LINK Cryptocurrency Explodes 16% to Surpass $25 as BTC Consolidates

- Bitcoin maintains consolidation near $118

- Altcoins like LINK, OKB, and XMR see gains

- Crypto market value surpasses $4 trillion

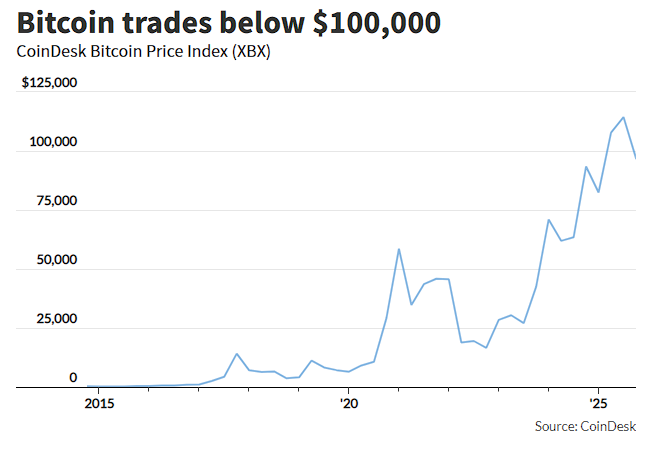

Bitcoin continued its consolidation over the weekend, remaining near the $118.000 level. After reaching a new high of just over $124.500 on August 14, the leading cryptocurrency underwent a correction that dropped its price to $121.000. The downward movement gained momentum after the release of the July PPI data, causing BTC to retreat below $118.000, a level at which it has remained stable ever since.

Even after the meeting between current US President Donald Trump and the Russian president, which generated little market expectation, Bitcoin failed to demonstrate a significant recovery. Currently, the cryptocurrency's market value is around $2,35 trillion, while its dominance over other digital currencies has fallen to 57,6%.

Meanwhile, some larger-cap altcoins managed to stand out. Chainlink (LINK) surged over 16% in the last day, surpassing $25. Monero (XMR) and Mantle (MNT) also saw similar gains, solidifying their position among the biggest gainers of the period. The highlight, however, was OKB's token, which rose 17% to reach $120.

On the other hand, other cryptocurrencies such as XRP, Cardano (ADA) and TRON (TRX) had discreet losses, while assets such as Ethereum (ETH), Binance Coin (BNB), Solana (SOL), Dogecoin (DOGE), Hype (HYPE), Stellar (XLM) and Sui (SUI) remained slightly positive, without movements of great relevance.

With the occasional appreciation of some altcoins, the aggregate market value of all cryptocurrencies has shown significant growth. Since the last close, more than $30 billion has been added, bringing the total to approximately $4,08 trillion, according to recent data.

This contrast between Bitcoin's consolidation and the occasional highs of projects like LINK and OKB highlights the resilience of certain assets even during times of pressure in global markets.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Former Federal Reserve Governor Coogler faced an ethics investigation before resigning.

Nillion will gradually migrate to Ethereum.

Both gold and tech stocks have seen dip-buying, but only bitcoin remains "sluggish."

Compared with the capital inflows into tech stocks and gold's sharp rebound after a plunge, bitcoin was a clear exception in Friday's market: it defied the trend by dropping 5%, hitting a six-month low, and has now declined for three consecutive weeks. This contrast highlights the unusual situation in the bitcoin market: even as it maintains a high correlation of 0.8 with the Nasdaq 100 Index, bitcoin exhibits an asymmetric pattern of "falling more on declines and rising less on rallies." Meanwhile, intensified whale sell-offs and concentrated selling by long-term holders are jointly suppressing bitcoin.

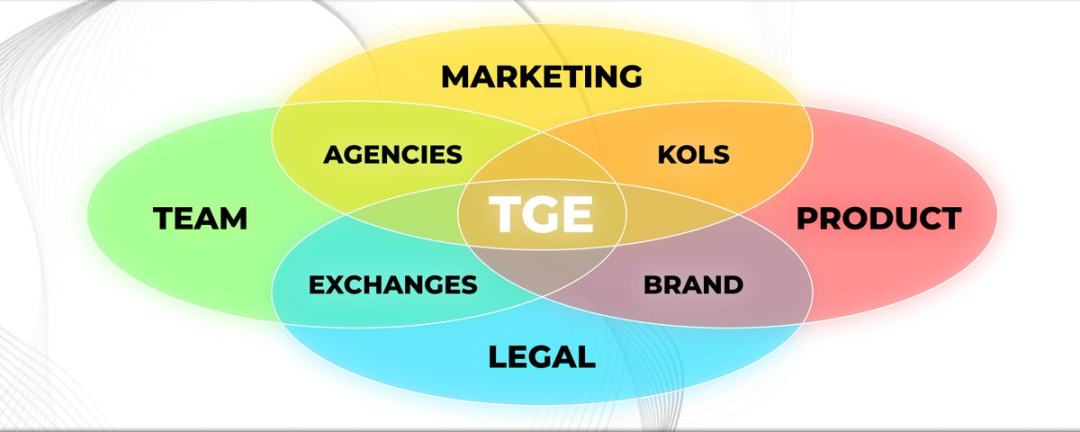

Why do 90% of project TGEs end in failure?

Doing these things is a prerequisite for a successful TGE.