'SPAC King' Chamath Palihapitiya looking to raise $250 million 'American Exceptionalism' vehicle to invest in AI, DeFi, defense, or energy

Quick Take Palihapitiya is looking to spin up another special purpose acquisition company, American Exceptionalism Acquisition Corp., to take another private company public. American Exceptionalism is eyeing disruptive industries like AI and DeFi for potential targets.

Chamath Palihapitiya appears to be back in SPACs. According to a U.S. Securities and Exchange Commission filing, the investor is looking to spin up another special purpose acquisition company — this time called American Exceptionalism Acquisition Corp. — to take another private company public.

In the S-1, chairman, director, and founder Palihapitiya notes the company is specifically targeting sectors "fixing the fundamental risks that come from our interconnected global order while reinforcing American exceptionalism." This includes AI, DeFi, warfighting robotics and drones, as well as innovations in energy production like nuclear and solar power.

"We intend to find companies that operate in sectors that we believe will be instrumental in maintaining U.S. global leadership for the next century,” the filing reads. “We believe that these innovative sectors are dependent on new company formation, the sustainability of robust private market funding and an increased willingness of private technology companies to become publicly-traded and therefore become available to a broader universe of investors."

Purely on the DeFi front, Palihapitiya, supposedly a longtime Bitcoin proponent, says "the next stage of development is the increased integration between traditional finance and decentralized finance," pointing to the success of Circle (ticker CRCL) and mainstream embrace of stablecoins.

"We will be attempting to find a great company at a great valuation to take public, but without doubt, the investment will entail substantial risk including the possibility of total loss," Palihapitiya wrote.

According to the registration statement with the SEC, Palihapitiya’s newly incorporated blank check company is looking to raise $250 million by selling common shares and eventually list on the NYSE. American Exceptionalism will have a 24-month “completion window” to locate a viable business operation to merge with and take public.

'SPAC King'

Palihapitiya was once dubbed the "SPAC King" after launching 12 SPACs alongside his venture firm Social Capital. These firms, including Virgin Galactic, Opendoor, Clover Health, and SoFi, raised billions when listing; however, many SPACs have since lost their luster after often losing 70%-95% of their peak valuations.

In addition to Palihapitiya, several executives from Social Capital, Jeffrey Vignos and Steven Trieu, are joining the SPAC in leadership roles.

Interestingly, the move comes at a time of increasing interest in equities tokenization from the likes of Kraken and Robinhood . Both firms are exploring ways to increase retail exposure to private funds using onchain representations of pre-market stock.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When AI Makes Candlestick Charts Speak

Ethereum Bearish Pressure Intensifies: 3 Critical Factors Threatening ETH’s Price

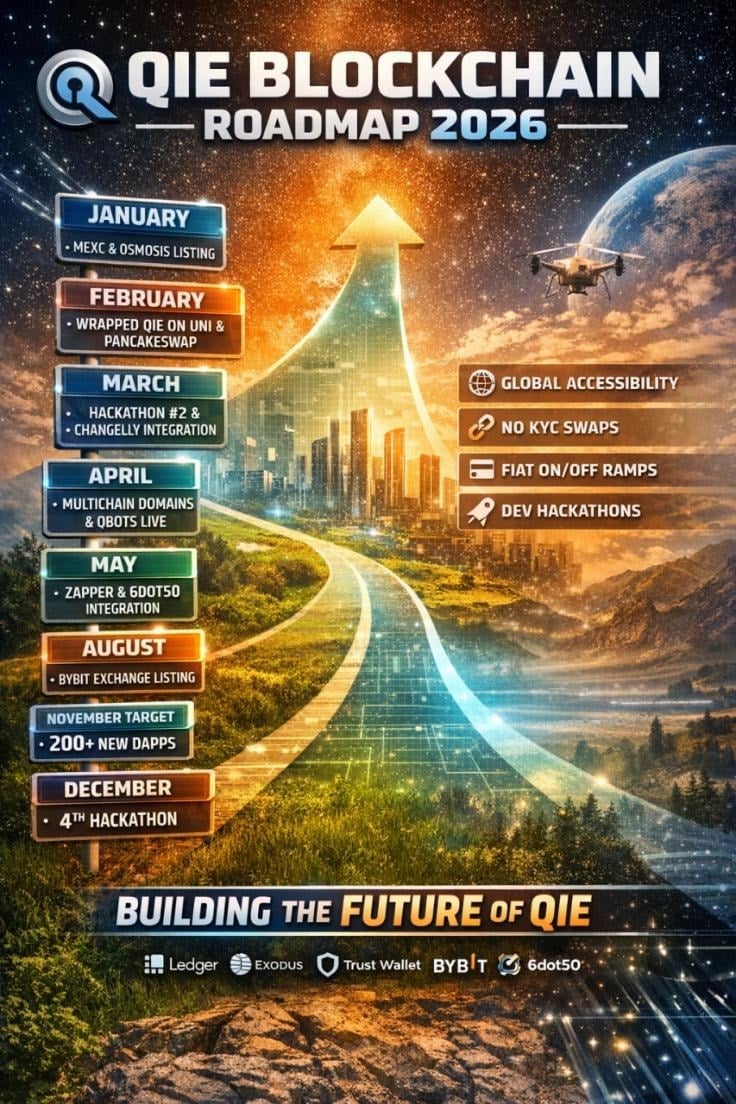

QIE 2026 Roadmap: Building the Infrastructure for Real Web3 Use

Ripple advances protocol safety with new XRP Ledger payment engine specification