Exclusive: Solana gains native Ethereum bridge via Across’ intents model

Solana dApps can now embed one-click transfers with Across’ new integration. The launch removes UX barriers that once pushed 13% of users to abandon bridging attempts, according to the protocol.

- Across has expanded its intents-based bridging infrastructure to Solana, enabling one-click transfers between Ethereum and Solana.

- The integration removes multi-step claims and leverages a decentralized solver network to finalize transfers in seconds.

- Solana’s $10.1 billion inbound bridge volume has faced high abandonment rates, and Across positions its model as a fix to legacy bridging inefficiencies.

Iinteroperability protocol Across has officially expanded its intents-based bridging infrastructure to the Solana blockchain, crypto.news can exclusively confirm.

Across said the integration allows developers to embed a single API into their decentralized applications, enabling users to move native assets between Ethereum and Solana in one step without manually claiming wrapped tokens on the destination chain or executing other complex workarounds.

Per the press release, the rollout leverages Across’ existing decentralized solver network to execute these cross-chain intents, aiming to finalize most transfers within seconds.

Tackling the core failure of multichain UX

According to Across, the decision to expand onto Solana was a direct response to a glaring market inefficiency. While the chain’s inbound bridging volume more than doubled to a staggering $10.1 billion year-over-year, the underlying user experience had failed to keep pace.

This growth was being hampered by legacy infrastructure, with complex, multi-step processes contributing to user abandonment rates as high as 13%. Across is positioning its intents-based architecture as the solution to this core problem, aiming to capture a significant portion of this volume by eliminating the very friction that causes it to leak away.

“Users shouldn’t have to compromise speed, security, or UX to move between ecosystems. This integration brings Solana into the interface people already know and use and pushes us closer to a future where bridging is something users don’t have to think about at all,” Hart Lambur, co-founder of Across, said.

This new infrastructure is technically different from conventional bridges. Where legacy models often rely on locked assets and mint synthetic tokens on the destination chain, forcing users into a manual claiming process, Across operates on an intents-based model.

The protocol, a co-author of the ERC-7683 standard with Uniswap, allows users to simply state their desired outcome. A decentralized network of solvers then competes to fulfill that intent in the background, routing native assets directly and abstracting all chain-level complexity away from the user. This means no more wrapped tokens or separate bridging UI; the action is completed in a single, app-native step.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Research Report|In-Depth Analysis and Market Cap of Monad (MON)

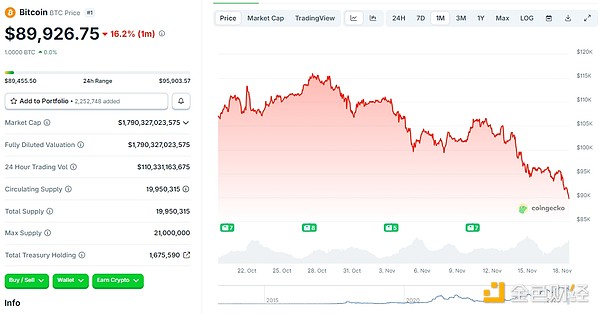

Is the crypto market bearish? See what industry insiders have to say

Whales make big bets, institutions deeply trapped, crypto market faces a cold wave

![[Bitpush Daily News Selection] Strategy increased its holdings by purchasing 8,178 bitcoins last week at an average price of $102,171; CBOE will launch continuous futures contracts for bitcoin and ethereum on December 15; Federal Reserve Governor Waller: Supports risk-management rate cuts in December](https://img.bgstatic.com/multiLang/image/social/8ce218bf9e396bdadfada2b4ef95f3111763451361931.png)