NFT Market Cap Falls $1.2B as Ether Pullback Hits Top Collections

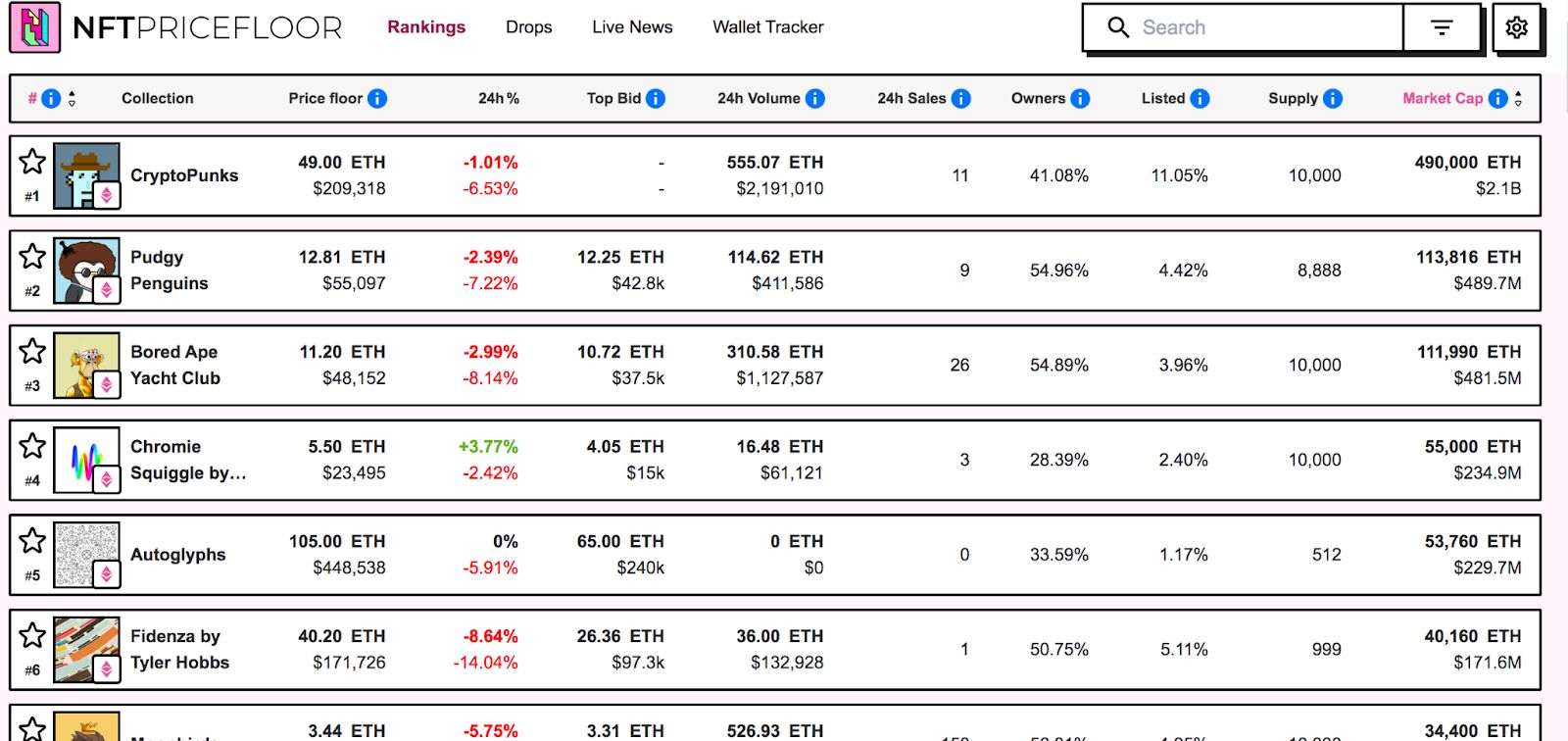

The non-fungible tokens (NFT) sector lost more than $1.2 billion in market value within a week as Ether prices cooled. According to NFT Price Floor, the market capitalization of NFT collections fell 12%, dropping from $9.3 billion to $8.1 billion. The correction followed Ether’s decline of nearly 9% after recently reaching a high of about $4,700.

In Brief

- NFT market cap drops 12% to $8.1B as Ether cools from recent highs.

- CryptoPunks and Bored Apes lose value while sales volume declines.

- Pudgy Penguins overtake Bored Apes, showing stronger market interest.

Ether Pullback and NFT Valuations

NFT prices are often tied to the performance of Ethereum, since many leading collections are built on the network. As Ether fell from its midweek highs, NFT collections priced in ETH saw their valuations contract. At the time of writing, Ethereum is trading at $4,292.33, showcasing a 5.53% drop in the last 24 hours.

This decline in Ether coincided with lower NFT sales activity. CryptoSlam reported that several top projects recorded fewer transactions and lower sales volume. NFT Price Floor data confirmed that most of the top 10 collections dropped in market capitalization as the crypto market cooled.

CryptoPunks and Bored Apes Decline

CryptoPunks retained its position as the largest NFT collection, but its market value slipped by about $300 million in the past week. The collection was valued at $2.1 billion, down from $2.4 billion. According to CryptoSlam, sales volume for CryptoPunks reached $12.7 million , which represented a 34% decline compared to the previous week. The number of sales also fell by nearly 28%, totaling 51 transactions.

The Bored Ape Yacht Club, another high-profile collection, also recorded a steep drop. Its market value fell nearly 20%, moving from $602 million to $482.3 million. This decline pushed Bored Apes from the second to the third position in overall market capitalization rankings, behind Pudgy Penguins.

Pudgy Penguins Move to Second Place

Pudgy Penguins gained ground despite also losing value during the broader market downturn. The collection’s valuation dropped from $591 million to $491 million, reflecting a 17% decline. However, this was enough to move it into second place, ahead of the Bored Ape Yacht Club.

The project has recently drawn attention for its expansion beyond the NFT sector . Blockchain company BTCS Inc. announced last week that it added three Pudgy Penguins NFTs to its corporate treasury. This marked a rare case of a publicly traded company purchasing NFTs for treasury diversification. The move suggested growing recognition of certain collections as digital assets with long-term utility. Market data also showed that Pudgy Penguins maintained strong activity compared to other projects. In earlier weeks, it recorded higher sales volume than Bored Apes, reflecting continued buyer interest even during a weaker market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

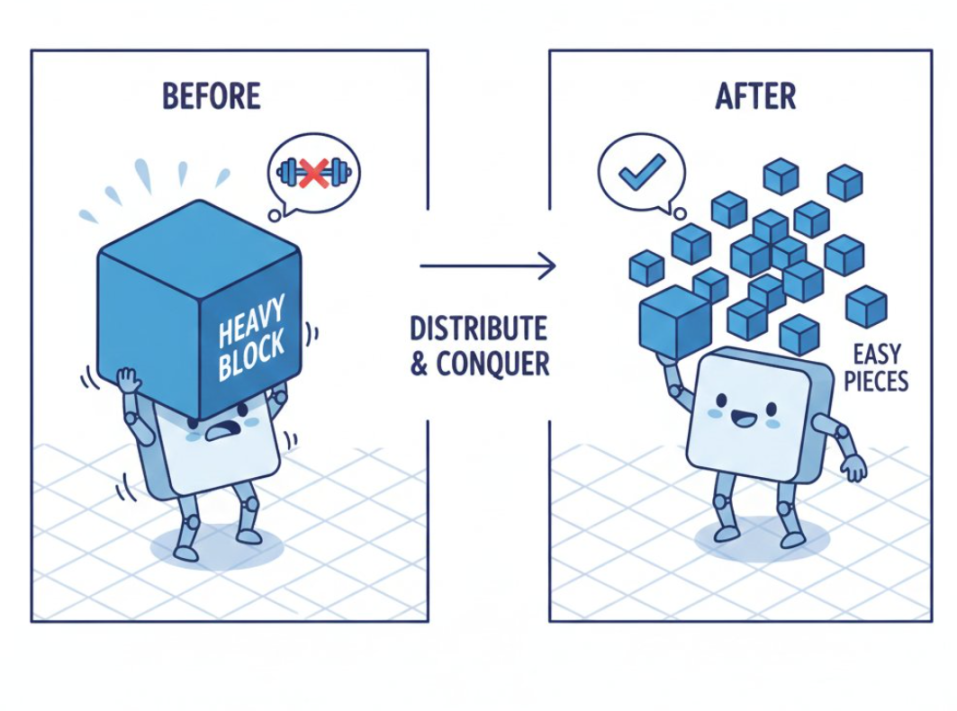

Is the DA war coming to an end? Deconstructing PeerDAS: How can it help Ethereum reclaim "data sovereignty"?

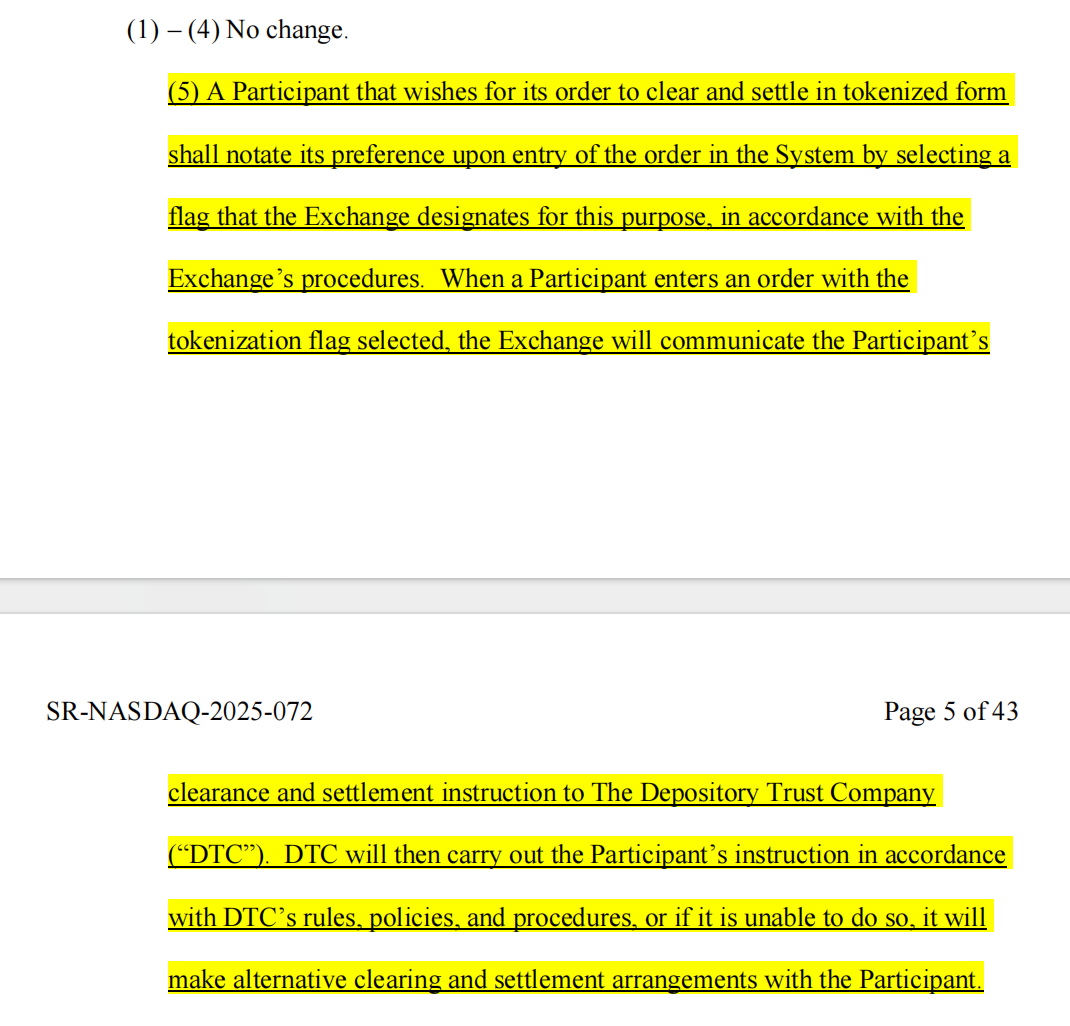

Frontline Report | Web3 Lawyers Interpret the Latest Developments in US Stock Tokenization

Why did the "Insider King" fall into his own trap on October 11?

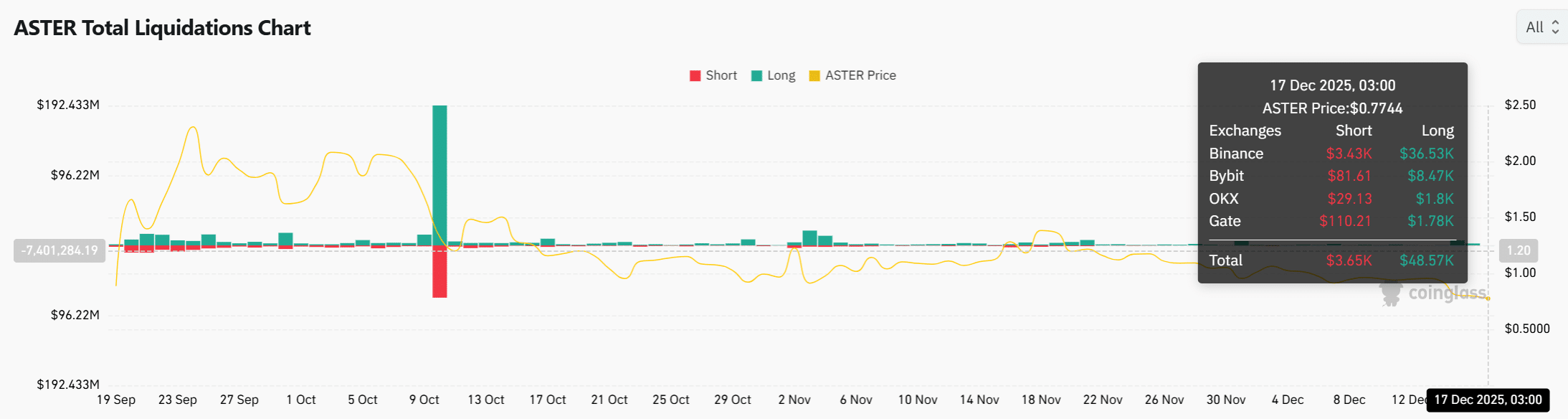

ASTER price sinks as whale losses deepen – Is $0.6 next?