Dogecoin flagged as next target by Qubic group after 51% attack on Monero

Qubic’s community has voted to make Dogecoin its next target, days after the group claimed majority control of Monero’s network.

- Qubic took over Monero’s network and reorganized six blocks.

- Its community voted Dogecoin as the next proof-of-work target.

- A 51% attack could raise risks for Dogecoin’s security and users.

Project founder Sergey Ivancheglo shared the update on Aug. 17 after a successful attack on Monero ( XMR ). Qubic ( QUBIC ) had announced last week that its mining pool had achieved a 51% attack on Monero.

The group reorganized six blocks, effectively proving it could rewrite blockchain history. Shortly after, Ivancheglo asked the Qubic community to choose another ASIC-enabled proof-of-work network to attack next. While Monero continued to function, the move forced Kraken exchange to pause deposits and raised fears of deeper disruption.

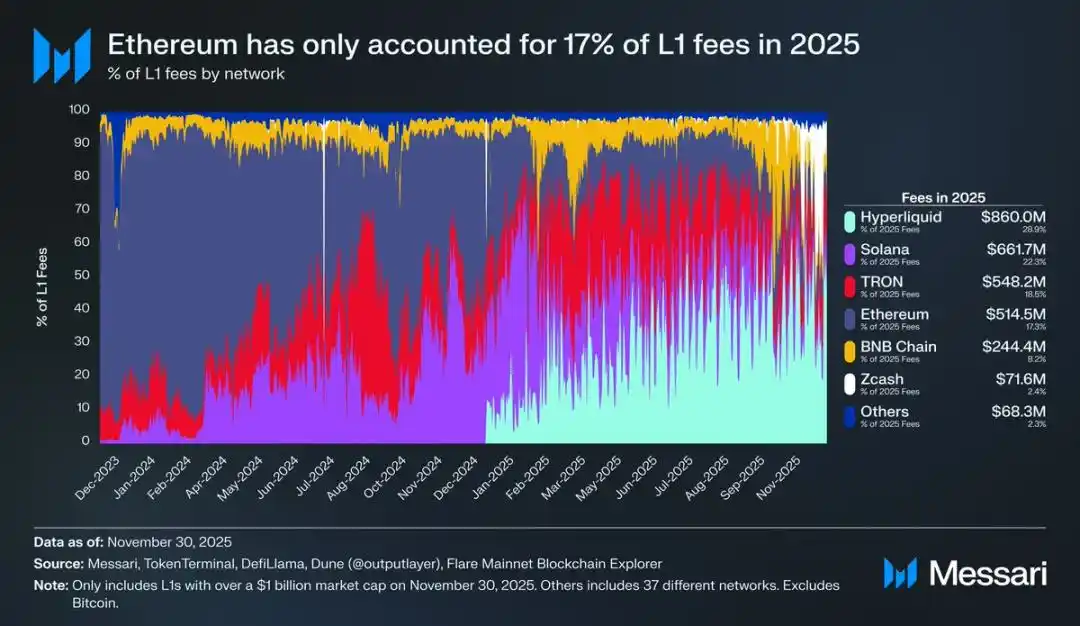

In a public vote, Dogecoin was selected over Zcash ( ZEC ) and Kaspa ( KAS ), receiving more than 300 votes, more than all other options combined. With a market capitalization above $35 billion, Dogecoin now faces the possibility of a similar attack.

What a Dogecoin attack could mean

A 51% attack allows the controlling party to reorganize blocks, stop certain transactions, or attempt double-spending. Qubic currently runs a pool with about 2.3 GH/s of Monero hashrate, enough to keep control of its network. If the same level of power were applied to Dogecoin, the risks could be significant.

Qubic describes its actions as “stress tests” designed to prove the strength of its own mining model, known as useful proof-of-work. Profits from the pool are used to buy and burn QUBIC tokens. The project has said it does not intend to break Monero or Dogecoin, but the experiments have raised new questions about the safety of proof-of-work systems when mining becomes concentrated.

No timeline has been shared for the move against Dogecoin, but the announcement has already drawn attention to the coin’s security and how its developers may respond.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Inside China’s mining ban: What it means for Bitcoin’s 2026 outlook

Why ChipForge Might Become the Home of the Next Generation of Edge-AI Chips

Ethereum's Identity Dilemma: Is It a Cryptocurrency or Just Bitcoin's Shadow?

Pundit to XRP Investors: Rough Week Ahead. Find Out Why