- The Chainlink (LINK) price is resisting at the upper end of the 7-day gain of 11.4%; the upper supportive factor appears at the value of 24.38, and the lower supportive factor appears at the value of 21.48.

- The price is up by 12.46%, market cap: $16.54B, and weekly volume increased by 23.56% to $1.34B.

- Technical charts indicate rejection in the mid-channel looking to potential pullback towards the 20 just before another breakout.

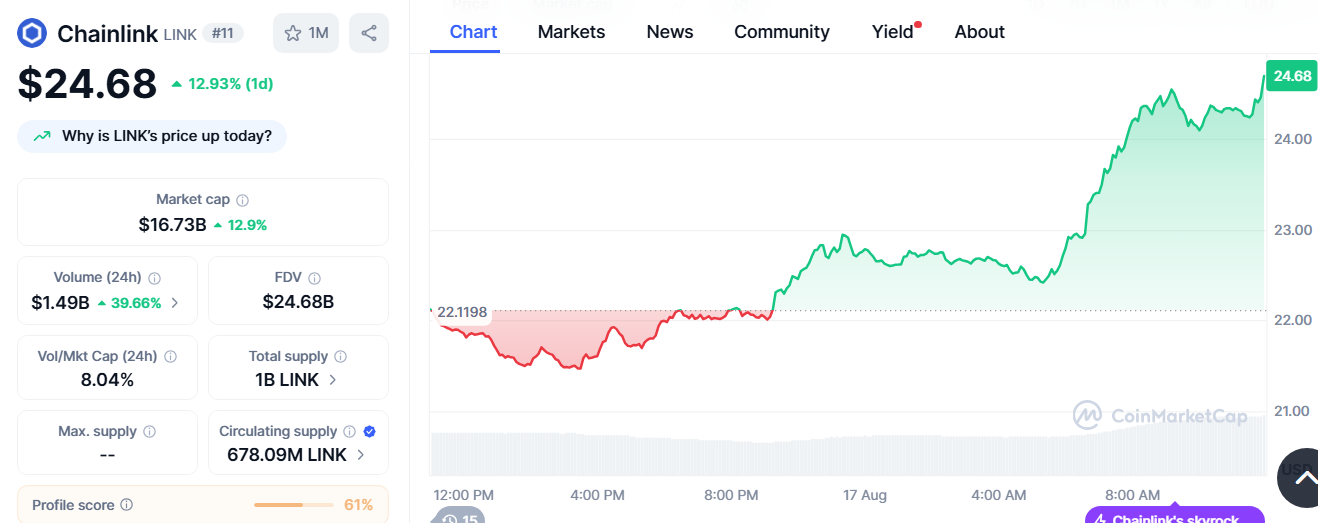

Chainlink (LINK) has reached resistance following a strong rally this week, with the token failing to stay above $24.40. The token jumped 11.4% over the past seven days as market capitalization and trading volume grew. However, the latest charting shows that LINK breached at the mid-channel resistance level and may drop to the $20 area before another breakout attempt.

LINK Faces Resistance at $24.38 as Market Activity Intensifies

The current LINK price is $24.40 with 0.0002066 BTC valuation and 12.0% appreciation for the week. Compared to Ethereum, the LINK price is 0.005447 ETH, indicating a 11.2% appreciation for the same period. The market capitalization has increased by 12.46% and now sits at $16.54 billion. The trading has also accelerated, with 24-hour volume up by 23.56% to $1.34 billion. These statistics indicate a live market situation around the token during the recent spike.

Source: CoinMarketCap

Source: CoinMarketCap

Despite the momentum, LINK is currently at $24.38. The resistance has halted further upside, with support found at $21.48. Price action between the two remains crucial as the traders assess near-term direction. The resistance test also aligns with mid-channel rejection on the larger-scale chart setup, and thus $24 is that much more important.

Technical Structure and Potential Pullback

The broader chart highlights LINK’s movement inside an ascending channel. The mid-channel has acted as a key pivot point, halting rallies when tested. Notably, the latest failure at this level suggests potential short-term weakness. According to analyst Ali-charts, a retracement toward $20 would bring the token closer to lower support, aligning with historical price behavior.

The outlined support at $21.48 remains crucial in preventing a deeper decline. Should LINK maintain this level, consolidation could follow before another attempt to break above $24.38. The technical outlook therefore emphasizes the relevance of the channel structure in guiding near-term movement. The market will likely continue monitoring these thresholds for confirmation of direction.

Trading Activity and Market Context

Increased trading volume has accompanied LINK’s recent move , suggesting greater participation during the price surge. However, the inability to close firmly above resistance highlights market hesitation. This pattern adds weight to the scenario of a pullback toward $20 before renewed strength.

Market participants remain attentive to the interaction between support and resistance, particularly given the expanded market capitalization and rising activity. While LINK has shown notable weekly gains, the current structure reinforces caution as the token continues to trade within the channel boundaries. The next sessions may prove decisive in clarifying whether LINK sustains higher ground or retests lower levels.