Chainlink Price Surges on Whale Buys—Yet a Key Metric Could Derail the Rally

Chainlink price outperforms the market as whales accumulate over $27 million in LINK, but rising exchange reserves suggest a short-term pause might be coming.

Chainlink price has moved ahead of the market again. While most altcoins are struggling to hold gains, LINK price has climbed more than 5% in the last 24 hours and over 140% in the past year.

The Oracle network’s use in DeFi keeps it relevant, but this latest rally isn’t just organic; it’s backed by heavy wallets buying in. Yet, one subtle metric might now hint at a pause.

Whale Activity Explains the Chainlink Price Rally

In the past seven days, whale wallets have added over 1.1 million LINK to their positions. At the current price of $24.80, this equals around $27.2 million in inflows. That kind of capital is rarely random; it usually reflects conviction. And it shows in the Chainlink price action.

Chainlink whale activity:

Nansen

Chainlink whale activity:

Nansen

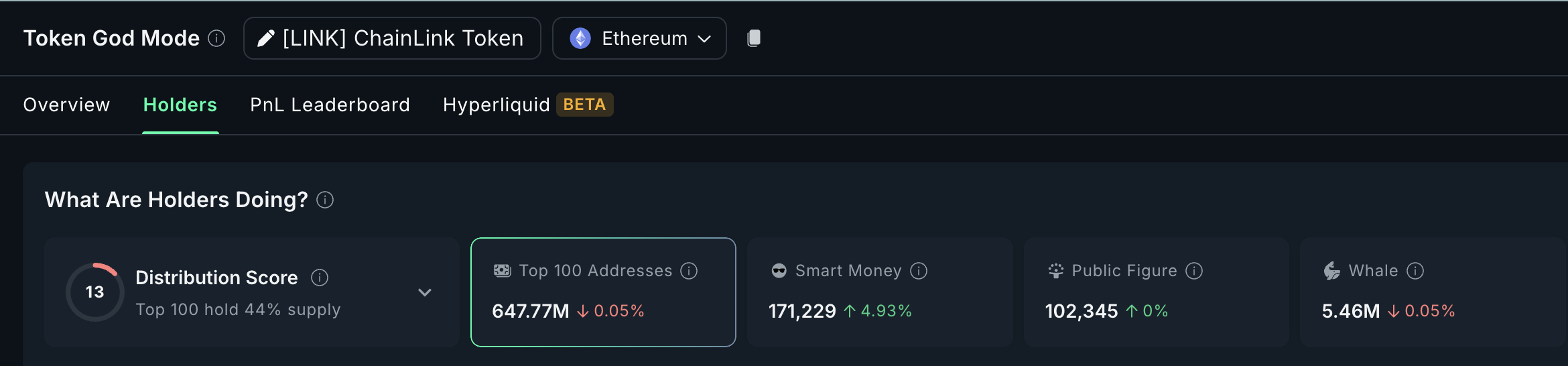

Smart money wallets, which usually track market entries well, have also increased their holdings by 12.6% over the week.

Meanwhile, the top 100 LINK addresses have resumed accumulation, even though slightly. The fact that all three segments are moving together is a clear reason why the LINK price has broken away from broader market weakness.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

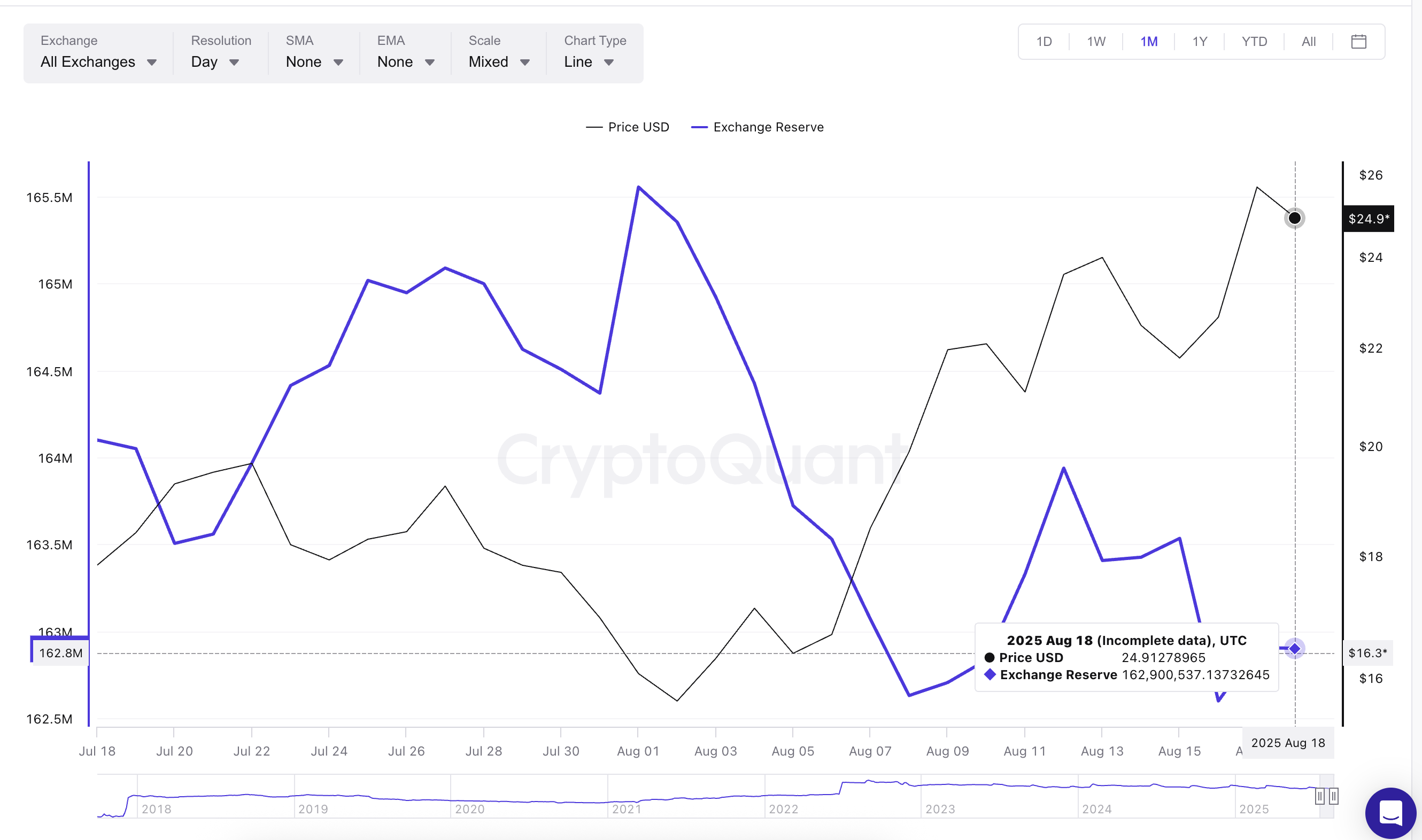

The Missing Link? Exchange Reserves Tell a Different Story

Despite this strong whale support, one metric suggests the Chainlink price might cool off in the short term: exchange reserves.

On August 16, LINK’s exchange balance dropped to a monthly low of 162.59 million LINK, right as the rally picked up speed. That was a good sign. It meant fewer LINK tokens were sitting on exchanges, so selling pressure was likely low.

But that has changed at press time.

Chainlink price and exchange reserves:

Cryptoquant

Chainlink price and exchange reserves:

Cryptoquant

As of today, reserves have increased to 162.90 million LINK; a rise of more than 300,000 LINK, or around $7.4 million at current prices. That tells us some traders are moving LINK back to exchanges, possibly preparing to book profits.

Moreover, in the last 24 hours, whale wallet balances have dipped slightly, meaning that some whales are no longer buying into strength. The top 100 LINK addresses have also shown mild distribution; not huge, but enough to support the idea that profit-taking may be close.

Do note that Smart Money continues to accumulate, hinting at mid-term price conviction.

LINK holders and whales might book profits:

Nansen

LINK holders and whales might book profits:

Nansen

So while the broader accumulation explains the recent gains, this shift in reserves and wallet behavior is the missing link that might interrupt the rally and cause a quick consolidation.

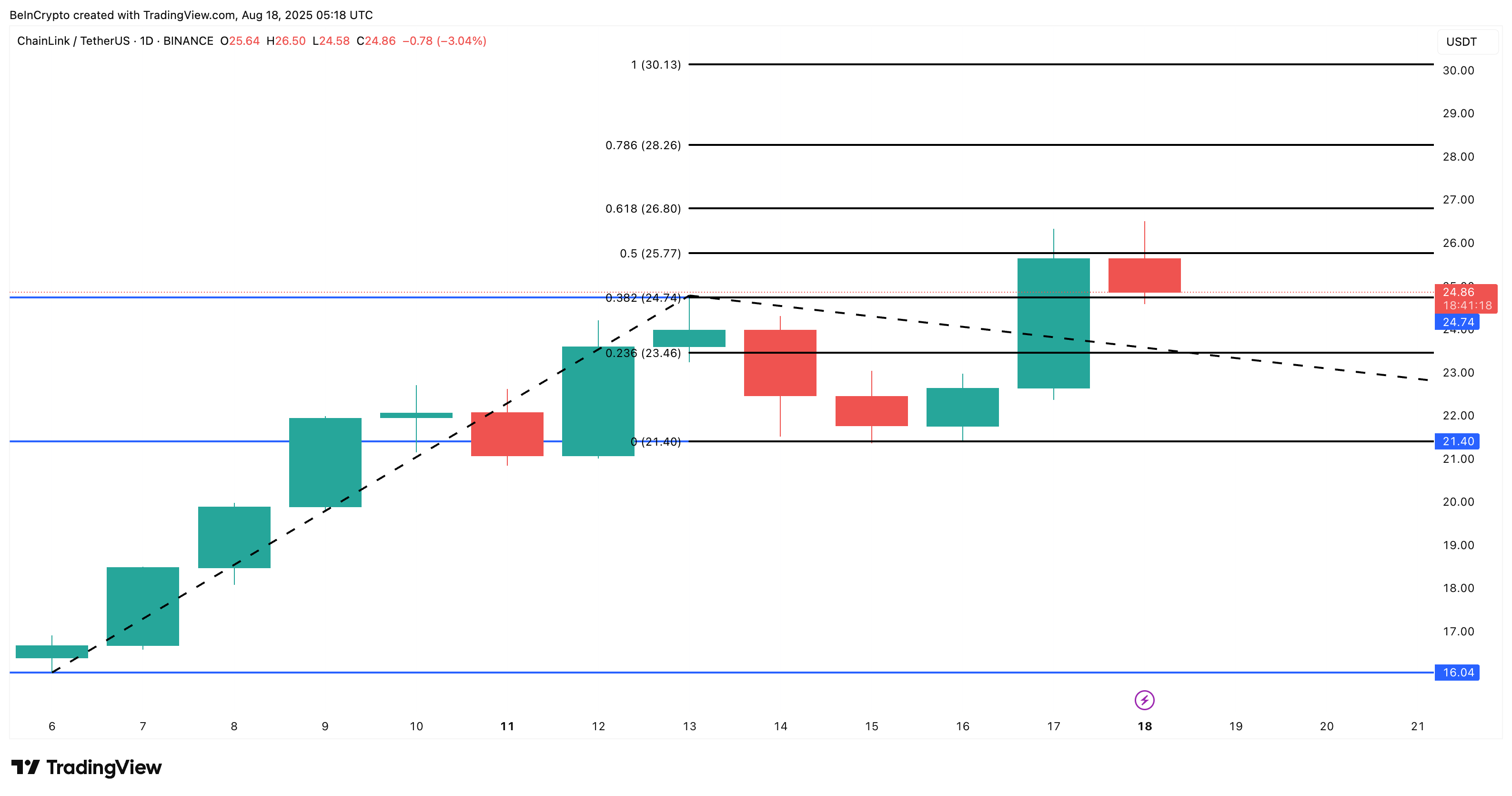

Chainlink Price Stuck Between Two Key Levels

The Chainlink price is currently trading around $24.80, caught between key zones. The nearest resistance is at $25.70, and a break above that could send LINK toward $28.20 and even $30.10; a level mapped by Fibonacci projections.

But there are key zones on the downside too.

Chainlink price analysis:

TradingView

Chainlink price analysis:

TradingView

If short-term selling builds, the first two support levels are at $24.70 and $23.40, followed by $21.40. These levels could hold if the exchange reserves stabilize or start dropping again.

So far, the bullish case still holds, provided the Smart Money accumulation continues and whales resume buying. But if reserves continue to climb, the LINK price might cool off before trying for new highs again. A dip under $21.40 could defeat the existing uptrend and turn the Chainlink price structure bearish in the short term.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Small-cap tokens fall to a four-year low—Is the "altcoin bull run" completely hopeless?

Despite having a correlation as high as 0.9 with major crypto tokens, small-cap tokens have failed to provide any diversification value.

Countdown to Bank of Japan rate hike: Will the crypto market repeat its downturn?

Since 2024, each interest rate hike by the Bank of Japan has been accompanied by a drop of more than 20% in the price of bitcoin.

Why aren't large language models smarter than you?

The user's language patterns determine how much reasoning ability the model can demonstrate.

Michael Saylor hints at next Bitcoin buy as BTC falls below $88K