rise to $1.4 Million by 2035, Analysts Say—Or Much Higher

Cryptocurrencies Face Turbulent Times as Market Shifts Intensify

Crypto's Capitol Hill champion Sen. Lummis says she won't seek re-election

Bitcoin: How did BTC react to U.S. inflation cooling down?