Date: Sun, Aug 17, 2025 | 06:00 AM GMT

The cryptocurrency market is staging a mild recovery after its initial pullback. Ethereum (ETH), which slipped to $4,375 earlier, has now bounced to $4,475, boosting overall sentiment across major altcoins .

One of the standouts in this rebound is Celer Network (CELR), which surged over 18% today and is flashing a bullish technical setup that looks eerily similar to Mantle’s (MNT) ongoing rally.

Source: Coinmarketcap

Source: Coinmarketcap

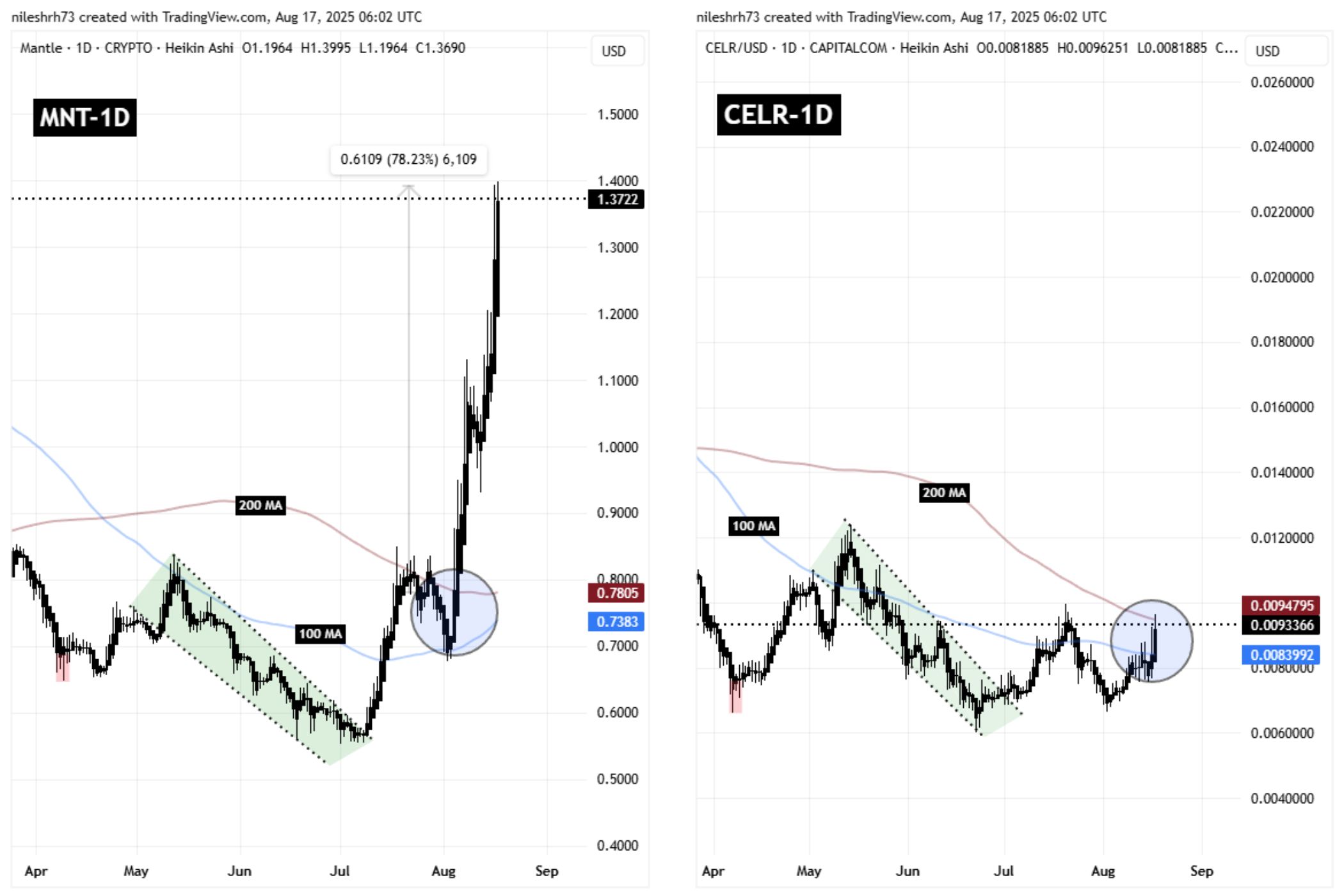

CELR Mirrors MNT’s Breakout Structure

Mantle’s recent price action offers a striking roadmap. After carving out a textbook falling wedge pattern — a classic bullish reversal setup — MNT briefly broke down but quickly reclaimed its 100-day and 200-day moving averages. That confirmation of support acted as fuel, propelling MNT into a stunning 78% rally in a very short time.

MNT and CELR Fractal Chart/Coinsprobe (Source: Tradingview)

MNT and CELR Fractal Chart/Coinsprobe (Source: Tradingview)

Now, CELR appears to be following in those same footsteps.

CELR has already broken out from its own falling wedge and, like MNT, experienced a brief pullback that tested the moving averages. At present, CELR has reclaimed its 100-day MA support around $0.0083 and is consolidating just beneath the critical 200-day resistance at $0.0094. This type of sideways action, sitting under a major barrier, often serves as the calm before a storm.

What’s Next for CELR?

For CELR to confirm this bullish fractal, it needs to hold firm above the 100-day MA and decisively push through the 200-day resistance. A clean breakout with strong trading volume could open the door for a sustained rally, potentially targeting the $0.017 region — a move that would mirror MNT’s recent surge.

Still, confirmation is key. If CELR fails to break above the 200-day MA, the bullish setup could be delayed. But given how closely CELR’s current structure resembles MNT’s successful breakout, traders have reason to keep a close watch.

Disclaimer: This article is for informational purposes only and not financial advice. Always conduct your own research before investing in cryptocurrencies.